How do profits shape domestic price pressures in the euro area?

Published as part of the ECB Economic Bulletin, Issue 6/2019.

Profits can account for a significant part of domestic price formation and affect the pass-through of changes in costs to final prices. National accounts contain a broad measure of profits, gross operating surplus, which can tell us more about the role of profits for domestic price pressures, as measured in the GDP deflator. Chart A depicts this role in terms of movements in unit profits, thus gross operating surplus divided by real GDP, the measure of profit margins used in this box. Unit profits accounted for roughly one-third of the increase in the euro area GDP deflator over the past two decades. This box illustrates how profits have recently shaped domestic price pressures in the euro area. It explains which factors are the main drivers of the movements in profit margins and discusses how they have likely contributed to their recent developments.

Chart A

GDP deflator and contributions

(annual percentage changes, p.p. contributions to annual percentage changes, quarterly data)

Sources: Eurostat and ECB calculations.

Notes: The combined contributions from compensation per employee and labour productivity provide the contribution from unit labour costs. The latest observations are for the second quarter of 2019.

The contributions from unit profits to domestic cost pressures decreased in 2018 and slightly strengthened but remained low during the first half of 2019. Unit profit growth weakened noticeably in the course of 2018, that is to say, over the period when wage growth (measured in terms of compensation per employee) and unit labour cost growth picked up strongly, thereby restraining the pace of increase in the growth rate of the GDP deflator (see Chart A). In the first half of 2019, unit profit growth turned slightly positive and supported the gradual further increase in the growth rate of the GDP deflator. At the aggregate level, there are two main driving factors that typically account for the movements in the unit profit contribution, the economic cycle and the terms of trade.

Profit margins are empirically found to procyclically move alongside developments in economic activity (see Chart B). In a downturn, unit labour costs typically rise since contractually fixed wages respond only with some delay to the downturn, while labour productivity drops immediately given the faster downward reaction of output than employment. As the weaker economic environment limits the scope for offsetting price increases, there is a squeeze in profit margins in a downturn and vice versa in an upswing. Profit margins, hence, show a strong positive response to real GDP and labour productivity developments as broad cyclical indicators. Chart B illustrates that this comovement also pertained in 2018 when growth in unit profits weakened in tandem with the slowdown in real GDP and labour productivity growth. In the first half of 2019, the deteriorations in all three indicators came to a halt, while unit profit growth had already started to strengthen gradually, reflecting the impact of other factors than the cycle.

Chart B

Unit profits, GDP and labour productivity

(annual percentage changes, quarterly data)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for the second quarter of 2019.

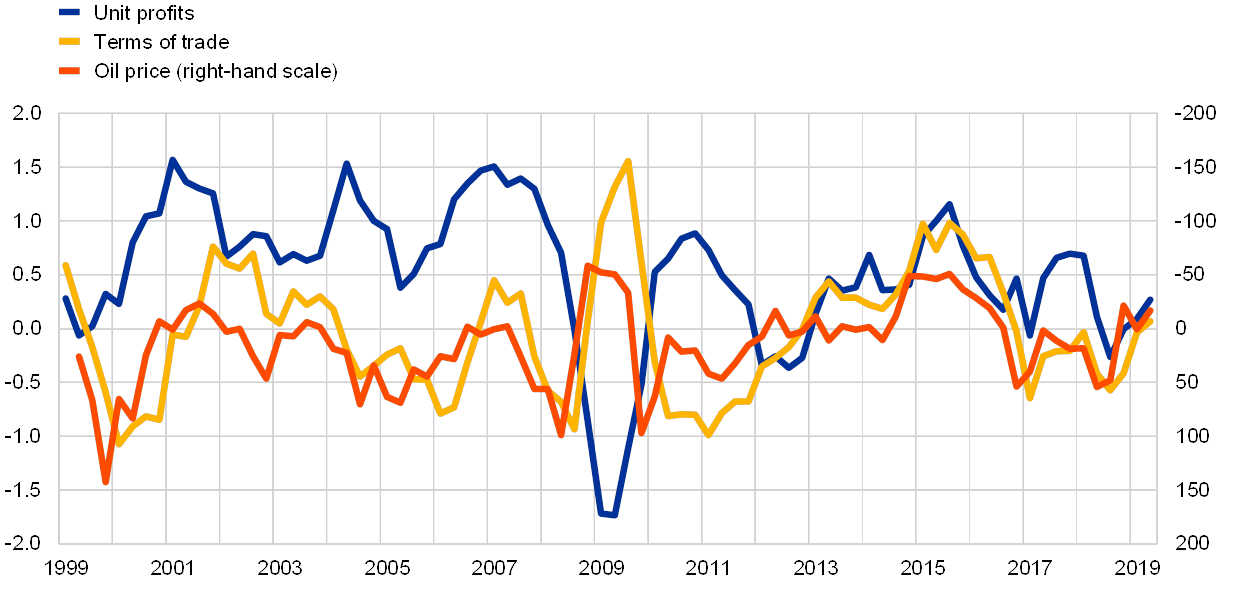

Profit margins are sometimes also closely related to developments in the terms of trade, in particular if these are subject to strong changes (see Chart C). Such changes can be traced back to different sources. Improvements in the terms of trade related to a drop in the prices of imported inputs such as oil can have a positive impact on profit margins, if firms adjust their selling prices downwards by less than the fall in their input costs. This appears to have been the case in the period from mid-2014 to early 2016. Changes in export prices, related to a depreciation in the euro exchange rate, can benefit profit margins if exporters price their products to the market and keep their export prices in foreign currency unchanged. Furthermore, terms of trade developments can also be influenced by developments in relative prices between the domestic and foreign economy if these are also reflected in the dynamics of export and import prices. In this respect, stronger relative price developments in the domestic economy than those of the foreign economy could entail improvements in the terms of trade with positive repercussions for profit margins. In 2018, the terms of trade appear to have weighed on profit margins and this was mainly due to the increase in oil prices. Oil prices, however, have come down since the end of 2018 leading to improvements in the terms of trade. This seems to have supported unit profit growth and thereby contributed to their more favourable developments compared to that of cyclical indicators in the first half of 2019.[1]

Chart C

Unit profits, terms of trade and oil prices

(p.p. contributions to the GDP deflator, annual percentage changes, quarterly data)

Sources: Eurostat, Bloomberg and ECB calculations.

Note: The latest observations are for the second quarter of 2019.

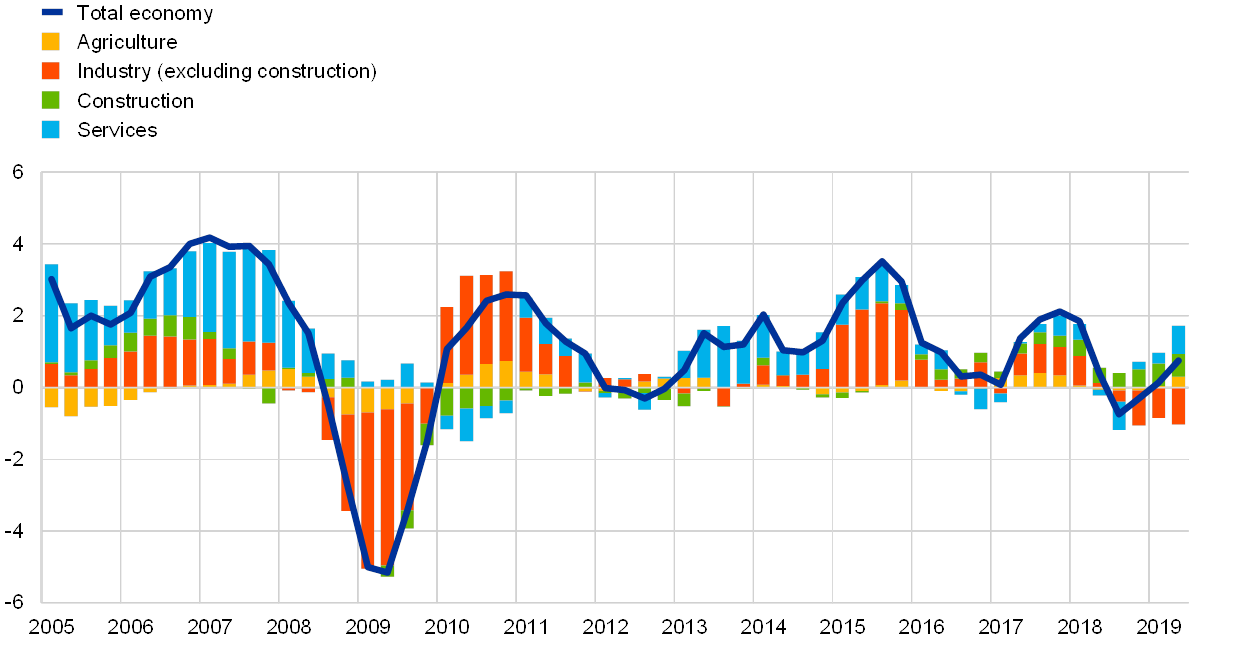

The sector composition of developments in unit profits confirms that the weakening in unit profits in 2018 occurred mainly in cyclically-sensitive sectors, while the gradual strengthening in unit profits in the first half of 2019 reflected developments in less cyclically sensitive sectors (see Chart D). A procyclical impact on unit profits is visible, in particular, for the industrial sector (excluding construction), which is heavily exposed to developments in trade and has thus suffered the most from the deterioration in the global environment and the euro area business cycle since end-2017. The deterioration in the terms of trade associated with the rebound in oil prices in the course of 2018 is likely to have contributed to the moderation in profit margins in 2018 particularly in sectors such as transportation (part of the services sector), and the ensuing decline in oil prices may have likewise supported their rebound. At the same time, developments in profit margins in more domestically-oriented sectors such as the construction sector have been holding up better over the entire period, which owes also to the currently very favourable financing conditions.

Chart D

Developments in unit profits and contributions from economic sectors

(annual percentage changes, p.p. contributions to annual percentage changes, quarterly data)

Sources: Eurostat and ECB calculations.

Notes: In the decomposition of unit profit growth by economic sectors unit profits are calculated based on value added. The latest observations are for the second quarter of 2019.

To conclude, aggregate profit margins weakened in the course of 2018 and dampened the increase in domestic price pressures in the euro area for that year, but started to increase gradually in the first half of 2019. The decline in profit margins in 2018 was a reaction to the recent slowdown in economic activity and the oil price-related deterioration in the terms of trade in that year.[2] The adjustment implied a partial buffering of the recorded increases in labour costs and generates the picture of a limited pass-through of wages to prices. In the first half of 2019 profit margins started to rebound reflecting, among other things, improvements in the terms of trade related to lower oil prices. Looking ahead, profit margins should strengthen in line with the gradual increase in economic activity envisaged in the September 2019 ECB staff macroeconomic projections.

- A further factor that contributed to the increase in unit profit growth in the first half of 2019 is the implementation of a fiscal measure in France in 2019. This fiscal measure entails the conversion of a tax credit (the CICE) into a permanent cut to employers’ social security contributions, thereby implying a decrease in compensation per employee growth but a corresponding increase in unit profit growth.

- Econometric evidence suggests that the decline in the growth rate of unit profits in 2018 was largely accounted for by foreign demand, oil supply and wage mark-up shocks (see the speech by Philip R. Lane, “The Phillips Curve at the ECB”, London School of Economics, 4 September 2019).