Rent inflation in the euro area since the crisis

Published as part of the ECB Economic Bulletin, Issue 4/2019.

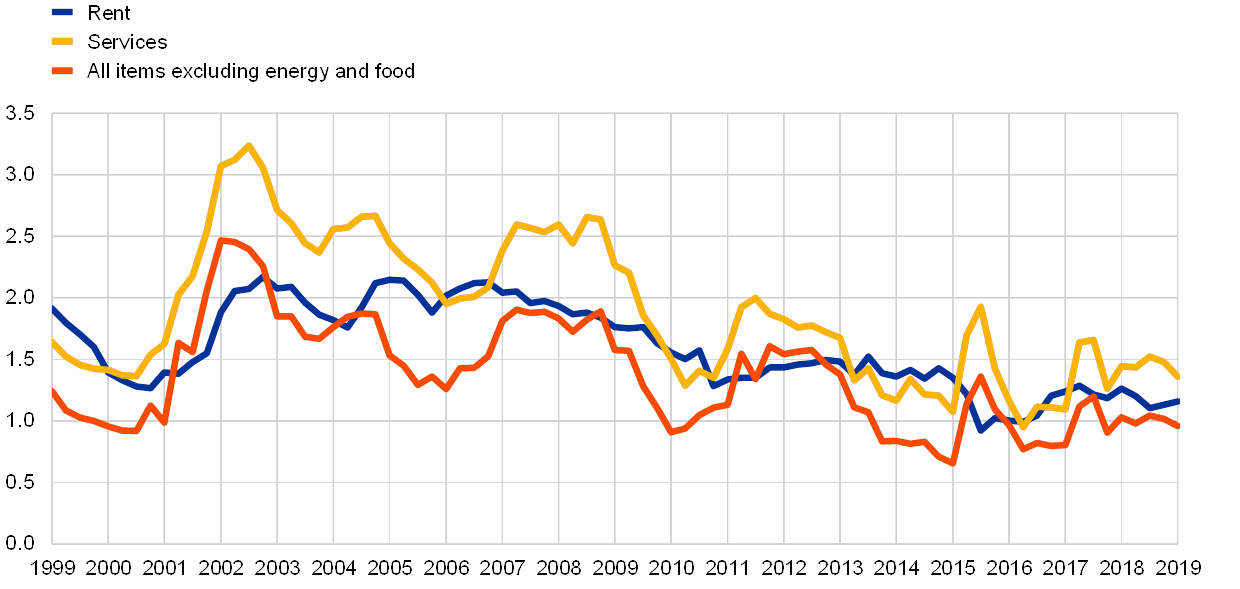

Rent inflation has recently strengthened, rather than mitigated, the still relatively subdued developments in services and underlying inflation in the euro area. Having been hovering around 1¼% since January 2018, rent inflation has, on balance, stayed below the inflation rate for services as a whole (see Chart A). While this was the case for most of the pre-crisis period[1], it appears more striking now, as rent inflation is typically considered to be a more resilient inflation component that is relatively higher in periods when other components of HICP inflation tend to be low. These developments are also interesting in the context of public debates, in many euro area countries, about strong rent increases, and against the background of the sustained increases in euro area house prices over recent years. This box puts recent developments in euro area rent inflation into perspective. As housing and rental markets have remained heterogeneous, this box also looks at developments across euro area countries.

Chart A

Euro area HICP excluding energy and food, services and rent

(year-on-year percentage changes)

Source: Eurostat.

Notes: The latest observations are for the first quarter of 2019. Annual inflation rates for services in 2015 are distorted upwards owing to the introduction, since January 2019, of a new methodology for calculating the German package holiday price index.

In the post-crisis period, rent inflation and its contribution to euro area services inflation have been declining. Annual changes in the rent component of the euro area HICP were, on average, 1.8% in the pre-crisis period but have fallen to 1.4% in the post-crisis period (see Chart B, panel a). The low rent inflation has been associated with a progressive decline in the contribution of rent to HICP services in the euro area. This contribution declined by one-third between the pre- and post-crisis periods (see Chart B, panel b). The pattern was shared by all large euro area countries with the exception of Germany, where the contribution of rent to HICP services increased post-crisis. However, developments in individual episodes can reflect country-specific factors. For instance, in France, the negative contribution of rent to HICP services since January 2018 is accounted for by rent cuts for social housing implemented in the course of 2018.[2] In Germany, the relatively low rent inflation in recent years may partly reflect the higher weight of private households as landlords in the statistical sample since 2015, given that private landlords tended to raise their rent less than, for instance, local authorities, housing associations and private companies.[3]

Chart B

House prices, rent and HICP services

(panel a: year-on-year percentage changes; panel b: percentage points)

Sources: Eurostat, ECB and ECB calculations.

Note: The latest observations are for April 2019 for all variables, with the exception of house prices, for which the latest observation is for the fourth quarter of 2018.

The decline observed in the contribution of rent to HICP services inflation was mainly driven by the fall in rent inflation. The contribution of rent to HICP services inflation is affected not only by the level of rent inflation but also by the weight of rent in HICP services, which varies widely across euro area countries (see Chart C, panel a). Of the five largest euro area countries, in Germany and the Netherlands rent has a greater weight than the euro area average, while in Spain and Italy it has a lower weight. This reflects, inter alia, the respective degree of owner-occupiers versus tenants across countries (see Chart C, panel b), as owner-occupied housing is excluded from the HICP[4]. At the euro area level, the weight of rent in HICP services has stood at 14.5% since January 2018, slightly down from an average of 15.1% for the period starting in 1999. This implies that changes over time in the weight of euro area rent in HICP services have not materially affected the contribution of rent to HICP services.

Chart C

Weights of actual rent in HICP services and tenant structure across euro area countries

(percentages)

Sources: Eurostat, EU-SILC, ECB and ECB calculations.

Strong house price developments are not necessarily associated with high rent inflation. There is generally a limited link between the two indicators[5], and this was observed also in the most recent period of subdued rent inflation associated with house price inflation exceeding 4% (see Chart B, panel a). When considering residential property as an asset, higher house prices should be the result, ceteris paribus, of a higher discounted value of future rent flows (viewed as a proxy of the corresponding dividends). However, several factors may explain a limited pass-through between house prices and rents, including rent regulation, fiscal policy measures related to housing, and changes in preferences and financing conditions. All these factors may weaken the theoretical long-term relationship between house prices and rents.

Several factors can affect rent formation, including maintenance costs, mortgage rates and demand conditions. First, the costs that owners incur for the maintenance and repair of dwellings can normally be expected to be partially or fully passed on to tenants via higher rents. In practice, in most of the five largest euro area countries, rent inflation in the post-crisis period has been below the inflation rate in “maintenance and repair of the dwelling”[6], suggesting only a partial recuperation of maintenance costs by owners. Second, mortgage rates also affect rent formation: if a buy-to-let purchase is financed by a mortgage, the higher the financing costs the higher the rent the owner will demand from the tenant. In this respect, lower financing costs in the post-crisis and most recent periods partly explain subdued rent developments. At the same time, the prevailing low-yield environment has made a given rental yield comparatively more attractive (even in cases of limited rent increases) vis-à-vis alternative investments in the equity or bond market.[7] In addition, housing demand should, in principle, also be a factor affecting rent formation, especially in certain jurisdictions or in urban areas, where supply can be constrained. Higher housing demand could allow owners to increase rents and mitigate some of the risks related to the fact that the property may become vacant, should the tenant move out after a rent increase. However, there are a number of institutional features in rental markets that can prevent rents from responding freely to cost and demand conditions.

Indexation may impose limits for the evolution of rents. Some form of indexation prevails in many euro area countries. Among the largest, in Spain rent increases are – at least for an initial period – generally capped by the rate of increase in the consumer price index (CPI). In France and Italy, rent increases cannot usually exceed, respectively, a rent reference index published quarterly by the Institut national de la statistique et des études économiques and based on the CPI excluding tobacco and rent, and a consumer price index for employees’ households. In the Netherlands, the maximum yearly rent increase is based, inter alia, on the inflation rate and the income situation of households. In Germany, some rental contracts are indexed to the German CPI, others – “step-up” rental contracts – set out the increases applicable during the life of the contract, while a majority of contracts contain no explicit provision for rent increases. In the case of the latter, the rent can be increased, for instance, when the dwelling is modernised[8] or when the rent is below the local average rent for comparable properties. In general, private owners often refrain from raising the rent to minimise the risk of the dwelling standing vacant if the tenant moves out[9]. All in all, some form of contractual indexation to the rate of inflation and a low turnover in rental contracts are important factors preventing rents from increasing freely.

Relatively subdued rent inflation in the euro area is mainly due to low inflation and a limited turnover in rental contracts. These factors explain the fairly moderate contribution of rent to services and to underlying inflation in the euro area, and the apparent disconnect between rents and house price developments. Should these factors persist, rent inflation will likely continue to make a relatively moderate contribution to services and underlying inflation.

- We use the term “pre-crisis period” to refer to the period between January 1999 and December 2007, and the term “post-crisis period” to refer to January 2008 onwards.

- The rent cuts in social housing took place in June 2018 and amounted to €800 million. They coincided with a reduction in housing allowances to tenants. The share of rents at reduced prices or free in France in 2017 stood at 16.4%, above the euro area average of 10.3% (see Chart C, panel b).

- For a discussion, see “Hintergrundpapier zur Revision des Verbraucherpreisindex für Deutschland 2019”.

- For a discussion, see the box entitled “Assessing the impact of housing costs on HICP inflation”, Economic Bulletin, ECB, Issue 8, 2016.

- For a discussion, see the boxes entitled “House prices and the rent component of the HICP in the euro area”, Monthly Bulletin, ECB, August 2014 and “Recent house price increases and housing affordability”, Economic Bulletin, ECB, Issue 1, 2018.

- “Maintenance and repair of the dwelling” covers expenditures on minor maintenance and repairs incurred by tenants and owner-occupiers.

- For a corresponding comparison, see the article entitled “The state of the housing market in the euro area”, Economic Bulletin, ECB, Issue 7, 2018.

- Such nominal rent increases due to building modernisation may, however, not show in the official statistics to the extent that the rent index is quality-adjusted.

- For example, in Germany rents generally increase when tenants change, which occurs on average after a rental duration of approximately ten years. See “Hintergrundpapier zur Revision des Verbraucherpreisindex für Deutschland 2019”.