Financial risks in China’s corporate sector: real estate and beyond

Published as part of the ECB Economic Bulletin, Issue 2/2022.

1 Introduction

Recent tensions in China’s real estate market have highlighted the risks inherent in the country’s highly leveraged corporate sector. These risks have been building up for some time, as high investment rates have coincided with high levels of debt accumulation. Moreover, the source of debt has moved beyond the traditional banking sector, with non-bank financial institutions providing financing which is less stable and more susceptible to sudden changes in investor sentiment. In addition, tensions in large corporate sectors could be transmitted to the rest of the economy through a number of channels. These channels include households, which are themselves increasingly leveraged and whose wealth is significantly exposed to the real estate market. A wider Chinese growth slowdown could, in turn, have global repercussions, given the size of the Chinese economy, its important global trade linkages and the central role it plays in international commodity markets. Against this backdrop, this article will review the rise in financial risks in China’s economy stemming from increasing private sector leverage, the interconnectedness between the financial and non-bank financial sectors, and households’ rising debt exposures.

2 China’s global importance and rising debt

Recent stress in the real estate sector has highlighted the tension in China’s corporate sector between high rates of growth and high leverage. As the world’s second largest economy, China has accounted for around one-third of global GDP growth over the last decade (Chart 1) while, at the same time, its share of global credit to the non-financial sector has increased from around 8% to 20%.[1] To some extent, this reflects the contribution made by investment spending as one of the main drivers of growth. However, the recent turmoil in China’s real estate sector and the payment difficulties experienced by several large Chinese property developers, such as Evergrande, illustrate the risks inherent in the high leverage, high growth and, ultimately, highly interconnected business model that is widespread among Chinese corporates, and real estate developers in particular.

Chart 1

China’s role in global economic activity

China’s contribution to global GDP growth remains considerable

(contribution to global GDP based on purchasing power parity weights, percentage points)

Sources: IMF and ECB staff calculations.

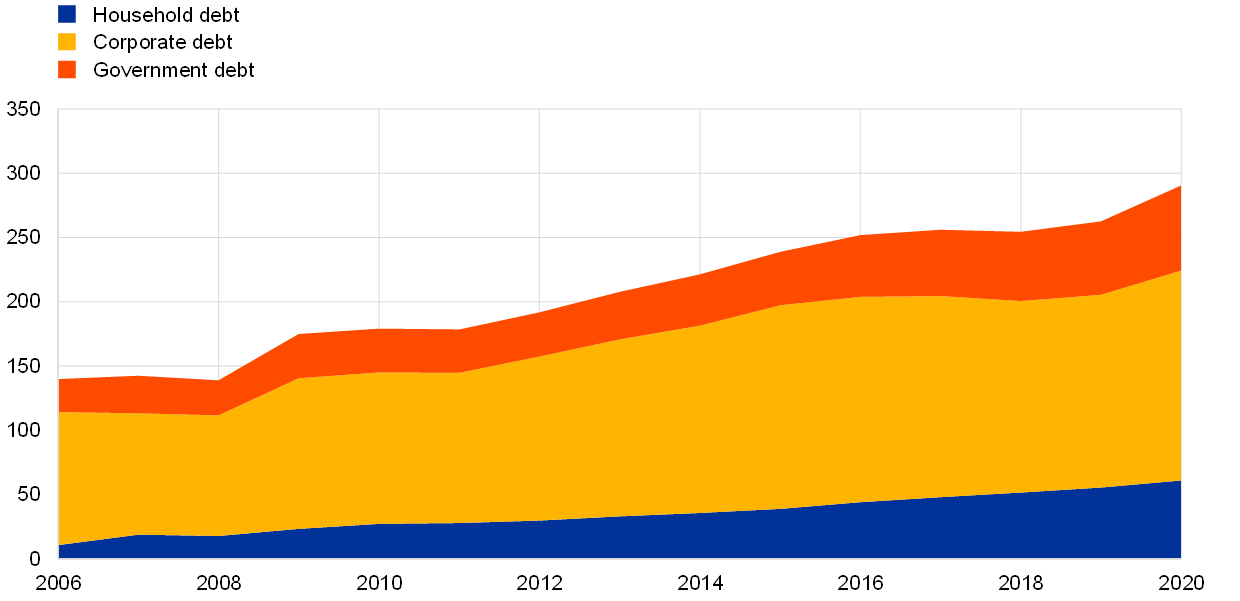

At the same time, a significant proportion of debt financing originates outside the banking sector. China’s debt-to-GDP ratio for the entire private sector now stands at over 250% (Chart 2). Given that the corporate component of this debt is the highest in the world, the banking regulations introduced by the Chinese authorities have increasingly placed limits on the provision of credit to highly leveraged corporates. While China’s financial system remains largely bank based, a significant proportion of funding is supplied to the corporate sector by non-bank financial institutions. The so-called shadow banking sector facilitates corporate financing that can circumvent capital constraints and credit regulations. Moreover, investors commonly expect an implicit guarantee for returns on investment products issued by the shadow banking sector. Despite the fact that contracts clearly state that returns are not guaranteed, both individual and institutional investors assume that the issuing financial company and, in some cases, the local or central government, will make up any shortfall if the investments do not deliver the targeted returns.[2] This leads to a significant underpricing of risks, which results in investor sentiment towards these products being subject to sudden change if a significant shortfall materialises. While the macroprudential regulations adopted by the authorities since 2015 have curbed the growth of shadow banking, its level of outstanding assets remains significant in size and continues to pose risks to the financial system. Moreover, large fintech companies are providing new sources of debt financing to the economy, thereby presenting new and additional challenges to the regulatory efforts made by the authorities to reduce leverage in the Chinese economy.

Chart 2

Debt in China

Debt by sector

(percentage of GDP)

Sources: BIS, IMF and ECB staff calculations. The latest observation is for 2020.

Finally, households could increasingly amplify the impact of corporate stress on the broader economy. For instance, household wealth is increasingly dependent on real estate market developments, and risks which materialise in the corporate sector could spill over to household wealth and, therefore, consumption. Similarly, wealth products provided by the shadow banking sector to households intertwine non-bank financial sector and household risks. As the level of household debt has been rising sharply in China, the interdependence of risk exposures in the private sector has given rise to systemic risks in China that could have adverse spillover effects, both domestically and internationally.

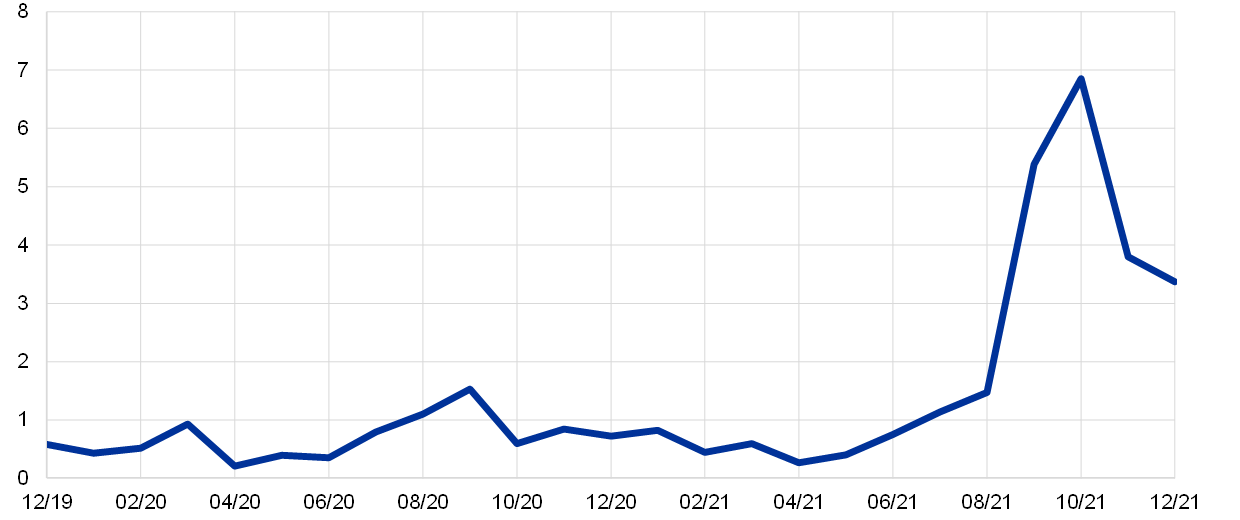

Considering China’s global interconnectedness, developments in the country are important for the global economy. The stress in China’s property sector has reverberated beyond its borders. Reports of Evergrande’s liquidity distress intensified around mid-September (Chart 3, panel a), when the developer reportedly missed the payment deadline on a number of bonds, triggering risk-off sentiment in global financial markets. Global equities fell, temporarily, by around 2-3%, credit spreads widened, and indicators of investor uncertainty rose steadily against a backdrop of flight-to-safety considerations. In addition, metal and oil prices declined, highlighting potentially reduced demand for commodities resulting from a slowdown in real estate activity in China (Chart 3, panel b). While the global spillovers proved to be short lived, in part due to the belief that the Chinese government would take action to mitigate adverse spillovers within its own economy, real and financial shocks in the world’s second largest economy have global repercussions. The ECB reported, in the May 2018 and May 2021 issues of its Financial Stability Review, that China’s weight and systemic relevance in the global financial system is increasing – even if the country remains relatively isolated financially.[3] Furthermore, China-specific shocks could have greater financial stability implications than shocks in other emerging markets.[4] Against this backdrop, this article will review the rise in financial risks in China’s economy deriving from increasing private sector leverage, the interconnectedness between the financial and non-bank financial sectors, and households’ rising debt exposures.

Chart 3

Global market response to the Evergrande crisis

a) The number of newspaper articles mentioning Evergrande increased substantially in 2021

(share of total articles mentioning China, percentages)

b) Financial markets reacted negatively around mid-September: 16/09/2021 to 20/09/2021

(percentages and basis points)

Notes: Panel a: Shares of newspaper articles mentioning Evergrande of total articles published on China in the Wall Streat Journal and the South China Morning Post. Panel b: Changes between 16 September 2021 and 20 September 2021. Equities (United States: S&P 500, Euro area: EURO STOXX 50, Japan: Nikkei 225, Emerging markets: MSCI Emerging Markets Index, China: Shanghai Stock Exchange Composite Index) – price (change, percentages); Uncertainty and risk aversion (VIX) – level change; Uncertainty and risk aversion (US 10-year Treasury) – yield (change, basis points); Uncertainty and risk aversion (Japan: Nominal Effective Exchange Rate) – index (change, percentage points); Uncertainty and risk aversion (gold price) – nominal price (change, percentages); Credit (ICE BofA, ICE BofA US Non-Financial, ICE BofA Euro Area Non-Financial, JP Morgan Emerging Market Bond Index, euro area bank CDS, China sovereign CDS) – yield spread (change, basis points); Currencies (JP Morgan Emerging Market Currency Index, USD/EUR) – index (change, percentage points); Commodities (GSCI Industrial Metals Index, Brent oil price) – nominal prices (change, percentages).

3 Rising leverage in the corporate sector and the implications for growth and financial stability

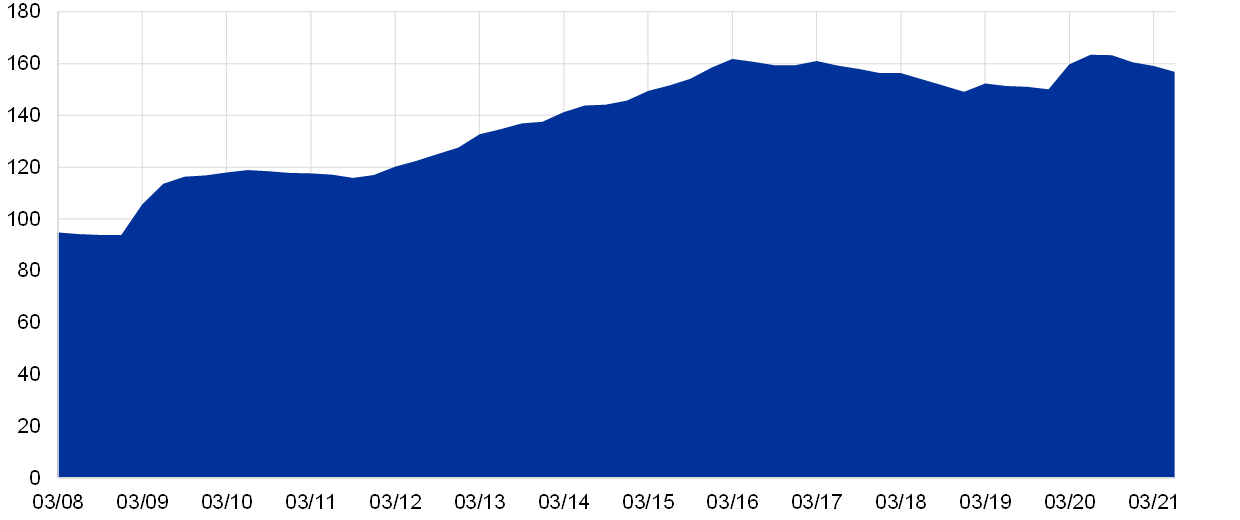

The rise in corporate debt outpaced that of other countries. Corporate credit rose from around 90% of GDP in 2008 to 160% in 2016, and currently exceeds the corresponding figure for both advanced and other emerging market economies (Chart 4, panel b). Although the government launched a deleveraging campaign in 2015, which led to a stabilisation of debt-to-GDP ratios at lower levels, the onset of the coronavirus (COVID-19) pandemic in 2020 saw the debt-to-GDP ratio once again reaching historical highs, although it has slowly declined since then amid volatile GDP growth (Chart 4, panel a).

Chart 4

Corporate sector debt dynamics and international comparison

a) Credit to non-financial corporations in China increased sharply

(percentage of GDP)

b) Credit to non-financial corporations is high by international comparison

(percentage of GDP)

Source: BIS via Haver Analytics. The latest observation is for Q2 2021.

Notes: Debt is estimated at market value, which is the price at which an asset would change hands if sold on the open market. Advanced economies are AU, CA, DK, EA, JA, NZ, NO, SE, CH, UK, US. Emerging market economies are AR, BR, CL, HK, IN, ID, MY, MX, PL, RU, SA, ZA, TH, TK.

The challenge for China is to strike a balance between the deleveraging of the corporate sector and supporting economic growth. The real estate sector has been at the epicentre of the government’s recent regulatory efforts to establish limitations on leverage for property developers. As corporate debt has declined in the real estate sector, housing activity has also slowed, creating headwinds to growth. More recently, banking-related activity undertaken by large technology companies has also become subject to more restrictive financial regulation. While the reforms are helping to lower financial risks in these sectors, lower provisions of credit may affect growth and, therefore, de-risking the corporate sector requires a highly targeted approach.

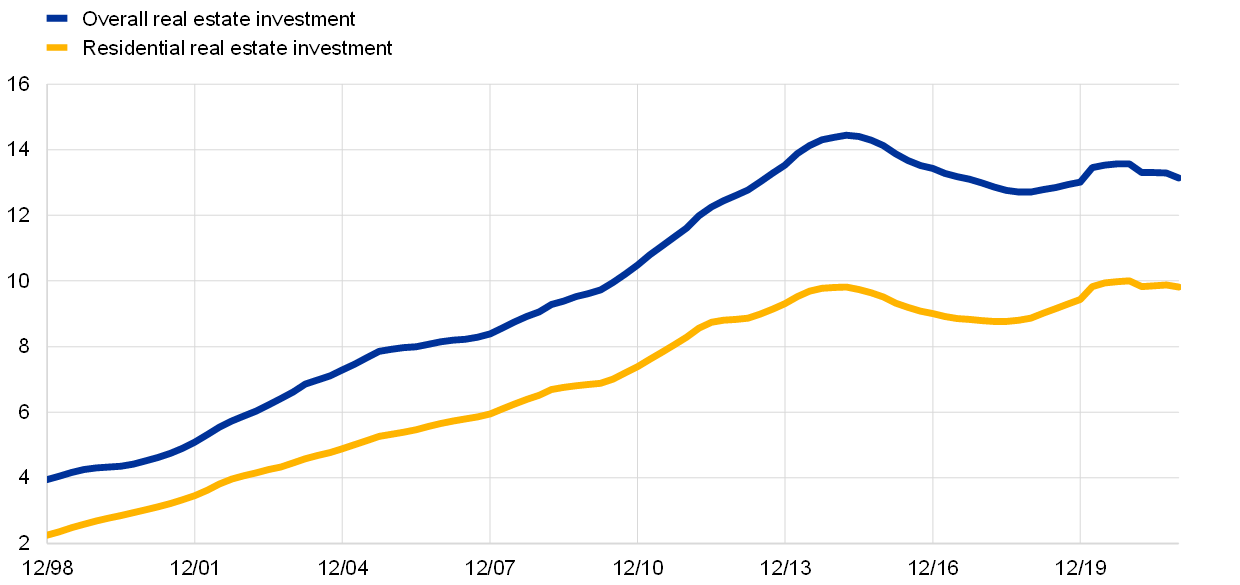

The real estate sector’s central role in the economy

The real estate sector plays a central role in China’s economy. According to China’s national account statistics the combined share of GDP for real estate services and construction increased from 10% in 1995 to around 14% in 2020. Investment in residential real estate has also increased steadily over the last 25 years, stabilising after 2015 as a result of the authorities’ deleveraging efforts, and now stands at around 10% of GDP, while overall investment in real estate is around 13% of GDP (Chart 5, panel a). However, according to many experts, these figures understate the importance of the sector for the Chinese economy. Most notably, using input-output tables, Rogoff and Yang[5] estimate that the impact of real estate activity on GDP is around 29% and has spiked over time, reaching levels which in other advanced economies, such as Spain or Ireland, had called for sharp corrections (Chart 5, panel b). Housing plays a prominent role in the Chinese economy – owning a house is a status symbol and housing represents both a store of value and a source of potential capital appreciation in the absence of other viable investment options. As a result, it accounts for more than half of households’ overall assets, and therefore has an important bearing on households’ expenditure decisions.

Chart 5

The importance of the real estate sector

a) The share of real estate investment of GDP has risen

(percentages)

b) The share of real estate-related activities of GDP is high by international comparison

(percentages)

Sources: Panel a: National Bureau of Statistics via CEIC and ECB staff calculations. The latest observation is for December 2021. Panel b: Rogoff and Yang (2021) using national input-output matrices. For China, see data sources in the paper; for other countries, KLEMS. The latest observation is 2017 for China and the United States, 2015 for Spain and Ireland as well as other euro area countries, 2014 for the United Kingdom and South Korea, and 2009 for Japan.

Indeed, according to China’s National Bureau of Statistics, households in China spend 23% of their income on housing, plus an additional 6% on household facilities, articles and services.[6] Furthermore, land sales represent one of the biggest sources of revenue for local governments.[7]

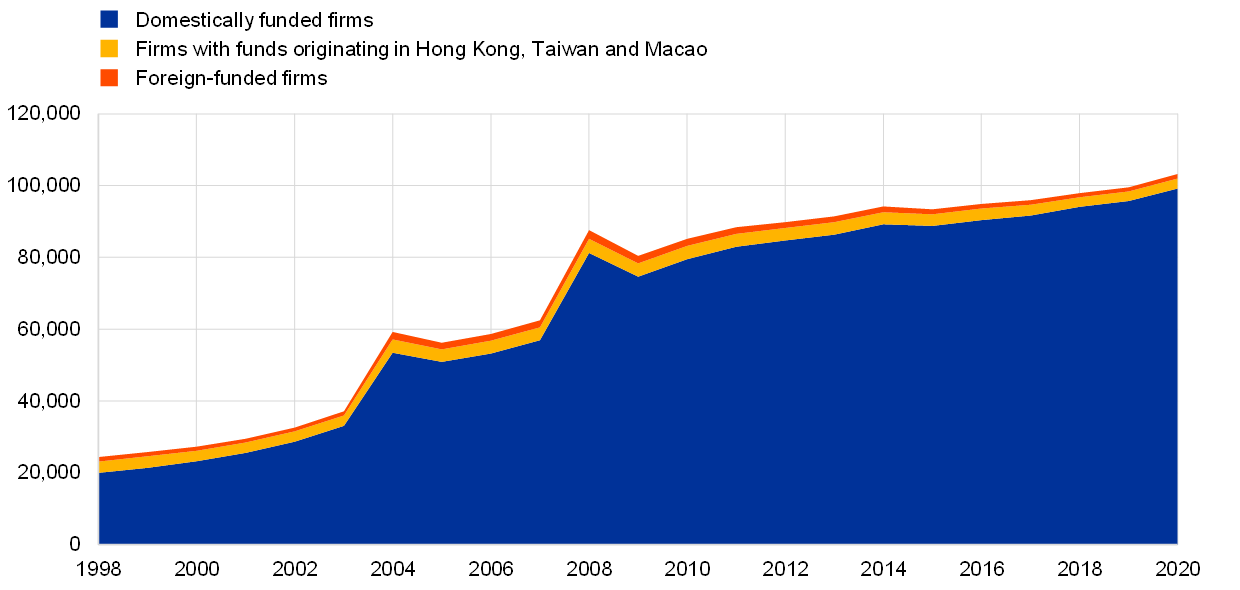

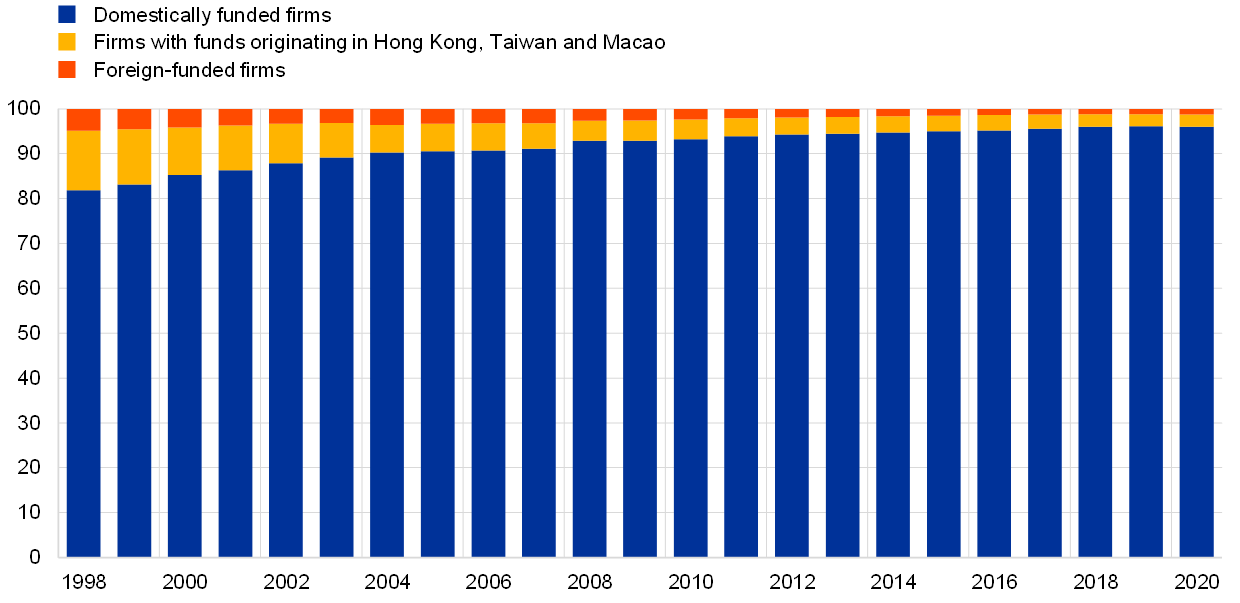

The majority of property developers in China are domestically funded. As of 2020, the number of China’s property developers surpassed 100,000 (Chart 6, panel a) with the pace of expansion accelerating in the aftermath of the global financial crisis. Property developers directly employ around three million people out of a total urban working population of around 400 million, a figure that does not account for the jobs created by residential-connected sectors. Firms in the sector are mostly domestically funded with the share of foreign capital-funded firms, including funds originating from Hong Kong, Macao and Taiwan, having decreased from around 18% in 1998 to less than 4% in 2020 (Chart 6, panel b). Prepayment for yet-to-be-built residential housing provides a substantial part of the liquidity of real estate developers.

Chart 6

Number of domestic property developers and source of funding

a) The number of China’s property developers has risen rapidly

(units)

b) Most Chinese property developers are domestically funded

(percentages)

Source: China National Bureau of Statistics via Haver Analytics. The latest observation is for 2020.

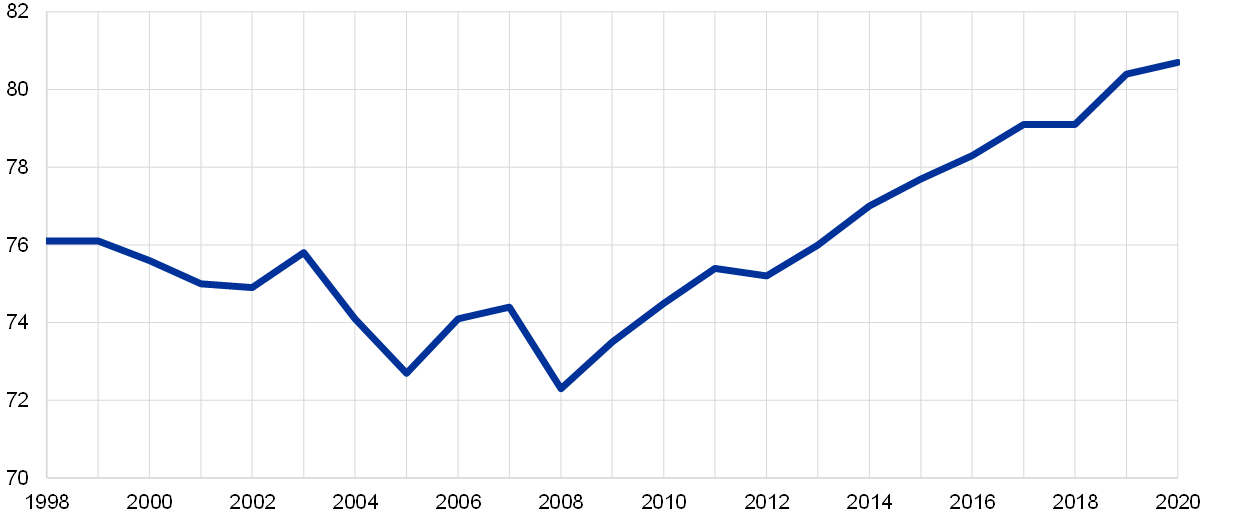

In addition to the steep increase recorded in 2008 in the number of enterprises, the property sector built up leverage fast. The liabilities-to-assets ratio increased from around 72% in 2008 to more than 80% in 2020 for developers overall (Chart 7, panel a). Partly as a response to these dynamics, in August 2020 the Chinese authorities introduced new regulations aimed at de-risking the residential sector.

Chart 7

Property sector leverage and loan dynamics

a) The liabilities-to-assets ratio is rising

(percentages)

b) Growth in loans to the real estate sector has declined

(yoy, percentages)

Sources: National Bureau of Statistics via Haver and CEIC and ECB staff calculations. The latest observations are for 2020 (panel a) and December 2021 (panel b).

The most significant regulation was the introduction of the three red lines – a set of thresholds for three financial ratios which, if crossed, would limit property developers’ ability to raise new debt. As a result, credit to the sector dried up in the second half of 2021, with both mortgages and loans to developers reaching historical lows (Chart 7, panel b).

Recent dynamics in the residential sector – in particular the liquidity problems faced by several developers – have raised concerns over the possibility of contagion spreading to other sectors. Although the authorities appear to be in control of the situation and are able to manage the deleveraging process, high debt levels and the importance of the residential sector to the economy remain potential sources of financial risk.

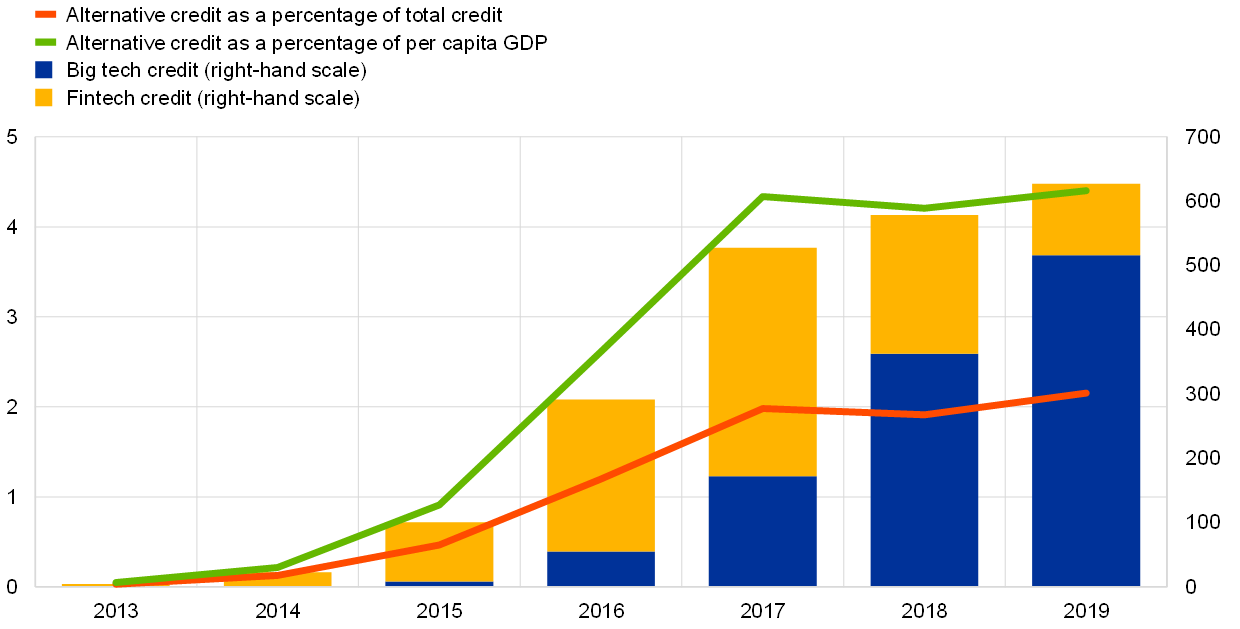

Risks posed by large technology companies’ expansion into credit provision

The activities of China’s large technology companies are raising concerns over market concentration, opaqueness and financial stability.[8] Over time, large technology companies have expanded beyond their (rapidly rising) provision of online payment services (Chart 8, panel a) into areas such as peer-to-peer lending, deposit taking, insurance and direct lending. As such, technology companies, which operate within a lighter regulatory and supervisory framework, are increasingly competing directly with commercial banks. The credit provided by large technology companies is now substantial, amounting to more than 2% of total domestic credit for the financial sector and more than 4% of GDP per capita (from a share which was little more than 0% in 2014), meaning that large technology companies (Chart 8, panel b) are a significant source of credit for consumers and small companies. The provision of credit in a light-touch regulatory setting has raised concerns over the adequacy of capital requirements, collateral sufficiency and the sale of online deposit products.[9]

The expansion of large technology companies into shadow banking activities in the form of risky fintech lending has exposed some financial risks. Fintech companies have facilitated the expansion of credit to new and financially constrained borrowers since the onset of the pandemic. A recent study finds that fintech lending to low-income users has expanded more than it has for traditional banks.[10] The study points to the financial risks associated with this activity, as delinquency rates for these shadow banking loans have tripled during the pandemic, while there has been no significant change in delinquency rates for bank loans. The results of the study show the potential fragility of large technology companies when delinquency rates spike. They also point to the negative implications for broader credit availability and the consequences for growth and financial stability.

Chinese policymakers have recently introduced stricter regulations for technology companies. The new regulations reflect the Chinese authorities’ increasing concerns over companies’ ability to use significant funds raised from capital markets to provide credit within a lighter regulatory and supervisory framework. The recent regulatory changes affecting internet enterprises also seek to reduce the financial risks posed by major incumbents. This could, in turn, help to safeguard financial stability and also foster innovation and generate positive spillovers for China’s small and medium-sized enterprises.

Chart 8

Online payments processed and credit provision

a) Online payments by non-banks continue to increase

(CNY trillions, not seasonally adjusted)

b) Credit provided by fintech and big tech has risen sharply

(percentages; USD billions)

Sources: National Bureau of Statistics via Haver; Cornelli, G., Frost, J., Gambacorta, L., Rau, R., Wardrop, R. and Ziegler, T., “Fintech and big tech credit: a new database”, BIS Working Papers, No 887, BIS, September 2020; World Economic Forum, IMF, 2021; and ECB staff calculations. The latest observations are for Q3 2021 and 2019.

Note: Alternative credit is provided by fintech and big tech.

4 Leverage and exposures between banks and non-bank financial institutions

Linkages to and ownership of banks and other financial institutions by large corporates are leading to a rise in financial stability risks. In part, this is due to the underlying nature of the so-called shadow banking sector. The People’s Bank of China defines shadow banking in China as “credit intermediation involving entities and activities outside the regular banking system, with the functions of liquidity and credit transformation, which could potentially cause systemic risks or regulatory arbitrage”.[11] In the context of high corporate leverage in China, shadow banking constitutes an important source of finance that has fuelled the rise in corporate debt.

Although the rate of growth of shadow banking has slowed recently, the shadow banking sector remains particularly vulnerable to adverse shocks. Shadow banking was virtually non-existent prior to 2008, but has expanded rapidly in recent years, reaching a share of about 60% of GDP (Chart 9, panel a). Although macroprudential policies have curbed growth in the sector, levels remain near all-time highs, posing risks to the Chinese economy. China’s shadow banking sector is mainly concentrated on activities that are highly vulnerable to changes in investor sentiment. These activities include certain types of investment vehicles, such as wealth management products whose value amounts to around 25% of GDP.

Chart 9

Shadow banking and its components

a) Shadow banking has stabilised and its share of GDP has remained roughly unchanged

(percentage of GDP; USD trillions)

b) The rise of shadow banking has been driven by unstable funding components

(percentages of GDP)

Source: Financial Stability Board, 2020.

Notes: The Financial Stability Board’s definitions, for non-bank financial intermediation, of economic functions (EFs) are: EF1: collective investment vehicles susceptible to runs (wealth management products); EF2: non-bank financial entities dependent on short-term funding to support lending activities; EF3: market intermediaries dependent on short-term funding; EF4: insurance or guarantees of financial products; and EF5: securitisation-based credit intermediation vehicles. Data for category EF4 are not reported for China.

Shadow banking is vulnerable given its reliance on short-term funding, its use in already highly leveraged sectors of the economy and its lack of transparency. Shadow banking remains dominated by wealth management products (WMPs) which are structured and offered by banks in cooperation with trust companies and securities firms. This legal structure moves them off banks’ balance sheets and out of the purview of deposit regulations, so they can offer higher rates of return than bank deposits. On the liabilities side, over 40% of outstanding WMPs have maturities of three months or lower, although these funds often feed into longer-term lending. As a result, WMPs need to roll over their funding very frequently, exposing themselves to liquidity and rollover risks (Chart 9, panel b). This risk is compounded by the fact that 70% of WMPs issued since 2007 are not covered by explicit guarantees, while investors perceive WMPs as being implicitly covered by guarantees from the banks distributing these products or, in the event of a default, by the government (Dang et al.).[12] Shadow banking has fuelled a rise in funding in riskier areas such as the real estate sector. Sun[13] reports that the shadow funding of real estate has far outpaced that of other sources such as loans. Banks can lend to non-banking financial institutions such as trust companies, which in turn provide entrusted loans to real estate companies to whom lending has otherwise been restricted. Trust companies have been subject to less regulation as they act on behalf of their beneficiaries. Shadow banking therefore increases the link between banks and non-bank financial institutions. More recently, non-financial enterprises have increasingly invested in a variety of financial institutions, while maintaining complex and non-transparent ownership structures.

The lack of transparency regarding cross-exposures between the non-financial and financial sectors harbours further risk in China’s financial system. In China there are cases in which multiple financial entities across different financial sub-sectors are controlled by the same non-financial conglomerate. In some cases, investments are made using borrowed funds, resulting in an increase of corporate leverage ratios. At the same time, ownership structures remain opaque with ownership being disguised through the use of complex equity arrangements or special purpose vehicles. As a result, the People’s Bank of China has found that some large holding companies give rise to contagion risk amid a severe lack of transparency of risk conditions.[14]

The authorities have tightened regulation considerably, to reduce many of the risks associated with shadow banking and the lack of transparency in the cross-exposures between corporate entities. For instance, new rules have been introduced to identify cross-ownerships of enterprises and financial institutions and to require such structures to be regulated as financial holding companies. In addition, stricter rules have been applied to limit lending to the real estate sector and to increase the oversight of fintech companies expanding into more traditional banking services. At the same time, many of the new regulations are being phased in gradually, so some systemic risks in the financial system will remain in the near term.

5 Household debt dynamics

Financial issues faced by a number of real estate developers have exposed the interdependence between households and corporates, and the importance of housing wealth to economic activity. The extent to which real estate developers rely for funding on households prepaying for yet-to-be-built residential housing, along with significant investment by households in real estate assets, has exposed the interconnectedness between corporate and household balance sheets. Housing represents a large part of household wealth, so it weighs heavily on households’ expenditure and risk tolerance and directly affects corporate incomes and funding. It also affects economic activity generally. Moreover, the high level of household debt constrains future household spending and is creating potential headwinds to economic growth. With real estate investment amounting to around 14% of GDP in 2020, a marked slowdown in the housing market could cause China’s economic growth to decelerate, with spillovers to the rest of the world.

Although the corporate sector accounts for the largest share of debt, household indebtedness has risen rapidly and is approaching advanced economy levels. Chinese household debt has more than tripled since the global financial crisis – it is now substantially above the emerging market average, very close to the euro area average (Chart 10), and near the levels reached by Japanese households in the 1990s. In its 2019 Financial Stability Report, the People’s Bank of China emphasised the need to closely monitor household debt risks from a macroprudential perspective. It also encouraged banks to strengthen their practices and recommended that a comprehensive credit information system be built up. The speed of debt accumulation by Chinese households has raised concerns as to whether further debt increases could lead to significant adverse effects on growth and financial stability.[15] Both the level and the rate of increase in household debt could pose risks to financial stability, given the lack of personal bankruptcy laws, which further impedes debt resolution.[16] Moreover, nominal interest rates are higher in China than in advanced economies, which makes debt servicing by households relatively more expensive.

Chart 10

Household indebtedness

The household credit-to-GDP ratio has risen to the euro area average

(percentage of GDP)

Sources: BIS via Haver Analytics and ECB staff calculations. The latest observation is for 2020.

The exposure of households to housing and other real estate developers is a cause for concern. Chinese household leverage (the ratio of debt to disposable income) has more than tripled since the global financial crisis (Chart 11, panel b). Most residential housing in China is purchased in the pre-sale market before construction has been completed.[17] In this way, households provide funding to real estate developers by prepaying for yet-to-be-built residential housing. The recent financial issues faced by several developers raise questions as to the completion prospects for prepaid housing and the availability of such funding in the future, while the weakness of residential housing prices could affect household balance sheets.[18]

Chart 11

Household indebtedness

a) Mortgage debt doubled between 2007 and 2021

(percentage of total loans)

b) The ratio of household debt to disposable income tripled between 2007 and 2021

(percentages)

Source: People’s Bank of China via CEIC. The latest observation is for December 2021.

6 Conclusion

China’s corporate debt remains high by international comparison and represents a risk to growth. High leverage in the corporate sector has underpinned high rates of investment and economic growth. However, as corporate debt in China has risen to levels significantly beyond those of advanced economies such as the United States and the euro area, financial risks have continued to build up. The current turmoil in the real estate sector illustrates the impact of the materialisation of such risks on the economy. Defaults by major property developers have increased financing costs in the corporate sector and slowed real estate activity, which in turn is weighing on GDP growth.

Deleveraging the corporate sector and stabilising the rise in household debt remains a priority but would probably create headwinds to economic activity. Reducing financial risks in China entails slowing the provision of credit to the non-financial corporate sector. Slowing down household debt accumulation and monitoring and analysing household debt risks could help to mitigate financial stability risks and promote sustainable growth. Striking a balance between de-risking the economy and maintaining stable growth will be a challenge. Targeted macroprudential and microprudential measures will help to achieve these dual aims.

At the same time, unstable funding sources from the shadow banking sector remain exposed to sudden changes in investor sentiment. In addition to high corporate leverage, the shadow banking sector gives rise to risks. Although growth in assets originating in the non-bank financial sector has been halted, the stock of assets that are subject to short-term financing needs remains historically high. As these assets remain vulnerable to sudden changes in investor sentiment they represent risks to the financial system. Furthermore, a lack of transparency with regard to exposures between the financial and non-financial sectors is giving rise to uncertainties which could intensify systemic stress when financial risks materialise. Overall, financial risks in the Chinese economy remain significant and it is essential to continue with ongoing regulatory efforts to de-risk the economy to ensure stable growth in the medium term.

- See Dieppe, A., Gilhooly, R., Han, J., Korhonen, I. and Lodge, D. (eds.) “The transition of China to sustainable growth – implications for the global economy and the euro area”, Occasional Paper Series, No 206, ECB, January 2018.

- See Allen, F., Gu, X., Li, C. W., Qian, J. and Qian, Y., Implicit Guarantees and the Rise of Shadow Banking: The Case of Trust Products, mimeo, 13 December 2021.

- See the box entitled “The growing systemic footprint of Chinese banks”, Financial Stability Review, ECB, May 2018, pp. 36-38.

- See the box entitled “Emerging markets’ vulnerability to a reassessment of risk”, Financial Stability Review, ECB, May 2021.

- Rogoff, K. and Yang, Y., “Has China's Housing Production Peaked?”, China & World Economy, Vol. 29, No 1, Institute of World Economics and Politics, Chinese Academy of Social Sciences, January 2021, pp. 1-31.

- This figure refers to expenditure on household and individual articles for living purposes as well as household services. It includes furniture and interior decoration, home appliances, home textiles, miscellaneous daily household articles, personal articles and household services.

- According to the 2019 IMF Article IV Consultation, local government revenues from land sales accounted for around 39% of local government revenues and 7% of GDP in 2017.

- Large technology companies include fintech and big tech companies. Fintech companies are companies that facilitate peer-to-peer/marketplace lending and invoice trading through their online lending platforms rather than through traditional banks or lending companies. Big tech companies are large companies whose primary business is technology which have entered credit markets, lending either directly or in partnership with financial institutions. For a detailed discussion see Bank for International Settlements, “Big tech in finance: opportunities and risks”, BIS Annual Economic Report, Chapter III, June 2019; and Claessens, S., Frost, J., Turner, G. and Zhu, F., “Fintech credit markets around the world: size, drivers and policy issues”, BIS Quarterly Review, September 2018.

- By the end of 2020 large technology companies had removed online deposit products from their platforms.

- Zhengyang, B. and Huang, D., “Shadow Banking in a Crisis: Evidence from FinTech During COVID-19”, Journal of Financial and Quantitative Analysis, Vol. 46, No 7, July 2021.

- See People’s Bank of China, “Shadow Banking”, China Financial Stability Report, Special Topic IV, 2013, pp. 197-205.

- See Dang, T.V., Liu, L., Wang, H. and Yao, A., Shadow Banking Modes: The Chinese versus US System, Columbia University, mimeo, 2019.

- Sun, G., “China's Shadow Banking: Bank's Shadow and Traditional Shadow Banking”, BIS Working Papers, No 822, Bank for International Settlements, 2019.

- See, for example, Trial Measures on Regulation of Financial Holding Companies, Order No 4, People’s Bank of China, 11 September 2020.

- See International Monetary Fund, “People’s Republic of China – selected issues”, IMF Staff Country Reports, No 19/274, August 2019.

- See Cheung, K-Y., China Law of the People’s Republic of China on Enterprise Bankruptcy, Baker McKenzie, 2018.

- See Deng, Y. and Liu, P., “Mortgage Prepayment and Default Behavior with Embedded Forward Contract Risks in China’s Housing Market”, Vol. 28, No 3, The Journal of Real Estate Finance and Economics, 2009, pp. 214-240.

- Substantial savings levels help to mitigate household debt risks. However, they have been declining in recent years, while employment conditions currently constitute another headwind.