A new method for the package holiday price index in Germany and its impact on HICP inflation rates

Published as part of the ECB Economic Bulletin, Issue 2/2019.

Harmonised indices of consumer prices (HICPs) are regularly updated for changes in consumption weights and the items included, and on occasion also for methodological improvements. One such improvement is a change in the way the price index for package holidays is calculated in the HICP for Germany, which was implemented with the HICP release for January 2019. This has led to revisions of annual rates of change not only for Germany, but also for the euro area as a whole.

The German price index for package holidays now shows a more meaningful seasonal pattern. While the previous method used seasonal expenditure weights – i.e. different weights in the price index for package holidays taken at different times of the year – the new approach uses annual weights that are kept fixed over the entire year. This means that the price index for package holidays is no longer affected by the switch between seasonal weights at the beginning and end of seasons. However, the application of fixed weights implies that, during out-of-season periods, when prices for seasonal trips are not observable, the missing changes in prices have to be estimated. For instance, in summer it is necessary to include estimates for the changes in prices of trips normally taken in the winter, and in the winter it is necessary to use estimates for the changes in prices in the summer. The estimation is done by means of imputation, where changes in holiday prices in out-of-season periods are estimated on the basis of the price dynamics of other trips actually conducted in that season. Whereas the former approach treated winter and summer holidays separately, the new integrated sample also includes destinations to which trips are made over the entire calendar year. This establishes a relationship between price developments of seasonal trips.

The methodological change has led to a more pronounced seasonal profile for the package holiday price index for Germany and also for the euro area. Chart A shows that the index for the euro area has greater seasonal variation than before, with higher values in the summer months and lower values in the winter months. While the new index varies more between seasonal peaks and troughs, however, its profile is less erratic.

Chart A

Price index for package holidays for the euro area before and after the revision

(index: 2015 = 100)

Source: Eurostat.

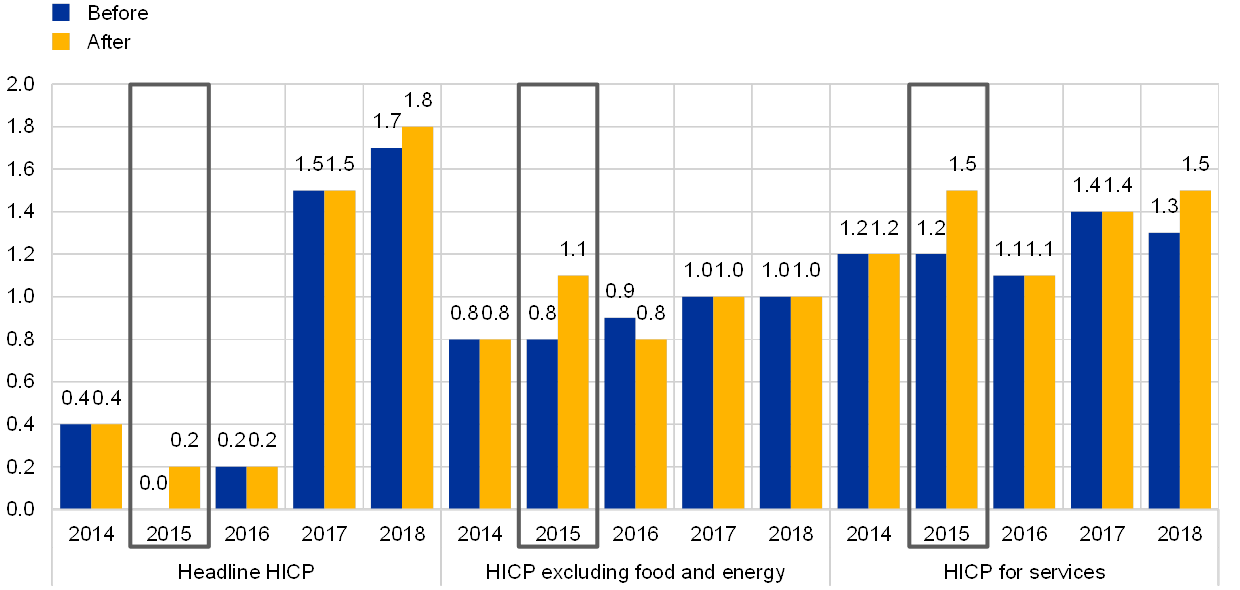

The revised data have had a considerable impact on the annual rates of change of several aggregates of the euro area HICP for the first year for which the methodological change was incorporated; afterwards the impact is more moderate (see Chart B). Index numbers from 2015 onwards use data compiled according to the new method, while the index for 2014 and before is still based on the former treatment of package holidays. The annual rates of change for 2015 are calculated using index values that are based on differing methods, and are therefore distorted.[1] As of 2016, annual growth rates are based entirely on the new method and are therefore undistorted. The impact on the annual growth rates for the period 2016 to 2018 is relatively moderate.

Chart B

Impact of the methodological change for the German package holiday price index on euro area HICP aggregates

(annual inflation rates)

Source: Eurostat.

Note: The annual growth rates in the HICP for services for the years 2017 and 2018 after the revision are also affected by the introduction of a more detailed product classification; see the box entitled “New features in the Harmonised Index of Consumer Prices: analytical groups, scanner data and web-scraping” in this issue of the Economic Bulletin.

Users must look through the distortions in annual growth rates, especially for 2015, when assessing past inflation developments. This is particularly the case, for instance, for euro area HICP inflation excluding food and energy as a measure of underlying inflation (see Chart C). The revision of the series distorts the picture of successive years of low underlying inflation. For analytical purposes, users can correct the series of annual percentage changes in different ways.[2] A simple approach to obtaining annual inflation rates that do not comprise data based on different methods is to use annual rates of change up to December 2015 based on the index before the methodological change, and to use annual growth rates that are derived from the index calculated according to the new method from January 2016.[3]

Chart C

Euro area HICP inflation excluding food and energy before and after the revision

(annual rates of change)

Source: Eurostat.

- See Eurostat, “Improved calculation of HICP special aggregates and German package holidays methodological change”, February 2019, p. 2.

- Approaches to mitigating the impact of the distortions could be facilitated by the use of time series analysis techniques such as seasonal adjustment.

- However, this method cannot be used to derive an HICP time series. The HICP is a price index based on a Laspeyres-type formula (See Eurostat, “Harmonised Index of Consumer Prices (HICP), Methodological Manual”, November 2018, p. 170.), meaning that annual expenditure weights are applied to component indices rather than their growth rates.