Exploring the factors behind the 2018 widening in euro area corporate bond spreads

Published as part of the ECB Economic Bulletin, Issue 3/2019.

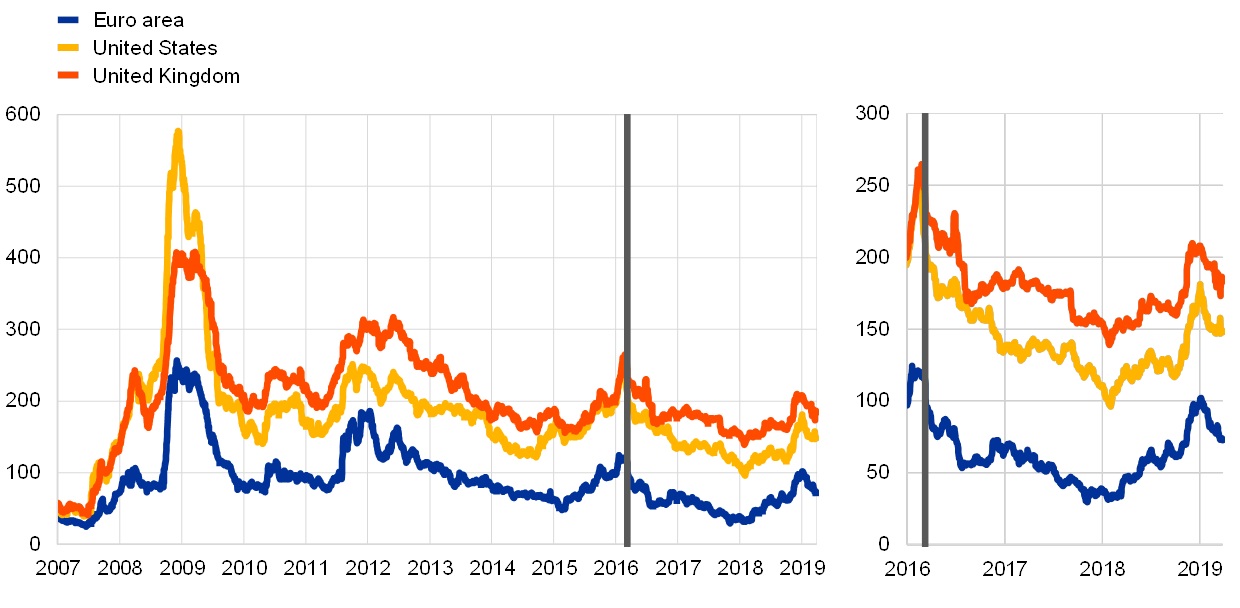

Global corporate bond spreads trended upwards over the course of 2018. Euro area investment grade non-financial corporate (NFC) bond spreads increased by around 60 basis points and peaked at just above 1%, close to the levels which had prevailed prior to the announcement of the ECB’s corporate sector purchase programme (CSPP) in March 2016 (see Chart A). Spreads on non-investment grade NFC debt widened more significantly, by around 200 basis points, and peaked at around 4%. The trend increase in euro area NFC bond spreads mirrored developments in global corporate bond markets; in the United States and the United Kingdom, spreads increased by around 80 and 60 basis points over the same time frame and peaked at 1.80% and 2.10%, respectively. Since the turn of the year, global NFC bond spreads have reversed a large part of the 2018 increase but nevertheless remain at elevated levels relative to those which prevailed in 2017. Furthermore, the largely synchronised movement in global spreads over this time frame alludes to a role for a common global factor, rather than a euro area-specific driver.

Chart A

Global investment grade NFC bond spreads

(basis points)

Sources: Thomson Reuters and ECB calculations.

Notes: The indices include only senior unsecured bonds. The vertical line marks the announcement of the CSPP on 10 March 2016. The United States (United Kingdom) indices refer to companies which issue in US dollars (pound sterling) and are not strictly limited to companies domiciled in the United States (United Kingdom).

Last observation: 29 March 2019.

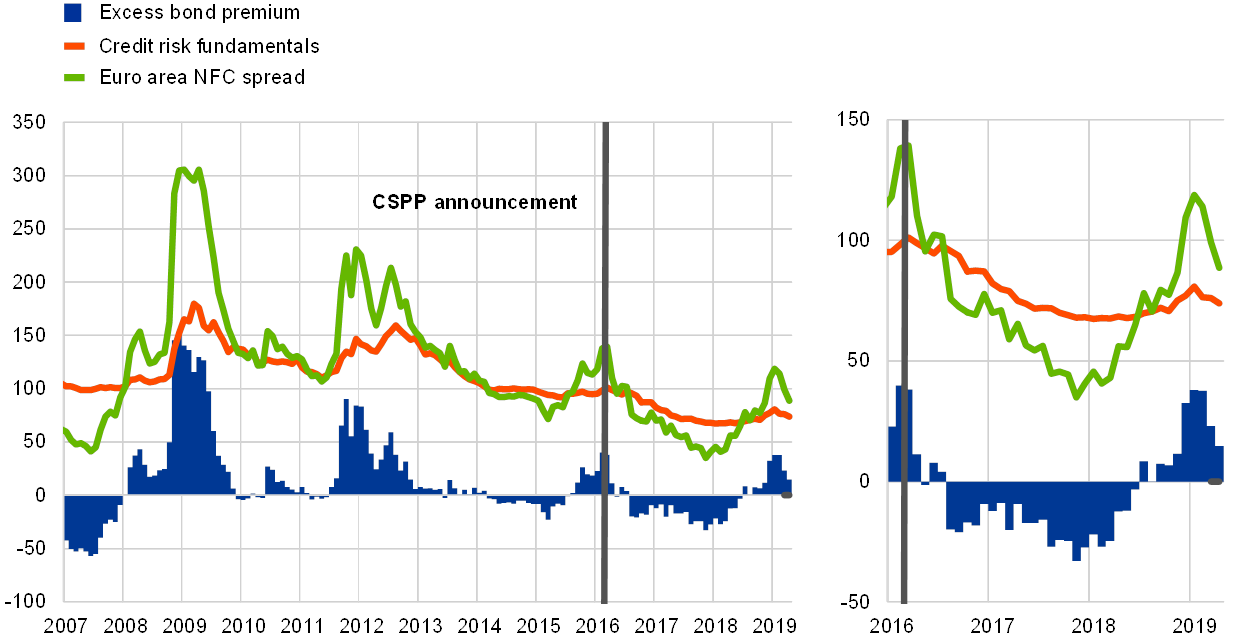

Changes in underlying credit risk fundamentals are unable to explain most of the increase in euro area corporate spreads over 2018. A model decomposition of NFC spreads into credit risk fundamentals and a residual component, the excess bond premia (EBP), identifies the EBP as the most prominent driver over 2018 (see Chart B).[1] The residual EBP component captures the drivers of credit spreads which are not related to credit risk fundamentals, measured in the model through expected default frequencies and changes in credit ratings. Thus, by implication, the recent slowdown in euro area macroeconomic growth is yet to translate into credit rating downgrades or a rise in expected corporate defaults.

Chart B

Decomposition of euro area NFC spreads into credit risk fundamentals and excess bond premia

(basis points)

Sources: Thomson Reuters, BofAML and ECB calculations.

Notes: The excess bond premium is the deviation of corporate bond spreads relative to the credit risk of the issuer. De Santis R.A., “Unobservable country bond premia and fragmentation”, Journal of International Money and Finance, Vol. 82, Issue C, 2018, pp. 1-25.

Last observation: March 2019.

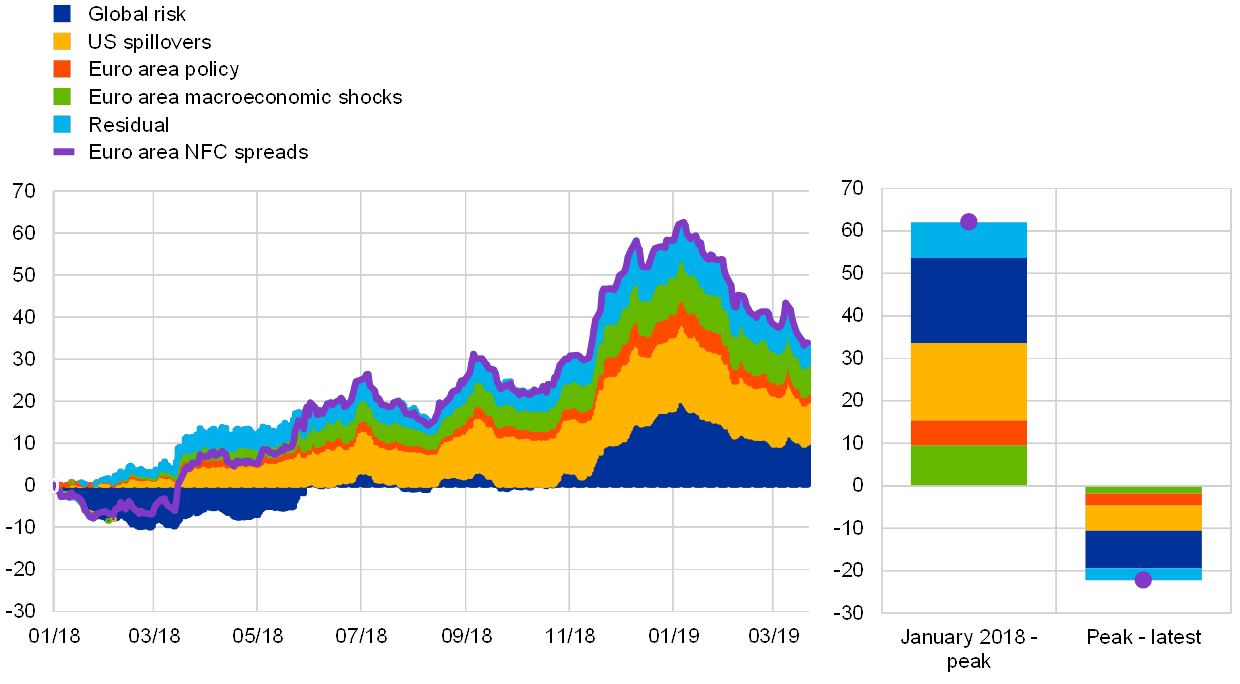

Further analysis suggests that spillovers from the United States and increased global risk aversion were the main contributors to the widening in spreads, with a more limited role being played by the deterioration in the euro area macroeconomic outlook. A Bayesian vector autoregressive (BVAR) model is estimated, which incorporates sign restrictions on cross-asset price movements in the United States and euro area variables to identify euro area macroeconomic and monetary shocks, as well as shocks originating in the United States and a global risk factor (see Chart C).[2] All identified shocks are found to have exerted upward pressure on euro area NFC spreads over the course of 2018. Moreover, the two key factors that account for most of the spread widening appear to be spillovers from the United States and the related global risk factor. The deterioration in the euro area macroeconomic outlook likewise provided some upward impetus, but to a more limited extent.

Chart C

Model-based decomposition of euro area corporate bond spreads since January 2018

(basis points)

Sources: iBoxx and ECB calculations.

Notes: Peak refers to the 4 January 2019. The structural shocks are identified using sign restrictions on cross-asset price movements in a Bayesian VAR model containing euro area risk-free long-term bond yields (10y), euro area and US stock prices, the USD/EUR, the spread between euro area and US long-term risk-free yields (10y) and investment grade euro area NFC spreads. The model is estimated using daily data over the period since July 2006.

Last observation: 21 March 2019.

The global risk factor is dominant in explaining widening NFCs spreads over the fourth quarter of 2018. Other risk asset markets also declined over this period, as shown by a significant fall in NFC equity prices. One dividend discount model suggests that the decline in equity prices was not primarily driven by downward revisions to analysts’ expectations regarding future corporate profitability, but by an increase in equity risk premia. Thus the increase in the global risk component was likely related to a broader deterioration in risk sentiment across risk asset markets. The source of this was most likely a rise in macroeconomic and political uncertainty, primarily in relation to global trade disputes. Since the turn of the year, the global risk factor has again been prominent in driving the moderation of spreads, reflecting a broad-based return of risk to a swathe of risk asset markets, including credit and equity markets. This was spurred by dissipation in perceived risks, supported by the communication by the Federal Open Market Committee at its January meeting that it would be patient with future adjustments to its policy rate.

The contribution of euro area monetary policy to the widening of corporate spreads is limited. The BVAR model suggests that only 5 basis points of the total 60 basis points of widening in corporate bond spreads can be attributed to euro area monetary policy. This conclusion is also supported by other evidence. Throughout 2018, spreads in both CSPP eligible and ineligible bonds increased by a similar magnitude. This stands in contrast to developments following the announcement of the CSPP in March 2016, at which point spreads in eligible bonds fell to a greater extent than those of ineligible bonds.[3] Furthermore, NFC spreads did not discernibly react to ECB policy announcements over this period. Finally, anecdotal evidence from market counterparties suggests that the end of Eurosystem asset purchases was widely anticipated and was only a background theme throughout 2018, rather than a prominent driver.

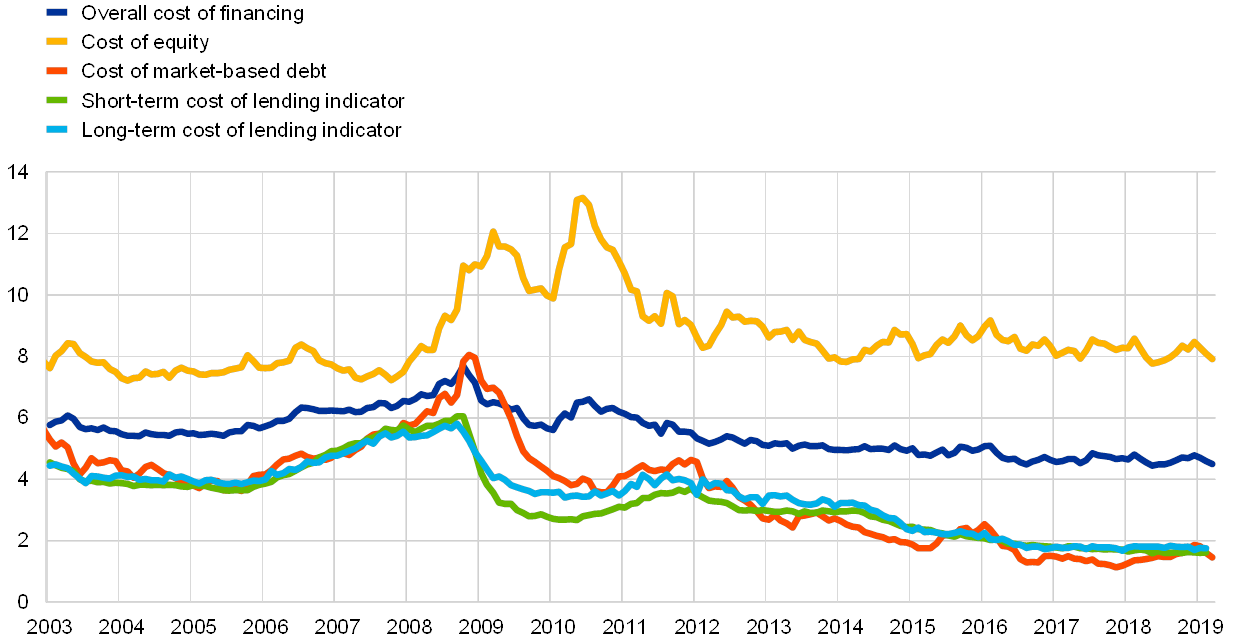

Regardless of the increase in NFC spreads since January 2018, broader financing conditions still remain very favourable. Market-based debt financing only represents a small share of broader NFC financing. Since the cost of other sources of financing has remained more stable, this implies that the increase in the weighted average cost of financing for NFCs has remained contained overall (see Chart D).[4] In addition, supply conditions in primary corporate bond markets remain healthier, in terms of issuance volume, than in the years prior to the launch of the CSPP.

Chart D

External financing conditions of euro area NFCs

(percentages per annum)

Sources: Thomson Reuters, Merrill Lynch, and ECB calculations.

Notes: Observation for March 2019 for the overall cost of financing is a nowcast, assuming that bank lending rates remain unchanged at their February 2019 levels.

Last observation: March 2019.

- Specifically, the model assumes that (the log of) the credit spread for a particular bond is linearly related to: (i) credit risk measured by the sum of credit ratings and expected default frequencies; (ii) other risk factors measured by the sum of coupon, duration and face value; and (iii) a residual component.

- The model is estimated using the BEAR toolbox, Alistair Dieppe, Björn van Roye and Romain Legrand, “BEAR toolbox”, Working Paper Series, No 1934, ECB, Frankfurt am Main, July 2016.

- “The impact of the corporate sector purchase programme on corporate bond markets and the financing of euro area non-financial corporations”, Roberto A. De Santis, André Geis, Aiste Juskaite and Lia Vaz Cruz, Economic Bulletin, Issue 3, ECB, Frankfurt am Main, 2018.

- The debt securities market accounts for less than 20% of NFCs’ outstanding debt and around 10% of their external financing volume.