Developments in mortgage loan origination in the euro area

Published as part of the ECB Economic Bulletin, Issue 5/2018.

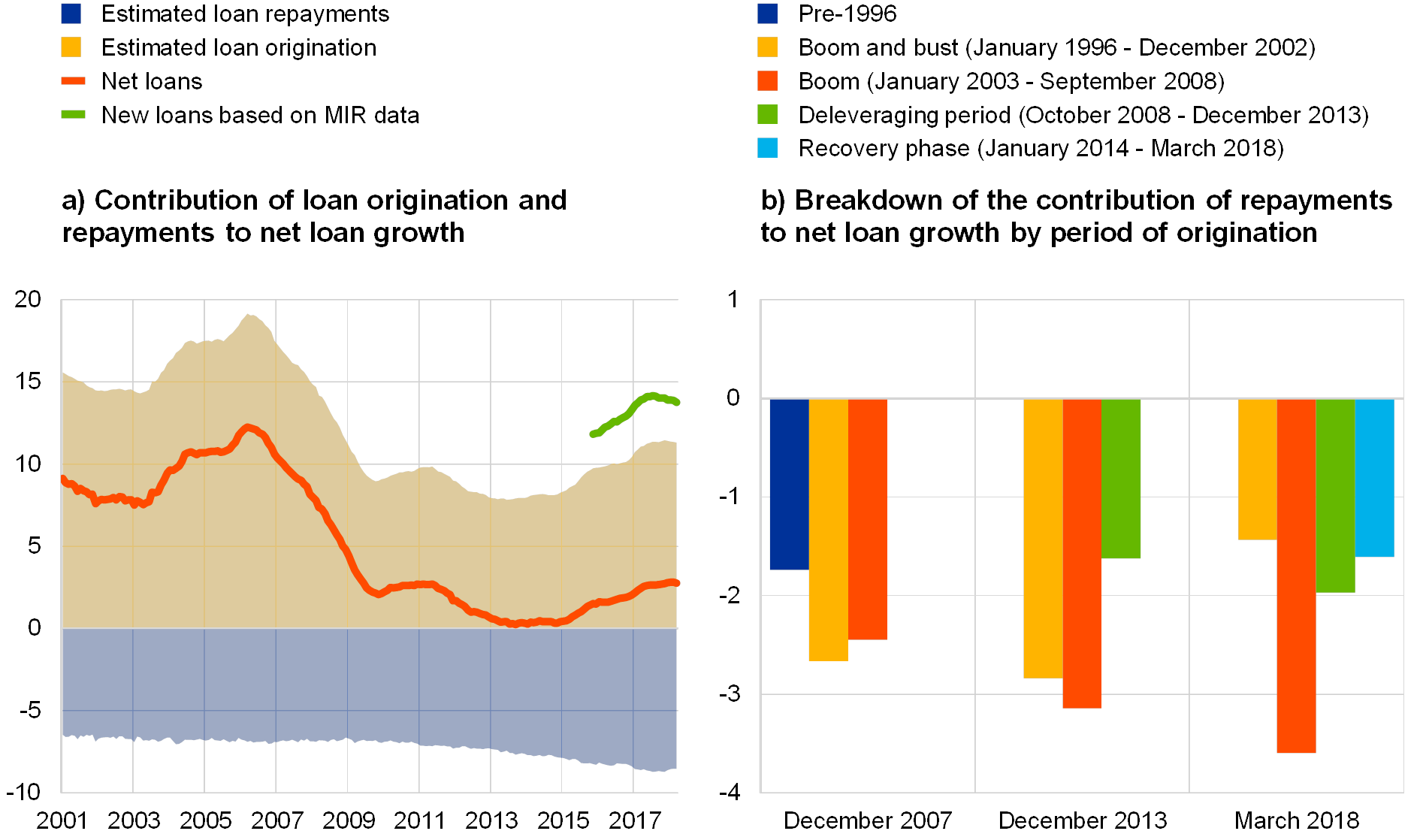

Loans to households for house purchase appear to have grown at a moderate rate in recent years, despite very favourable financing conditions, the recovery in economic activity and dynamic housing markets.[1] The annual growth rate of adjusted loans to households for house purchase was 2.8% in the first quarter of 2018, having increased gradually from slightly above 0% in 2014 (red line in Chart Aa). However, when assessing loan developments, it should be noted that loan growth figures are usually reported in net terms, i.e. newly originated loans and the repayments of previously granted loans are considered together because statistics on balance sheet items are derived from stock figures. Given the long-term nature of mortgage contracts, loan repayments have a long-lasting impact on net figures, especially after a boom, and thus obfuscate the prevailing lending dynamics. Against this background, this box presents the results of a simulated portfolio approach which decomposes net lending flows into loan origination and the repayments of previously granted outstanding loans. Examining these two components separately provides a better view of current loan developments.[2]

Loan repayments have been increasingly dragging down net loan growth in recent years, concealing an increasing dynamism in loan origination. In the first quarter of 2018, loan repayments made a negative contribution to the annual growth rate of loans to households for house purchase of around -8 percentage points, compared with -6 percentage points just before the boom (blue shaded area in Chart Aa). In other words, had the contribution of repayments remained constant since that period, the annual growth rate of loans to households for house purchase would currently be 2 percentage points higher. This negative contribution is expected to grow further, likely peaking in 2022, dragging down net loan growth by around 3.5 percentage points more than before the boom (this estimate is made under the assumption that, in the coming years, the stock will continue to grow at the current pace). Loan origination is estimated to currently be contributing around 11 percentage points to the annual growth of loans to households for house purchase (yellow shaded area in Chart Aa). The estimated recent developments in loan origination are in line with the new data on “pure new loans” published by the ECB in the monetary financial institution interest rate (MIR) statistics (green line in Chart Aa). These are the closest available data to the concept of loan origination, as they report new business data net of statistical renegotiations. However, they still include some transactions that can be considered renegotiations from an economic point of view (e.g. renegotiated loans resulting in a transfer to another bank and loan substitutions). This explains why the contribution of “pure new loans” is somewhat higher than the contribution of the estimated loan origination.[3]

Chart A

Net growth, origination and repayments of loans to households for house purchase

(a – annual growth rate and percentage point contributions to annual growth rate; b – percentage point contributions to annual growth rate)

Source: ECB and ECB calculations.

Notes: Loans to households for house purchase are adjusted for sales and securitisation. Adjusted loans before 2015 are constructed by allocating to loans to households for house purchase all securitisation and loan sales adjustments of loans to households. From 2015 onwards, internally available data on securitisation and sales of house purchase loans are used to adjust the series. “New loans based on MIR data” is the ratio of the accumulated 12-month flows of “pure new loans” from the MIR statistics to the stock of loans to households for house purchase. The latest observations are for March 2018.

The increasing contribution of repayments to the annual growth rate of loans to households for house purchase is a consequence of the large amount of mortgages granted in the boom period before the financial crisis. The predetermined nature of loan repayments allows them to be traced over the life of their respective loans and their contribution to net loan growth to be broken down by period of origination. The contribution of the repayments of loans granted in the boom period has been increasing in the last ten years, and in recent years they have become the loan group that is contributing the most to repayments (Chart Ab). The delayed impact of these mortgage loans reflects the fact that principal amounts are repaid over a long period.[4] This lagged effect is intensified by the fact that most euro area mortgage loans embed increasing repayments over the life of the loan.[5] After a boom, this lag mechanism, which operates through repayments, has a long-lasting impact on the stock of loans, depressing its growth rate for many years ahead and thus blurring the picture of lending dynamics conveyed by net figures. For this reason, especially after large lending booms, it is worth looking at loan origination per se, or relative to alternative scale variables such as GDP.

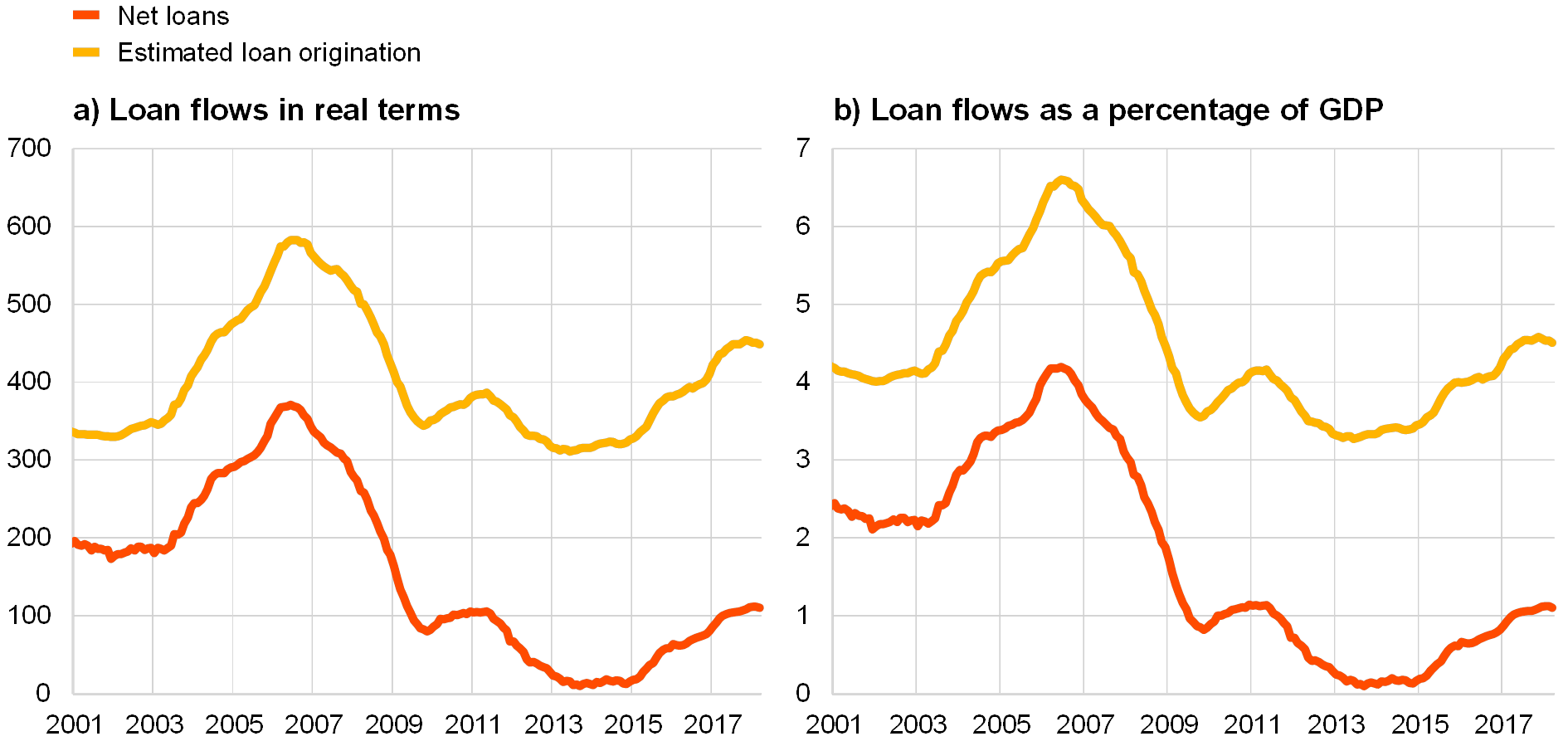

While net loan flows suggest that mortgage lending remains subdued compared with the pre-boom period, loan origination is currently estimated to be around the average observed since 2001 (Chart B). This is valid both when annual loan flows are expressed in real terms (i.e. deflated by the GDP deflator) and when they are expressed as a percentage of GDP. In the 12 months up to March 2018, real loan origination amounted to around €450 billion (or 4.5% of GDP), compared with an average of €405 billion since 2001 (or an average ratio of loan origination to GDP of 4.4%). This is in contrast to the picture obtained by looking at net lending, which in March 2018 was at significantly lower levels than in the pre-boom years. The message from loan origination is consistent with the buoyant house price dynamics observed in recent years, as well as with banks’ own perceptions of loan dynamics as reported in the bank lending survey (see Section 5 of this issue of the Economic Bulletin). According to this survey, both credit standards and loan demand have been supporting mortgage lending dynamics for a number of years, a situation not observed since the pre-crisis period.

Chart B

Flows of loans to households for house purchase

(a – accumulated 12-month flows in EUR billions, deflated by the GDP deflator; b – accumulated 12-month flows over nominal GDP)

Source: ECB and ECB calculations.

Notes: Loans to households for house purchase are adjusted for sales and securitisation. Adjusted loans before 2015 are constructed by allocating to loans to households for house purchase all securitisation and loan sales adjustments of loans to households. From 2015 onwards, internally available data on securitisation and sales of house purchase loans are used to adjust the series. The latest observations are for March 2018.

- The term “loans to households for house purchase” denotes loans for the purpose of investing in houses for own use or rental, including building and refurbishments, or for the purchase of land. Loans included in this category may or may not be collateralised by various forms of security or guarantee. For reasons of concision, throughout this box, the terms “loans to households for house purchase” and “mortgage loans” are used interchangeably.

- The technical details of the methodology are set out in Adalid, R. and Falagiarda, M., “How repayments manipulate our perceptions about loan dynamics after a boom”, Working Paper Series, ECB, forthcoming.

- MIR statistics on “pure new loans” have been publicly available since August 2017 and internally available since December 2014. The latest MIR data are available on the ECB’s website.

- The average original maturity of the mortgages granted during the boom period is estimated at between 18 and 19 years (data derived from the Household and Finance Consumption Survey).

- The most prominent example is the “French” loan, characterised by a fixed monthly instalment with decreasing interest payments and increasing repayments over time. As the decomposition approach used in this box focuses on the repayments schedule of that type of loan, it also covers most variable rate contracts, as long as they share the amortisation schedule of an equivalent French loan.

Banca centrale europea

Direzione Generale Comunicazione

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

La riproduzione è consentita purché venga citata la fonte.

Contatti per i media