Country-specific recommendations for economic policies under the 2019 European Semester

Published as part of the ECB Economic Bulletin, Issue 5/2019.

On 5 June 2019 the European Commission issued its annual policy recommendations for EU Member States under the 2019 European Semester. The European Semester is the EU’s annual policy coordination cycle. In this respect, the country-specific recommendations (CSRs) are a source of guidance for Member States when designing their economic and fiscal policies for the following year. This box examines all policy recommendations addressed to euro area countries, with the exception of those pertaining to fiscal policy.[1]

The 2019 recommendations call on Member States to strengthen their economic resilience and growth potential. The implementation of well-designed structural reforms is essential for reducing vulnerabilities in euro area countries, rendering those countries better able to withstand economic shocks.[2] Reforms are also needed to meet structural challenges facing euro area countries, including digitalisation and demographic change.

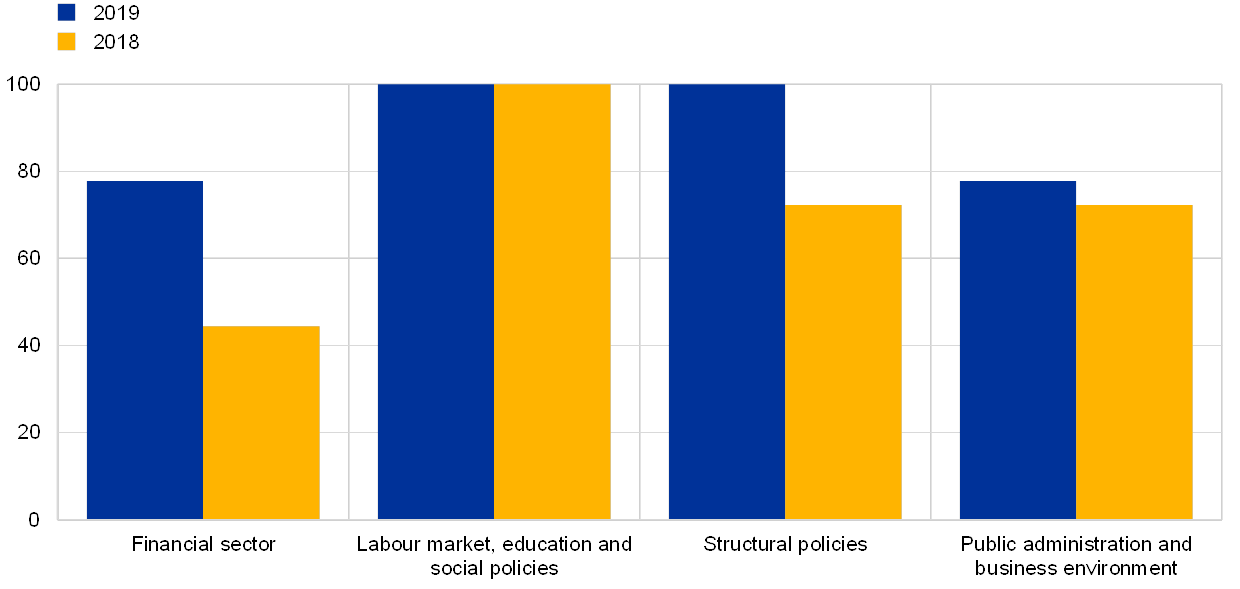

The 2019 CSRs cover structural policies and policies related to labour markets, public administration and the financial sector. According to the Commission’s CSR classification, the majority of euro area countries received recommendations in each of the broad policy areas covered (see Chart A). The number of euro area countries with CSRs in the “public administration and business environment” category remained broadly stable. However, within this category more countries received CSRs related to the business environment and judicial system this year, which appears warranted given the importance of high quality institutions for resilience and long-term growth.[3] As in 2018, the “labour market, education and social policies” category remains a priority. Within this category, recommendations related to workers’ skills and lifelong learning gained importance, reflecting the increasing challenges posed by digitalisation. By contrast, only a few countries received CSRs on wage-setting arrangements. Although favourable economic conditions have led to a decline in unemployment rates over recent years, the negative effects of limited labour market adaptability in some euro area countries could become more apparent when the economic cycle turns.

Overall, the 2019 CSRs place greater emphasis on investment-enhancing structural policies and financial sector policies. In contrast to last year, in 2019 all euro area countries received at least one CSR related to the Commission’s “structural policies” category, covering, inter alia, regulatory frameworks, competition, network industries, and research and innovation. This in part reflects the focus of this year’s CSR package on identifying structural investment bottlenecks. This focus should be seen in the context of broader efforts by the Commission to strengthen the link between the European Semester and the EU budget, in particular the cohesion funds. The share of euro area countries receiving CSRs aimed at the “financial sector” category also increased in 2019, driven partly by recommendations related to the housing market. Specifically, the CSRs call on several Member States with dynamic house price growth to alleviate supply bottlenecks and market distortions, with a view to preventing the build-up of vulnerabilities.

Chart A

Share of euro area countries receiving CSRs broken down by broad policy area

(percentages)

Source: ECB calculations based on the 2018 and 2019 CSRs.

Notes: The chart shows the share of euro area countries receiving CSRs broken down into broad policy areas, based on the European Commission’s classification. “Financial sector” policies relate to financial services, the housing market, access to finance and private sector indebtedness; “labour market, education and social” policies include employment protection, active labour market policies, wage-setting frameworks, lifelong learning and health care; “structural” policies include research and innovation, competition, regulatory frameworks and network industries; “public administration and business environment” policies include business environment, civil justice and anti-corruption measures. CSRs for public finances and taxation are not included. For the sake of comparability across time, the chart excludes Greece. In 2018 the country did not receive CSRs as it was under an economic adjustment programme. It has been under enhanced surveillance since August 2018 and is therefore now part of the European Semester.

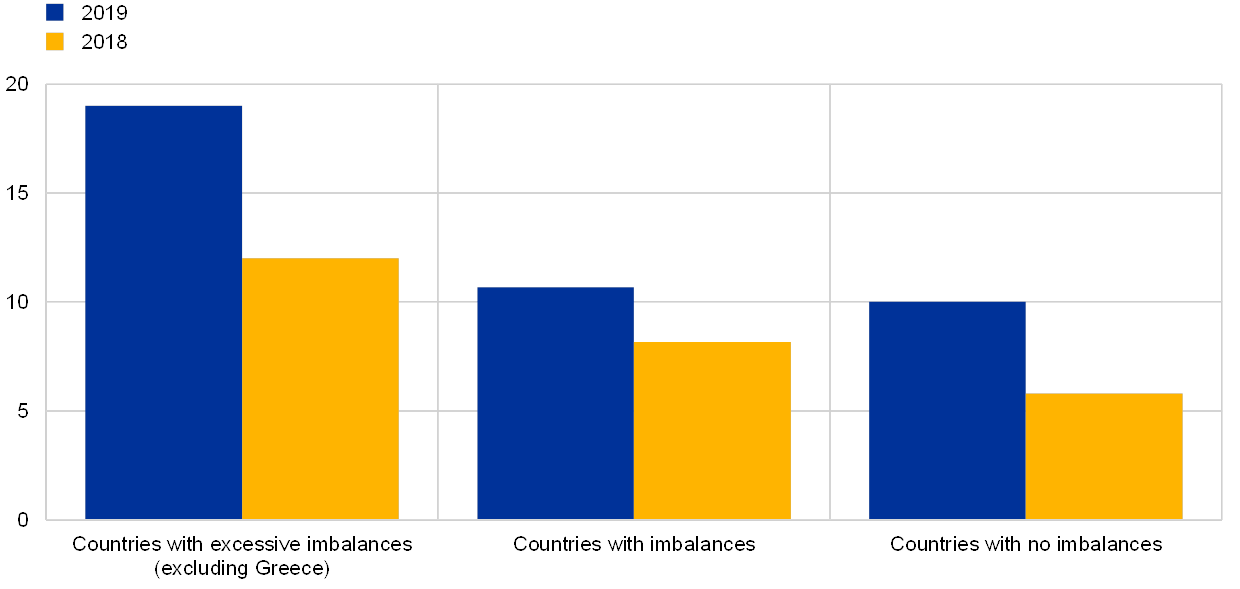

Overall, the 2019 CSRs for countries with excessive macroeconomic imbalances cover a broader range of policy areas than those for other countries.[4] Chart B shows the average number of policy areas covered by the CSRs across three groups of euro area countries, with the groups corresponding to the Commission’s assessment as to whether a country has excessive macroeconomic imbalances, imbalances or no imbalances.[5] The Commission’s analysis suggests that the average number of policy areas for countries with excessive imbalances is higher than for other euro area countries and that this gap widened compared with 2018.

Chart B

Average number of policy areas covered by the CSRs across country groups

Source: ECB calculations based on the 2018 and 2019 CSRs.

Notes: The chart shows the average number of policy areas covered by the CSRs across country groups, based on the European Commission’s disaggregated mapping of the CSRs into 26 policy areas (such as “housing market”, “research and innovation” and “civil justice”). CSRs for public finances and taxation are not included. The country groups are based on the Commission’s assessment under the EU’s macroeconomic imbalance procedure (MIP). The composition of the country groups was stable in 2018 and 2019. For the sake of comparability across time, the chart excludes Greece. In 2018 the country did not receive CSRs as it was under an economic adjustment programme. It has been under enhanced surveillance since August 2018 and is therefore now part of the European Semester.

Continued weak CSR implementation by Member States, including those with excessive imbalances, remains a challenge.[6] In February 2019 the European Commission concluded that none of the 2018 CSRs for euro area countries had been “fully” implemented. “Substantial” progress was only visible for around 5% of the CSRs. The remaining 95% of policy recommendations had either not been implemented or, at best, had been implemented to “some” extent. The CSR implementation record has therefore continued to deteriorate in line with the trend seen over recent years (see Chart C). Moreover, countries with excessive imbalances do not seem to have taken further decisive policy action to step up the implementation of their CSRs.

In order to reap the full benefits of the ECB’s monetary policy measures, other policy areas must contribute more decisively to raising the longer-term growth potential and reducing vulnerabilities. In particular, the implementation of structural reforms needs to be substantially stepped up, with the 2019 CSRs serving as the relevant signpost. While the CSRs provide important guidance to all countries, the corrective arm of the macroeconomic imbalance procedure (MIP) might offer a well-defined process to assist the most vulnerable countries, in particular. In addition, a more rigorous prioritisation of CSRs according to their macro-critical relevance could encourage compliance with the MIP and also help incentivise countries to take firmer ownership of structural reforms. If appropriately designed and implemented, EU tools offering financial support and technical expertise for important structural reforms could also help to provide the right incentives for such reforms and national ownership.

Chart C

CSR implementation over the period 2013-18 in euro area countries

Source: ECB calculations based on the European Commission’s Country Reports.

Notes: The chart shows the implementation of (non-fiscal) CSRs for the year given as assessed by the European Commission in the overview table of each Member State’s Country Report published the following year. “Full implementation” signifies that the Member State has implemented all measures needed to address the CSR appropriately; “substantial progress” signifies that the Member State has adopted measures that go a long way in addressing the CSR, most of which have been implemented; “some progress” signifies that the Member State has adopted measures that partly address the CSR, and/or it has adopted measures that address the CSR but a fair amount of work is still needed to fully address it as only a few of the adopted measures have been implemented; “limited progress” signifies that the Member State has announced certain measures but these only address the CSR to a limited extent, and/or it has presented non-legislative acts, yet with no further follow-up in terms of implementation; and “no progress” signifies that the Member State has not credibly announced or adopted any measures to address the CSR.

- For details of the 2019 CSRs related to fiscal policy, see the box entitled “Priorities for fiscal policies under the 2019 European Semester” in this issue of the Economic Bulletin.

- See Masuch, K., Anderton, R., Setzer, R. and Benalal, N., “Structural policies in the euro area”, Occasional Paper Series, No 210, ECB, June 2018.

- See Masuch et al., op. cit., Chapter 5.

- According to Regulation (EU) No 1176/2011 of the European Parliament and of the Council of 16 November 2011 on the prevention and correction of macroeconomic imbalances, the term “imbalances” means any trend giving rise to macroeconomic developments which are adversely affecting, or have the potential adversely to affect, the proper functioning of the economy of a Member State or of the economic and monetary union, or of the Union as a whole. The term “excessive imbalances” means severe imbalances, including imbalances that jeopardise or risk jeopardising the proper functioning of the economic and monetary union.

- Under the macroeconomic imbalance procedure, there are three possible outcomes: “no imbalances”, “imbalances” or “excessive imbalances”. If the European Commission identifies imbalances, the country concerned will receive policy recommendations designed to address them. When the imbalances are assessed as being so severe that they are found to be “excessive”, the Commission can take further action by recommending that the Council activate the excessive imbalance procedure.

- For more details, see the box entitled “The European Commission’s 2019 assessment of macroeconomic imbalances and progress on reforms”, Economic Bulletin, Issue 2, ECB, 2019.