Next Generation EU: a euro area perspective

Published as part of the ECB Economic Bulletin, Issue 1/2022.

1 Introduction

Next Generation EU (NGEU) is a cornerstone of Europe’s common policy response to the economic challenges raised by the coronavirus (COVID-19) pandemic. The pandemic triggered a severe economic downturn in the EU and a re-intensification of cross-country divergences. In July 2020, the EU responded forcefully by announcing NGEU, an EU-wide investment and reform programme. In the short term, NGEU aims to support the recovery. In the medium term, it is designed to act as a catalyst for the modernisation of the EU economies, with positive effects on their growth, resilience and convergence. To achieve these objectives, NGEU offers financial support to the EU Member States conditional on the implementation of concrete investment and reform projects over the period 2021-26. If implemented effectively, NGEU should thus provide a significant boost to the capital stock and potential output of EU Member States.

NGEU offers a unique chance to foster transformative momentum in the Member States on account of its funding volume, inbuilt cross-country solidarity and the fact that funding is linked to national policy performance. NGEU mobilises an unprecedented funding volume of up to €807 billion in current prices, the equivalent of 6% of 2020 EU GDP, of which €581 billion has been requested by EU Member States to date. Of the seven NGEU programmes, the Recovery and Resilience Facility (RRF) is by far the largest, accounting for 90% of the total envelope.[1] About half of the RRF funds are made available in the form of non-repayable grants to Member States; the other half is made available in the form of loans. Moreover, relatively more funding is made available for countries that have been hit hardest by the pandemic crisis, which also display lower GDP per capita and/or relatively higher debt-to-GDP levels. By designing NGEU with these features, Member States have demonstrated strong solidarity with each other. At the same time, RRF funding is made available to Member States conditional on the implementation of national recovery and resilience plans (RRPs), which set out concrete investments and reforms aligned with EU guidance.[2] Each RRP must be assessed by the European Commission and approved by the Council of the EU.

NGEU could provide useful lessons for the economic governance framework and for a potential permanent fiscal capacity for the euro area in the future. NGEU is designed as a one-off measure. At the same time, the ECB has long supported a common macroeconomic stabilisation function to complete the economic and institutional architecture of Economic and Monetary Union (EMU). A fiscal capacity for the euro area should be designed in such a way as to complement a set of incentives for sound national fiscal and economic policies and, in particular, for reforms aimed at addressing national structural challenges and strengthening compliance with the EU’s fiscal and macroeconomic surveillance framework.[3],[4]

This article provides an overview of NGEU from a euro area perspective, with a special focus on the national investment and reform plans. By late 2021, the RRPs of all euro area countries except for the Netherlands (which has not yet submitted an RRP) had been assessed by the Commission and approved by the Council and entered the implementation phase. All the RRPs were subject to the same EU rules, operational guidance by the Commission and peer review in the EU fora, which facilitates a horizontal analysis. Against this backdrop, Section 2 reviews the fiscal aspects of the RRPs, most notably the planned investments and their expected macroeconomic impact. Information missing from the RRPs, for example on the time profiles of fiscal measures and their statistical classification, is complemented by Eurosystem and ECB staff assumptions, which are subject to some uncertainty. Section 3 assesses the structural reforms included in the RRPs. Section 4 analyses the elements of the governance in place for the RRF that can sustain a successful implementation of NGEU. Section 5 concludes.

2 Plans for fiscal measures

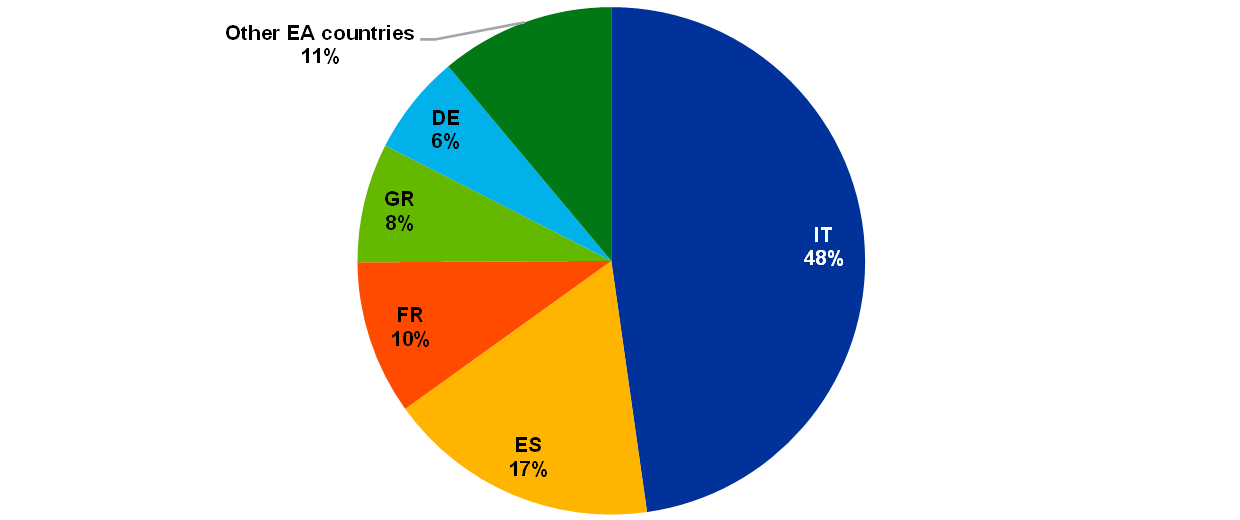

All euro area Member States intend to make full use of the available RRF grants, while only a few governments have requested loans so far.[5] The grants total €262.1 billion for euro area Member States (Chart 1, panel a). RRF loans have been requested up to the ceiling of 6.8% of gross national income only by Greece and Italy. Slovenia, Portugal and Cyprus make so far some limited use of the loan funding available to them, bringing the overall amount of loans requested by euro area countries to €138.9 billion. While there are other euro area countries for which RRF loans would be available at favourable conditions compared with market rates, these have opted not to use them for the time being.

Almost two-thirds of RRF funding requested in the euro area is currently allocated to Italy and Spain. The overall funding to be mobilised for euro area countries is currently expected to be €401 billion over 2021-26, equivalent to 3.5% of euro area 2020 GDP. Almost half of it (48%) is currently estimated to be absorbed by Italy (Chart 1, panel b). This amounts to €191.5 billion in grants and loans, or 11.6% of Italy’s 2020 GDP. Spain will, in turn, absorb 17% of the requested RRF funding, which represents €69.5 billion in grants or 6.2% of its 2020 GDP. France and Germany will together receive another 16% of the RRF funding. Finally, around 19% will be directed to the smaller euro area countries: Greece being the major recipient of funds (8% in the form of grants and loans).

NGEU allows the EU to issue a significant volume of debt at the European level. The issuance of new NGEU debt is to take place between mid-2021 and 2026 and entails bond issuance of up to €150 billion per year to finance the non-repayable grants and the RRF loans.[6],[7] This activity reinforces the role of the Commission in the capital markets as a major provider of safe assets denominated in euro.[8] NGEU provides new impetus for the EU to reform its system of own resources and introduce new own resources in the coming years, inter alia for the purpose of repayments.[9]

Chart 1

RRF funding sources in the euro area countries

a) RRF entitlements and funding requested in euro area countries

(2021-26, percentage of 2020 GDP)

b) Volume of RRF funding requested in euro area countries

(2021-26, share of total take-up of grants and loans)

Sources: European Commission and ECB staff calculations.

Notes: Grant entitlements for countries are shown according to the European Commission data. Loan entitlements for countries are calculated as 6.8% of their 2019 gross national income (GNI). No information on RRF grants and loans is available for the Netherlands as this country still has to submit its RRP to the European Commission.

The RRPs include a growth-friendly composition of expenditures financed by the RRF in the euro area Member States. In line with the policy objectives of NGEU, almost 80% of RRP-related expenditures in the euro area is expected to be allocated to investment projects with relatively high fiscal multipliers compared with other expenditure components. Nearly 50% of expenditure is direct government investment and about 30% takes the form of support to private investment via capital transfers (grants to the private sector, public-private partnerships, etc.). As a result, the use of the RRF is expected to increase the share of public investment in euro area GDP during the period 2021-26 by about 2.5 percentage points (Chart 2, panels a and b). The remaining measures will mostly pertain to subsidies, social payments, and other current transfers to be implemented especially in the initial years of the plans. Overall, the RRPs of euro area governments imply a stronger impact on macroeconomic variables than would be the case if RRF funding had been earmarked for social spending or debt reduction.[10]

Chart 2

RRF-financed expenditure profile by statistical category

a) Public investment in the euro area

(percentage of GDP)

b) Expenditure profile of RRF funding requested in the euro area

(2021-26, percentage of total requested)

Sources: Eurosystem and ECB staff assumptions and calculations.

Notes: “RRF-funded investment” includes both (i) government investment (direct public investment, dark green bars) and (ii) capital transfers (indirect public investment, light green bars). GFCF stands for gross fixed capital formation in national accounts, i.e. investment. The public investment-to-GDP ratio (blue lines) includes government GFCF and investment grants. The information for the Netherlands is not included since its RRP has not been submitted to the European Commission yet. In the case of Greece, capital transfers include direct payments to the private sector to carry out new investment projects, which are statistically recorded as deficit-debt adjustment (DDA).

The macroeconomic simulations by ECB staff point to a significant positive contribution of NGEU to the recovery in the euro area. ECB staff macroeconomic models suggest that the additional spending from RRF funding will raise the level of euro area real GDP by around 0.5% in 2023 ‒ an effect that will largely persist in the subsequent years (see Box 1). While the effects are expected to be stronger in the countries that particularly benefit from the programme, they will positively affect all countries also thanks to trade spillovers stemming from higher demand in the EU internal market. This is in line with other studies, which also emphasise the importance of spillover effects.[11] The cross-border nature of some investment projects (e.g. hydrogen and the 5G technology projects) would also contribute to strengthening the EU internal market.[12]

The realised medium-term macroeconomic impact of NGEU may turn out to be higher than currently estimated on account of confidence effects and structural reforms. First, the political agreement on NGEU – in tandem with supportive monetary policy measures – produced significant positive confidence effects in the euro area after the pandemic shock. This is reflected in the fall of sovereign spreads in the most vulnerable economies, reflecting the signal that in times of crisis the EU Member States stood together in solidarity.[13] Second, for the time being, ECB staff simulations, like those published by the Commission, do not take into account the positive impact of structural reforms, which may be very significant. RRF-funded investment is expected to be particularly productive where it is reinforced with appropriate structural reforms. Investments and other productive expenditure directly increase the capital stock, which may enhance total factor productivity and/or create employment, thereby increasing the level of potential output. The structural reforms embedded in the RRPs have the potential to reinforce the impact of the planned investments (see Section 3).

Nonetheless, there are also several risks on the downside over the lifespan of the RRPs, which are difficult to quantify at this stage. These include the possibility of lower absorption rates than expected and a reduction of non-RRF investment, with the funding re-allocated to less productive expenditure categories.[14] Hence, it is key to achieve the agreed milestones and targets in the implementation phase of the RRPs (see Section 4).

If properly implemented, the RRPs may also contribute to reducing cross-country divergences that the pandemic crisis has further exacerbated in the euro area. Over the medium run, NGEU funding may help to offset some of the fragmentation caused by the crisis. Chart 3, panel a, shows that the estimated NGEU-driven increase in the GDP level in 2026 is higher the lower the countries’ GDP per capita in 2019. In this way, NGEU funding also loosens the budget constraint of vulnerable countries and helps forestall a potentially strong fiscal contraction, such as the one observed in some countries in the context of the global financial crisis.

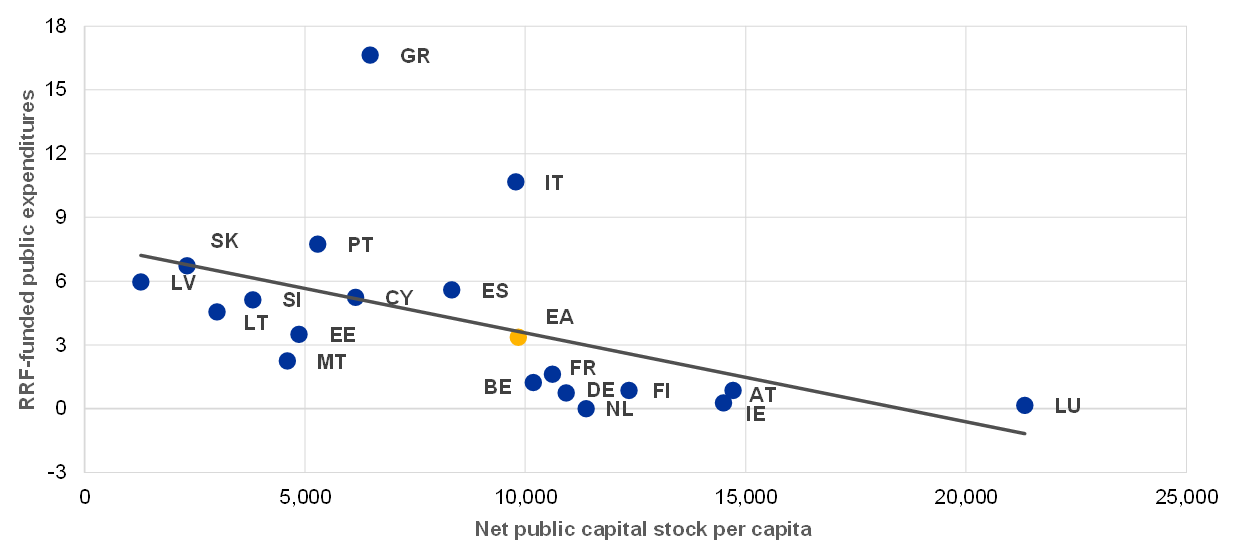

Over the longer run, NGEU may also mitigate some of the most entrenched structural divergences in the euro area economies. For example, RRF funding may trigger a catching-up process for investment. RRF-funded public expenditure as a percentage of GDP is indeed particularly high in the countries with a relatively low net capital stock per capita (Chart 3, panel b). Furthermore, higher growth prospects and lower cost of financing may improve debt sustainability in the vulnerable countries.[15] This may also provide more fiscal space for national economic stabilisation in the future.

Chart 3

NGEU’s contribution to mitigating economic divergence

a) Estimated impact of NGEU on GDP level by 2026 and 2019 GDP per capita

(x-axis: EU27=100, 2019; y-axis: percentages)

b) Total RRF-funded public expenditure and per capita public capital stock

(x-axis: EUR, 2019; y-axis: percentage of 2019 GDP)

Sources: European Commission; Pfeiffer, P., Varga, J. and in ’t Veld, J., “Quantifying Spillovers of Next Generation EU Investment”, European Economy Discussion Papers, No 144, European Commission, July 2021; and ECB staff assumptions and calculations.

Notes: Panel a): For IE and LU the gross national income (GNI) per capita in purchasing power standards (PPS) has been used. For the estimated growth owing to NGEU funds, Pfeiffer, P. et al. use the QUEST model assuming a linear disbursement over six years and no structural reforms. The scenario represented in the chart considers spillover effects and assumes high productivity. For further details on the estimated impact of NGEU on GDP, see Pfeiffer, P. et al. Panel b): Public expenditure is based on the total grants and loans requested by the euro area countries.

Apart from its contribution to economic recovery and resilience, RRF funding is targeted to foster the green and digital transitions of the EU economies. The RRF Regulation[16] requires Member States to allocate at least 37% of RRF-funded expenditure to the green transition, i.e. to measures in spheres such as sustainable mobility, energy efficiency, and clean energy and networks. At least 20% of total expenditure has, in turn, to be devoted to the digitalisation of the economy, especially the digitalisation of public services and the corporate sector, investment in human capital and investment in connectivity. All euro area RRPs fulfil these requirements, though with significant differences across countries.

Box 1

The macroeconomic impact of expenditure plans funded with NGEU

To assess the macroeconomic impact of Next Generation EU (NGEU), this box presents the model specifications, assumptions and results of two ECB staff models, namely a large-scale DSGE model (EAGLE) and a semi-structural model (ECB-MC).[17] Given high uncertainty surrounding the effects of NGEU, the two models are deployed with a view to cross-checking the results.

Model specifications and assumptions

The two models are well equipped with fiscal policy instruments/shocks and are therefore suitable for analysing policies such as the implementation of NGEU. At the same time, they have some distinctive properties. Most notably, the EAGLE model embeds detailed trade links, thereby emphasising spillover effects stemming from higher demand in the EU internal market, and public investment enhancing total factor productivity. Moreover, its forward-looking nature allows the deflationary pressures reflecting the future supply effects of NGEU investment to be identified. By contrast, the ECB-MC model applied here features backward-looking expectations where economic agents do not commensurately internalise the future outcomes of the programme. Instead, the strength of the model comes from its semi-structural nature and close links to the data. Notwithstanding differences, the fiscal multipliers for government investment associated with the two models fall into the typical range (around unity) consistent with the relevant literature, which emphasises the relatively high potency of this fiscal instrument.[18], [19] Finally, estimates reported below do not reflect the impact of the structural reforms associated with NGEU or any confidence effect (reflected in the evolution of sovereign spreads).

The use of RRF funds is somewhat frontloaded over the RRF programme period (from mid-2021 until 2026) in terms of the euro area aggregate (Chart A). Close to 77% of grants and loans are estimated to finance additional fiscal measures in the euro area.[20] Taken in isolation, i.e. without the SURE programme (Support to mitigate Unemployment Risks in an Emergency) and the other components of NGEU, these measures add fiscal stimulus of 0.3% of GDP in 2021 and around 0.5% of GDP per year in 2022 and in 2023. The stimulus in the subsequent years is expected to wane gradually.

Chart A

Amount of RRF funding used for additive vs. substitutive fiscal measures

(percentage of GDP)

Sources: Eurosystem and ECB staff assumptions.

Model results

The analysis suggests that the boost to the level of euro area GDP from NGEU implementation, which reaches around 0.5% in 2022 and in 2023, persists largely in the subsequent years (Chart B). The effects are expected to be relatively more pronounced in countries that particularly benefit from the programme, but visible in all countries. At the same time, short-term effects on inflation are more model-dependent. Forward-looking models with fully rational agents like EAGLE tend to emphasise that rapid demand-driven inflation is quickly offset by disinflationary pressures on account of expected increases of productive capacity in the future. On the other hand, models with backward-looking expectations, like ECB-MC, tend to mostly reflect past and contemporaneous additional demand, which gradually pushes up prices. For this reason, the inflation results will depend on which forces will eventually prevail. However, the impact on euro area inflation is not expected to be significant over the medium run. The implementation of NGEU should lead to a minor reduction in the euro area government debt-to-GDP ratio measured by aggregating debt of single Member States, i.e. not accounting for EU common issuance. This largely reflects NGEU grants used to finance projects that would have been implemented even in the absence of NGEU, i.e. a substitutive element.

Chart B

Simulation of the impact of RRF measures on the euro area GDP level (left panel), annual HICP inflation (middle panel), and government debt-to-GDP ratio (right panel)

(left panel: percentage deviation from the baseline; middle and right panels: percentage point deviation)

Source: ECB staff calculations.

Compared with previous analyses, the current results tend to paint a more moderate picture of the macroeconomic impact of NGEU.[21] This is because they are based on the investment and other expenditures actually included in the RRPs of euro area governments, which effectively replace the assumptions that had to be made in past stylised scenarios.

3 Structural reform plans

The structural reforms in the RRPs are strongly geared towards the public sector, framework conditions for the green and digital transitions, and “soft” labour market policies. The RRPs of euro area countries envisage more than 600 structural reforms. 39% of these reforms are related to the public sector (see Figure 1). This category includes, for instance, policy measures aimed at enhancing the functioning of the judiciary or the health care system. Green/digital framework conditions, such as eco-friendly revisions of building codes, account for 24% of the reforms. There are also synergies with other reform areas, most notably public sector reforms that also support the green and digital transitions, for example by promoting e-governance. 22% of all reforms are related to the labour market, education and social policies. Within this category, measures related to digital skills and active labour market policies are particularly frequent. Measures addressing the business environment and financial policies feature less prominently.

Figure 1

Breakdown of RRP reforms in euro area countries by policy area

(percentage of total)

Source: ECB staff.

Notes: (A) Pensions; (B) Employment protection legislation, framework for labour contracts; (C) Insolvency frameworks. The classification is based on an ECB staff assessment. It has been applied at the level of individual milestones and targets.

The reform mix embedded in the RRPs exploits synergies with the RRF-funded public investments and could thus increase NGEU’s effectiveness in modernising the euro area economies. The reform mix is overall well suited to facilitate a swift and effective roll-out of RRP projects by removing administrative and regulatory bottlenecks. This is particularly important in view of the relatively weak track record of some countries in implementing reforms and absorbing EU structural funds effectively.[22] The reform plans also have the potential to reduce public sector inefficiencies on a broader basis and improve the framework conditions for private investments into green and digital projects, with positive effects on potential output over the medium term. The envisaged activation policies and skill-related initiatives, in turn, could facilitate post-pandemic labour market adjustments.

A stronger focus in the RRPs on labour and product market institutions and the business environment could have increased NGEU’s impact on potential output and resilience. “Classical” reforms aimed at the liberalisation of labour and product markets or the broader business environment feature less prominently in the RRPs. Such reforms are important, since sound structural policies in these fields are widely considered to foster allocative efficiency, potential growth and economic resilience.[23] From a euro area perspective, sound economic structures and institutions also help to reduce the incidence and impact of asymmetric shocks and support the effectiveness of the ECB’s monetary policy, thereby contributing to the smooth functioning of EMU.[24] Corresponding reform efforts would therefore need to take place outside the RRPs, most notably in the context of the European Semester ‒ the EU’s annual policy coordination cycle.

Countries receiving larger RRF funds have committed to more structural reforms than their peers, which is conducive to economic convergence in the euro area. The RRPs of the euro area countries are relatively well aligned with the country-specific recommendations (CSRs) issued in the context of the European Semester, according to the Commission (see Chart 4). This is a requirement laid down in the RRF Regulation. At the same time, the number of reforms envisaged by the RRPs is overall higher for countries that receive particularly large RRF funds relative to GDP.[25] Taken together, these stylised facts on the breadth and depth of reforms suggest that the plans of the main RRF-recipient countries are particularly ambitious. This is broadly in line with the RRF Regulation, which requires a balance between investment and reforms. The cross-country distribution of reforms is also conducive to economic convergence since the main recipients tend to underperform in comparison with their peers in terms of institutional quality and income per capita.

Chart 4

Depth and breadth of the RRPs

(x-axis: number of reforms; y-axis: score, 0=no coverage, 1=full coverage; bubble size: RRF grants and loans, percentage of 2019 GDP)

Source: ECB staff calculations based on European Commission data.

Notes: The x-axis (“breadth”) shows the number of reforms for each RRP, while the y-axis (“depth”) reports the extent to which each RRP addresses the country-specific recommendations (CSRs) according to the European Commission’s assessment. The latter indicator is calculated as an unweighted average score across individual CSRs elements. The bubble size captures the volume of RRF grants and loans requested by a country as a percentage of its 2019 GDP. The dotted lines refer to the unweighted euro area average.

The comprehensive reform plans triggered by the RRF stand in contrast to the weak reform momentum under the European Semester over the past decade. From a multiannual perspective, only 6% of the CSRs issued between 2011 and 2019 have been fully implemented under the European Semester, according to the European Commission. The RRF appears to have been more successful so far in aligning national policy plans with EU policy priorities, although implementation will be key. Moreover, some reforms are not considered additive since they were already planned or implemented before the adoption of the RRPs.

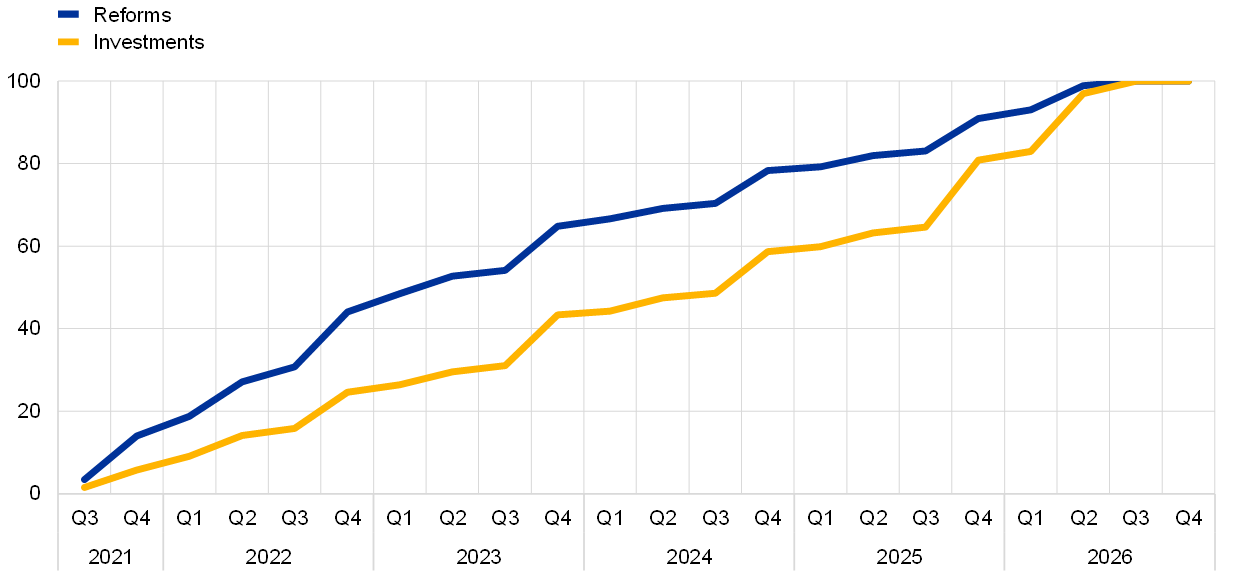

Despite the frontloading of reforms, adverse macroeconomic side effects in the short term are likely to be relatively small and outweighed by the RRF’s positive fiscal impulse. The RRPs envisage that the milestones and targets related to reforms will overall be implemented earlier than those for the investments (see Chart 5). This sequence is relevant from a macroeconomic perspective, since certain reforms can have adverse short-term effects on economic activity before their beneficial impact materialises over time.[26] However, based on the currently available information on the RRPs, it is difficult to find clear examples of reforms planned in the short term that could risk stifling the recovery. Most notably, only a few of the planned labour market reforms are related to changes in employment protection legislation, for which some studies have found significant short-term transition costs. The dynamic effects of the reforms related to the public sector and the digital and green transitions are more difficult to assess, given limited overlaps with the relevant literature. Even so, it seems plausible that households and firms should immediately benefit from policy actions that speed up administrative processes, reduce court congestion, ensure swifter payments in public procurement and enhance digital training.

Chart 5

Cumulative path of RRP milestones and targets

(percentage of total)

Sources: European Commission and ECB staff calculations.

Notes: The chart shows the sum of milestones and targets. Milestones are qualitative achievements, such as the adoption of legislation, while targets are quantitative objectives.

4 Governance

The RRF establishes a new governance framework with several innovative elements, which could be a decisive factor for the success of NGEU and provide lessons for the economic governance framework. First, the RRF lays out a clear framework for the approval of national reform and investment plans, as well as their implementation. Second, the RRF Regulation sets out a balance of roles for the Member States, the European Commission and the Council, which has resulted in close cooperation between national governments and these institutions. It also has the potential to increase national ownership of policy design and the effectiveness of peer reviews. Third, and most importantly, disbursements are made conditional on the fulfilment of milestones and targets set out in each Member State’s RRP, providing positive incentives and accountability for productive investment and reforms. Thus, the RRF could provide useful lessons for the economic governance framework and for a potential permanent fiscal capacity for the euro area in the future.

The process of approval of the RRPs and of disbursement requests involves the Commission and the Council. As illustrated in Figure 2, in the approval phase, Member States submit their RRPs, which set out a package of reforms and investment, including the envisaged milestones and targets for their implementation. These RRPs are assessed by the Commission and approved by the Council.[27] In the subsequent implementation phase, Member States submit requests for payments up to twice per year. The Commission must assess whether the milestones and targets associated with each payment have been fulfilled, taking into account the opinion of the Council’s Economic and Financial Committee (EFC).[28] The Commission then decides whether to approve the disbursement of the relevant portion of grants and loans to the Member State concerned.[29] By end-2021, the RRPs of all euro area countries except for the Netherlands (which has not yet submitted an RRP) had been approved, and €50 billion of pre-financing payments had been disbursed. On 27 December 2021, the Commission disbursed the first payment of €10 billion to Spain. Throughout the approval and implementation phases, the Commission must keep the European Parliament fully informed, both through the regular provision of information and through attendance at regular Recovery and Resilience Dialogues. Moreover, the Commission must prepare reports on the implementation of the RRF. The first review report will be prepared by 31 July 2022, taking into account common indicators and a recovery and resilience scoreboard as provided in the RRF Regulation. A comprehensive interim evaluation report will follow by 20 February 2024.

Figure 2

Procedures under the Recovery and Resilience Facility (RRF)

Source: Authors based on the RRF Regulation.

Note: EFC stands for Economic and Financial Committee.

Thanks to its design and procedural features, the RRF has the potential to strengthen the partnership between the Commission and Member States. Member States prepared RRPs within the framework set by the RRF Regulation and with guidance from the Commission. In contrast to previous EU structural reform instruments, Member States and the Commission engaged in extensive bilateral dialogue on the draft RRPs before they were formally submitted to address gaps and outstanding issues. The Commission notes that this process has the potential to promote mutual trust and understanding of policy priorities and challenges at national and EU level while also ensuring national ownership of the plans.[30]

The RRF also has the potential to strengthen the peer review process in the Council. The Council plays an important role in both phases of the RRP process. This allows Member States to scrutinise the design and implementation of important elements of economic policy in each Member State. The detailed milestones and targets in the plans have the potential to enhance transparency and accountability. However, the effectiveness of this peer review process will critically depend on the willingness and ability of Member States to closely scrutinise requests by other Member States. For example, in the implementation phase, the highly technical nature of individual milestones and targets implies a high administrative burden to monitor their effective implementation. The Council may need to rely on the Commission’s assessment for its discussions, particularly in smaller Member States. This may reduce the scope for Member States to engage in robust scrutiny, and it will therefore be important to ensure the benefits of multilateral surveillance are reinforced.

Through its design and procedural features, the RRF also offers a new way to look at economic policy coordination. By linking disbursements of RRF grants and loans to the successful completion of reforms and investments, the RRF in principle provides stronger incentives for Member States to implement reforms. The RRF also takes a forward-looking approach to economic policy, placing a key focus on the need to make EU economies more sustainable, resilient and better prepared for future challenges. In addition to the country-specific recommendations under the European Semester, which focus mostly on macroeconomic imbalances and structural reforms, the RRF gives high priority to measures aimed at supporting the climate and digital transitions. In doing so, the RRF includes several key features of a system of positive financial incentives for reforms as advocated in the political economy literature (see Box 2). Not only are the RRPs designed to address critical common challenges in a manner specific to each Member State, the ongoing assessment of milestones and targets fosters national ownership and accountability, along with promoting continual dialogue between the Member States and the Commission.

Box 2

Financial incentive mechanisms for structural reforms in the political economy literature

Prepared by Navid Armeli and Marguerite O’Connell

The political economy literature has discussed various ways of using financial incentive mechanisms to promote structural reforms. It finds these incentives to be more persuasive for reform implementation than the mere threat of sanctions.[31] Moreover, financial incentives can be useful to overcome the issue of veto players in the political system that have vested interests and benefit from the institutional status quo.[32]

The literature has identified two main criteria that should be met for positive incentives to exert the most influence. First, to avoid moral hazard, ex ante conditionality and transparent selection criteria need to be applied, together with a clear indication of the division of national and European responsibilities.[33] Financial support should then be granted on a conditional basis and in accordance with a transparent set of rules. Moreover, positive incentive schemes should encourage complementarities in the sequencing of reforms. Second, positive incentives need to support ownership and accountability. To do so, they must be sufficiently country-specific and take into account the domestic institutional set-up and administrative capacity.[34] Reform agendas to address common challenges should not be detached from country-specific problems and should not give the impression that they have been formulated by external actors. Ownership is stronger when national electorates see the benefits of implementing reforms.[35] For this to occur, it is important to communicate that the EU is positively supporting reforms instead of merely sanctioning non-compliance. Moreover, funds need to be well targeted and efficiently used, promoting critical reforms that provide cross-border spillovers across the EU.

The RRF’s design and its clear focus on performance broadly fulfil the criteria set out in the literature. Making RRF funding conditional on reform performance provides a positive incentive for compliance. Furthermore, the RRF encourages reform implementation by mitigating short-term negative effects and enabling countries to complement legislative changes with adequate resources, such as improvements in digital systems. The RRPs are designed to address critical common challenges in a manner tailored to each Member State. The funding is thus expected to deliver significant cross-border spillovers, along with contributing to European public goods,[36] particularly by facilitating the climate and digital transitions. Milestones and targets must be met throughout the lifecycle of the RRF and measures related to such milestones and targets must not be reversed by the Member State.[37] This promotes continual dialogue between the Member States and the European Commission and offers the possibility for a more effective peer review process.

Nevertheless, there are some aspects of the RRF not fully aligned with the criteria for financial incentives to exert the most influence noted in the literature. For example, in some cases the RRPs may lack the level of detail needed to ensure transparency and clarity in the implementation. Finally, it remains to be seen how well the RRF, which is designed as a one-off programme ending in 2026, can encourage long-term structural reforms beyond that time horizon.

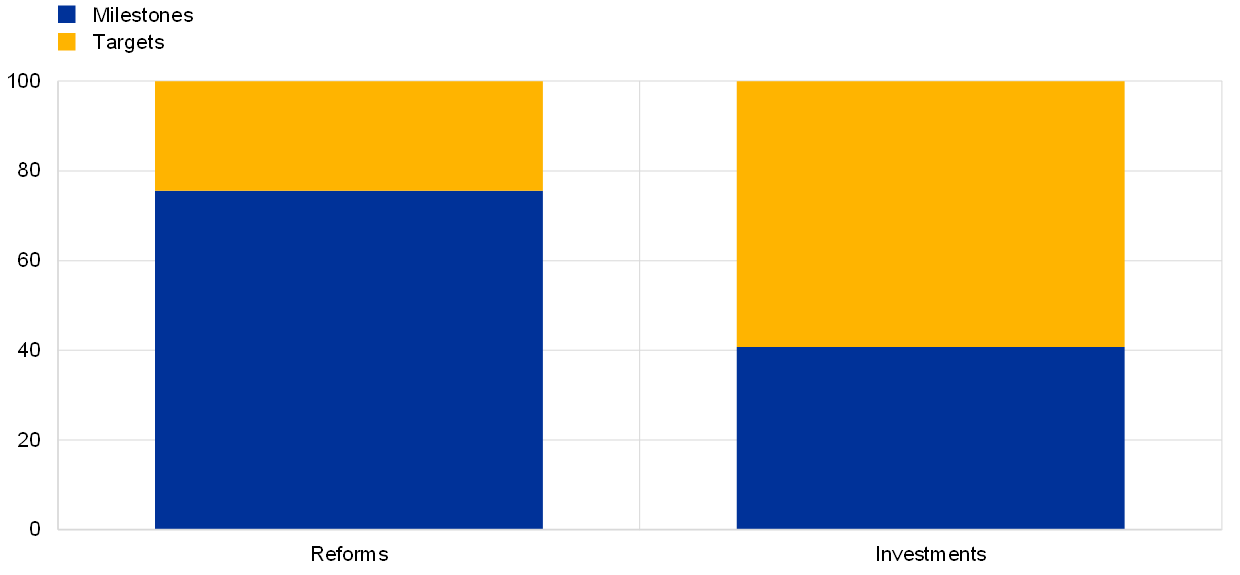

Some weaknesses in the formulation of RRPs might complicate an effective implementation of NGEU and delay the detection of slippages. The content of some reforms in the RRPs is not specified in detail, which could lead to ambiguities regarding the policy action expected from Member States. Moreover, “hard” quantitative targets are relatively scarce in relation to reforms and backloaded for both reforms and investments (see Chart 6). This increases the risk that some structural reforms will not be implemented effectively and that slippages will be detected only at a relatively late stage. Thus, a clear picture of the effectiveness of NGEU might only become available towards the end of its envisaged lifespan.

Chart 6

Distribution of RRP milestones and targets

a) Time profile

(average number per country for investments and reforms)

b) Breakdown by type of policy measure

(percentages)

Sources: European Commission and ECB staff calculations.

Note: Milestones are qualitative achievements, such as the adoption of legislation, while targets are quantitative objectives.

5 Conclusion

As an immediate crisis response to the COVID-19 pandemic, NGEU is expected to contribute significantly to the recovery in Europe. NGEU funding loosens the budget constraint of the Member States over the programme period. This will help to avoid the need for a potentially strong fiscal contraction like the one observed in some countries in the context of the global financial crisis. ECB staff simulations suggest that fiscal stimulus provided in the short term is high and expected to increase real GDP. In addition, linking the NGEU disbursements to the completion of milestones and targets in the RRPs is expected to have positive confidence effects. In tandem with accommodative monetary policy, the fiscal and structural policy response may contribute to preventing scarring effects in the euro area.

Over the medium term, NGEU has the potential to act as a catalyst for the modernisation and economic convergence of the euro area economies. The investments and reforms envisaged by the RRPs of euro area countries complement each other and are overall well designed to support the green and digital transitions, also by unlocking necessary private investment. The RRPs also include structural reforms that can further enhance potential growth and resilience, particularly in the main recipient countries. Higher growth prospects and lower cost of financing (i.e. interest savings), in turn, will help to reduce debt sustainability concerns in vulnerable countries and may provide more fiscal space for economic stabilisation in the future. In the countries with high debt-related risks, it is also key with a view to reducing the stock of public debt through more favourable economic conditions and improved quality of public finances. At the same time, structural reforms and catching-up of investment in some Member States could enhance economic convergence.

NGEU is expected to have a net benefit for all euro area countries. First, in a closely integrated euro area economy, aiding the recovery of the more vulnerable countries will have positive effects via spillovers for all countries. Spillovers result, not least, from the confidence effects that NGEU has on the euro area economy. Second, the transformative momentum of NGEU can further support the structural transition towards more sustainable economies across the euro area.

NGEU’s effectiveness will crucially depend on a timely and effective implementation of the RRPs. Fiscal implementation risks relate to lower-than-expected absorption capacities and the substitution of productive investment expenditure with consumption/social expenditure. Regarding structural reforms, some measures are not set out in detail and “hard” targets are relatively scarce in relation to reforms and typically backloaded. Taken together, these features increase the risk that some reforms will not be implemented effectively and that slippages will be detected only at a relatively late stage. Against this backdrop, a careful monitoring and implementation of the reporting and review mechanisms in place at the European and national level is key for the success of the NGEU project. Shortcomings in this respect could impair the effectiveness of NGEU and public trust in this novel policy instrument. Finally, depending on the experience with the implementation of the temporary NGEU project, a more permanent central fiscal capacity could play a key role in enhancing macroeconomic stabilisation and convergence in the euro area in the longer run.

- The RRF consists of loans (up to €385.8 billion) and grants (€338.0 billion). The funds from the other six programmes are smaller: REACT-EU (€50.6 billion), Horizon Europe (€5.4 billion), InvestEU (€6.1 billion), Rural Development (€8.1 billion), Just Transition Fund (€10.9 billion) and RescEU (€2 billion).

- RRF funding is made available in two phases. In the approval phase, following the assessment of the RRPs by the Commission and approval by the Council, pre-financing of up to 13% of the grants and loans approved for each respective Member State is disbursed. Further disbursements take place sequentially during the implementation phase, based on the satisfactory fulfilment of the milestones and targets agreed in the RRPs, which are regularly monitored.

- See the Five Presidents’ Report: Completing Europe’s Economic and Monetary Union, 2015 and Opinion of the ECB of 9 November 2018 on a proposal for a regulation on the establishment of a European Investment Stabilisation Function (CON/2018/51) (OJ C 444, 10.12.2018, p. 11).

- NGEU builds on previous attempts to establish policy instruments incentivising the implementation of necessary national structural reforms. Both the proposed budgetary instrument for convergence and competitiveness (BICC), which was designed to support structural reform implementation in euro area countries, and the proposed Reform Support Programme, aimed at providing financial and technical support to EU Member States implementing reforms, exploited the concept of rewarding policy actions reinforcing EU economic policy coordination, with the aim to support competitiveness and convergence. See the Proposal for a Regulation of the European Parliament and of the Council on a governance framework for the budgetary instrument for convergence and competitiveness for the euro area (COM(2019) 354 final); and the Proposal for a Regulation of the European Parliament and of the Council on the establishment of the Reform Support Programme (COM(2018) 391 final).

- While NGEU and the RRF are EU-wide programmes, 81% of the total RRF funds are allocated to the euro area countries.

- The European Commission became a novel actor in the bond markets during 2020 by raising €100 billion for financing the SURE programme (standing for Support to mitigate Unemployment Risks in an Emergency). After the approval of the Own Resources Decision, which establishes how the EU budget is financed, by all Member States on 31 May 2021, the Commission started borrowing to finance NGEU in June 2021. Another novelty is that 30% of the NGEU funding (€250 billion) will be issued in green bonds to be used exclusively for green and sustainable investments across the EU.

- The RRF grants will be recorded as EU debt, while the RRF loans will be accounted to the national debt of the recipient Member States.

- European Central Bank, “EU and ECB policy responses to the COVID-19 pandemic and the international role of the euro”, The international role of the euro, June 2021.

- European Council Conclusions of 17 to 21 July 2020.

- Previous work by ECB staff shows the expected macroeconomic impact of several stylised scenarios, including the use of NGEU loans and grants for (i) productive public investment, (ii) unproductive government spending, and (iii) replacing or repaying existing sovereign debt; cf. Bańkowski, K., Ferdinandusse, M., Hauptmeier, S., Jacquinot, P. and Valenta, V., “The macroeconomic impact of the Next Generation EU instrument on the euro area”, Occasional Paper Series, No 255, ECB, January 2021.

- See Pfeiffer, P., Varga, J. and in ’t Veld, J., “Quantifying Spillovers of Next Generation EU Investment”, European Economy Discussion Papers, No 144, European Commission, July 2021; and Bańkowski, K., Domingues, J., Dorrucci, E., Freier, M., Jacquinot, P., Modery, W., Rodríguez-Vives, M., Valenta, V. and Zorell, N., “The economic impact of Next Generation EU: A euro area perspective”, Occasional Paper Series, ECB, forthcoming.

- However, preliminary estimates suggest that only around 4% of the total funds assigned to euro area countries will be devoted to multi-country investment projects.

- The impact of the RRF funds in the government accounts reflects a redistribution element. Risk-sharing is deepened by means of a common fiscal capacity, as this time a percentage of the funds do not need to be repaid by the recipient country. The redistribution element (via the grant component) alleviates the public finance situation of the beneficiary Member State, i.e. it does not directly increase its deficit or the stock of debt. The pooling element is found in the deficit equation of the Member States (via the net contributions to the EU budget).

- Compared with previous EU programmes, however, the absorption capacity may have improved for some countries on account of the national governance reforms detailed in the RRPs (e.g. putting audit and project managers in place).

- NGEU is also expected to improve debt sustainability in high-debt countries. This may materialise via four main channels: (i) confidence effects; (ii) solidarity effects owing to the fact that a significant share of NGEU resources consists of non-repayable grants that are relatively higher for high-debt countries; (iii) higher growth prospects; and (iv) the positive impact on potential output over the longer term.

- Regulation (EU) 2021/241 of the European Parliament and of the Council of 12 February 2021 establishing the Recovery and Resilience Facility (OJ L 57, 18.2.2021, p. 17).

- DSGE stands for dynamic stochastic general equilibrium. For the models applied in the analysis, see Gomes, S., Jacquinot, P. and Pisani, M., “The EAGLE: A model for policy analysis of macroeconomic interdependence in the euro area”, Economic Modelling, Vol. 29, Issue 5, 2012, pp. 1686-1714; and Angelini, E., Bokan, N., Christoffel, K., Ciccarelli, M. and Zimic, S., “Introducing ECB-BASE: The blueprint of the new ECB semi-structural model for the euro area”, Working Paper Series, No 2315, ECB, September 2019.

- For a review of typical values of fiscal multipliers, including those associated with government investment, see Coenen et al., “Effects of Fiscal Stimulus in Structural Models”, American Economic Journal: Macroeconomics, Vol. 4(1), January 2012, pp. 22-68 (based on structural models operated by different policy institutions); and Gechert, S. and Rannenberg, A., “Which Fiscal Multipliers are Regime-dependent? A Meta-regression Analysis”, Journal of Economic Surveys, Vol. 32, Issue 4, September 2018, pp. 1160-1182 (based on various studies including both structural and reduced-form models).

- The EAGLE (undiscounted) long-run government investment multiplier lies between 2.5 and 5 depending on the productivity of public capital (low or high respectively). For technical details, see Clancy, D., Jacquinot, P. and Lozej, M., “Government expenditure composition and fiscal policy spillovers in small open economies within a monetary union”, Journal of Macroeconomics, Vol. 48, Issue C, 2016, pp. 305-26.

- The remaining 23% of grants and loans are “substitutive” in nature, i.e. they are used to finance fiscal measures that would have been taken even in the absence of NGEU and, as such, have no additional economic impulse. This is the case, however, for just a few countries.

- The analysis conducted in the past concluded that NGEU funds, if used for productive public investment, could increase real output in the euro area by around 1.5% of GDP over the medium term, see Bańkowski, K., Ferdinandusse, M., Hauptmeier, S., Jacquinot, P. and Valenta, V., “The macroeconomic impact of the Next Generation EU instrument on the euro area”, Occasional Paper Series, No 255, ECB, January 2021.

- See Darvas, Z., “Will European Union countries be able to absorb and spend well the bloc’s recovery funding?”, Bruegel, blog post, 24 September 2020.

- See Masuch, K., Anderton, R., Setzer, R. and Benalal, N. (editors), “Structural policies in the euro area”, Occasional Paper Series, No 210, ECB, June 2018; and Sondermann, D., “Towards more resilient economies: the role of well-functioning economic structures”, Journal of Policy Modeling, Vol. 40(1), 2018, pp. 97-117.

- See Masuch et al., ibid.

- This cross-country finding is robust to the use of alternative indicators, such as the number of reform-related milestones and targets, and confirmed by a qualitative, in-depth assessment of the RRPs. Importantly, however, the relative position of individual countries may change depending on the metric used. Therefore, such indicators should not be used to construct a country ranking.

- See International Monetary Fund, “Time for a supply-side boost? Macroeconomic effects of labor and product market reforms in advanced economies”, World Economic Outlook, Chapter 3, April 2016.

- On this basis, the Commission makes the first disbursements in the form of pre-financing payments of up to 13% of the total amount allocated to each country.

- The Council can also prevent the adoption of a Commission disbursement decision by qualified majority through the examination procedure. Furthermore, within the EFC, any Member State with concerns about serious deviations from milestones and targets can escalate the matter to the European Council for discussion.

- Bańkowski, K., Domingues, J., Dorrucci, E., Freier, M., Jacquinot, P., Modery, W., Rodríguez-Vives, M., Valenta, V. and Zorell, N., “The economic impact of Next Generation EU: A euro area perspective”, Occasional Paper Series, ECB, forthcoming.

- European Commission Communication, “The EU economy after COVID-19: implications for economic governance”, COM(2021) 662 final, 19 October 2021.

- See Dolls, M., Fuest, C., Krolage, C., Neumeier, F. and Stöhlker, D., “Incentivising structural reforms in Europe? A blueprint for the European Commission’s Reform Support Programme”, EconPol Policy Brief, Vol. 3, No 14, February 2019; Grüner, H., “The political economy of structural reform and fiscal consolidation revisited”, Economic Papers, No 487, European Commission, April 2013; Steinbach, A., “Structural reforms in EU member states: exploring sanction-based and reward-based mechanisms”, European Journal of Legal Studies, Vol. 9, No 1, 2016, pp. 173-210; Kiess, S., French, D., Sloan, N., Vallance, D. and Williams, D., The use of sanctions and rewards in the public sector, UK National Audit Office, 2008; Welch, S. and Thompson, K. “The impact of Federal Incentives on State Policy Innovation”, American Journal of Political Science, Vol. 24, No 4, 1980, pp. 715-729.

- Banerji, A., Ebeke, C., Koloskova, K., Schölermann, H. and Siminitz, J., “Can Structural Reforms Foster Real Convergence in the Euro Area?”, in IMF Country Reports, No 17/236, IMF, July 2017, pp. 15-22; Fernandez, R. and Rodrik, D., “Resistance to Reform: Status Quo Bias in the Presence of Individual-Specific Uncertainty”, American Economic Review, Vol. 81, No 5, pp. 1146-1155, 1991. The European Commission took up the idea of positive incentives in its proposal for a Reform Support Programme (COM(2018) 391 final), intended to promote structural reforms by financing reform agendas in the context of the European Semester.

- See Dolls et al., op. cit.

- See Banerji, A., Barkbu, B., John, J., Kinda, T., Saksonovs, S., Schölermann, H., Wu, T. and Kang, K., “Building a Better Union: Incentivizing Structural Reforms in the Euro Area”, IMF Working Paper, Issue 201, IMF, 2015; Steinbach, op. cit.

- See Grüner, H., “Externalities, Institutions and Public Perception: The Political Economy of European Integration Revisited”, European Economy Discussion Paper, No 57, European Commission, July 2017.

- The concept of European public goods draws on the welfare-economic concept of public goods, i.e. in contrast to private goods, public goods justify the provision of services by the State when certain types of market failure occur. Within a federal system, public goods can be provided by different levels of government. A policy can be considered to be a European public good if the net benefits of carrying out the policy at the European level are higher than the benefits of carrying it out at the national level, i.e. when it entails European added value. See Thöne, M. and Kreuter, H., “European public goods – their contribution to a strong Europe”, Vision Europe, Paper No 3, FiFo Institute for Public Economics and Bertelsmann Stiftung, September 2020.

- See Article 24(3) RRF Regulation.