The evolution of the ECB’s accountability practices during the crisis

Published as part of the ECB Economic Bulletin, Issue 5/2018.

This article examines the evolution of the ECB’s accountability practices during the financial crisis. After describing the challenges stemming from the crisis and changes resulting from the conferral of new supervisory tasks on the ECB, it provides evidence on how the strengthening of the ECB’s accountability has taken shape in the context of its relationship with the European Parliament in line with the latter’s key role as provided for in the Treaties. The ECB and the European Parliament, building on the accountability framework enshrined in primary law, have increased the frequency of their interactions, made innovations regarding the format and sharpened the focus of their exchanges, allowing increased scrutiny of the ECB’s policies. This has provided the ECB with more opportunities to explain its decisions and demonstrate that it is acting in accordance with its democratic mandate, which is a fundamental pillar of its legitimacy.

1 Introduction

The financial crisis that emerged in 2007/2008 raised a number of challenges for central banks in all advanced economies. In order to fulfil their mandates during the crisis, central banks adopted a number of monetary policy measures taken both from within and outside their standard toolkits. In some cases they also took on new responsibilities. As a result, they have been subject to close attention and scrutiny, in line with the necessity for independent authorities to be held accountable by democratically elected bodies. However, the variety and novelty of central bank measures tested existing accountability frameworks, as they made it more complicated to track and scrutinise monetary policy.

The ECB was no exception, and the evolution of its role during the crisis was accompanied by a commensurate evolution in its accountability practices. Like other central banks, the ECB adopted a number of monetary policy measures to preserve price stability, which supported the euro area’s economic recovery.[1] The ECB, however, had to operate in the unique institutional environment of the euro area, where, during the crisis, the integrity of the monetary union was questioned and financial fragmentation hampered the transmission of monetary policy. It is against this background that in July 2012 the President of the ECB, Mario Draghi, said “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro”.[2] The ECB also took on new tasks as a micro- and macroprudential supervisor, and was called upon to provide its expertise in financial assistance programmes alongside the International Monetary Fund and the European Commission. Despite the creation of specific accountability arrangements for its new tasks as a banking supervisor, the unchanged Treaty framework governing accountability led to a perception in some quarters that the ECB’s accountability had not adjusted to the new policy environment.[3] This article argues that such a focus on the accountability framework overlooks the evolution in the ECB’s accountability practices during the crisis.

The strengthening of the ECB’s accountability has been particularly visible in the context of its relationship with the European Parliament, in line with the latter’s key role as provided for in the Treaties. The ECB is subject to the scrutiny of the European public at large, and, as emphasised in an ECB Monthly Bulletin article in 2002,[4] the Treaties entrust the European Parliament – as the representative of EU citizens – with a central role in holding the ECB accountable. Building on the provisions laid down in primary law, detailed accountability practices had already been developed before the crisis. It should therefore come as no surprise that the European Parliament was the main and natural forum via which the demand for stronger ECB accountability was channelled during the crisis. Although other EU institutions, actors and communication channels also play an important role, this article focuses on the ECB’s active relationship with the European Parliament.

The ECB’s accountability practices have evolved to respond to the new demand for accountability. After explaining the concept of accountability and the framework set out in the Treaties to hold the ECB accountable (Section 2), this article looks at the increased challenges and public awareness that resulted from the crisis (Section 3). While the focus of the article is on accountability for central banking tasks, Box 1 in Section 3 discusses the specific accountability framework set up for the task of banking supervision. Section 4 provides new quantitative and qualitative evidence on how the ECB’s interactions with the European Parliament intensified and evolved during the crisis in terms of frequency, format and content. The analysis is combined with further insights on the evolution and intensity of hearings of the Committee on Economic and Monetary Affairs of the European Parliament (ECON) through text analysis in Box 2. Section 5 summarises the main themes of the article and concludes with perspectives on the future of the ECB’s accountability practices.

2 ECB accountability and its relevance

Central bank accountability should be understood as the legal and political obligation of an independent central bank to explain and justify its decisions to citizens and their elected representatives. In the case of the ECB, accountability is understood as an obligation vis-à-vis the representatives of European citizens and is a crucial cornerstone of the legitimacy of the ECB and its policies.[5]

Primary EU law sets out explicit accountability obligations for the ECB. Article 284(3) of the Treaty on the Functioning of European Union (TFEU) and Article 15.3 of the Statute of the European System of Central Banks and of the European Central Bank provide that the ECB is primarily accountable to the European Parliament, as the representative of EU citizens.[6]

The ECB’s decision-making bodies are held collectively accountable at EU level for the decisions they take in the pursuit of the ECB’s mandate. Specifically, it falls to the President of the ECB and other members of the Executive Board to explain and justify their collective decisions at EU level. This reflects the core provision of the Treaties, which establishes that the ECB’s monetary policy mandate concerns the euro area as a whole and that governors of national central banks (NCBs) do not represent their respective countries but the interests of the euro area when they attend Governing Council meetings.[7] Thus, according to the Treaties, ECB accountability is discharged at EU level. In other words, a single monetary policy requires single accountability.[8]

Accountability is a fundamental aspect of delegation to independent bodies in democratic societies. The rationale for accountability can be envisaged in a principal-agent framework; as powers are delegated to an agent (the ECB) to be exercised independently of its principal (the European Parliament and, ultimately, EU citizens), there must be some provisions in place to ensure that the agent respects its mandate.[9] The ECB is granted a high degree of independence in order to be protected from any temptation by governments to seek changes in monetary policy.[10] Independence also protects the principal from the risk that the agent will be diverted from its mandate as a result of short-sighted motivations. However, independence does not mean that central banks can act in a completely unfettered way. In modern democratic societies, independent institutions are accountable.[11] In fact, for the delegation of powers to an independent, unelected agent to be democratically legitimate, it is crucial that the agent can be held accountable by directly elected bodies. The literature emphasises that, for the accountability obligation in a principal-agent relationship to be effective, a clear contract detailing the mandate conferred upon the agent is needed in order to allow adequate scrutiny of the agent by the principal.[12] In the case of the ECB, such a contract is represented by the Treaty, which enshrines the ECB’s mandate of price stability in primary law.

The legitimacy of the ECB’s independence therefore relies on its accountability. Accountability ensures that independence does not lead to arbitrariness and that the mandate is fulfilled. From this perspective, proper accountability arrangements strengthen the case for independence.[13] Independence and accountability are therefore two inseparable sides of the same coin and reinforce each other.[14] Only through a strong and well-defined governance framework is it possible for central banks to be “very powerful and independent yet unelected”.[15]

Even before the crisis, accountability practices had already been developed that not only reflected Treaty requirements but also went beyond them. In line with the Treaty requirements, every year the ECB submits to the European Parliament, the Council, the Commission and the European Council an annual report on its tasks, the activities of the European System of Central Banks (ESCB) and the Eurosystem’s monetary policy. In addition, the Vice-President of the ECB presents the report to the European Parliament’s ECON committee in a dedicated session. The report is also presented by the President on the occasion of a plenary debate on the European Parliament resolution summarising the European Parliament’s view on the ECB’s policies and practices.[16] A cornerstone of the accountability framework is the “Monetary Dialogue”, i.e. the ECB President’s participation in the regular public quarterly hearings before the ECON committee, where he delivers a statement on the ECB’s actions and answers questions from Members of the European Parliament (MEPs) attending the hearing.[17] The importance of this practice, which is provided for by Rule 126 of the Rules of Procedure of the European Parliament (RoP)[18] and has taken place since January 1999,[19] was underlined by ECB President Mario Draghi at an ECON hearing in September 2016.[20] A study published in 2004 found that the frequency of the ECB’s appearances before the European Parliament exceeds the average of appearances by other central banks before their respective parliaments.[21] In addition, ECB Executive Board members have participated on numerous occasions in hearings of the ECON committee to explain the ECB’s reasoning and decisions on specific topics, as also provided for by Rule 126(4) of the RoP. Moreover, all MEPs (not just ECON members) are able to address written questions to the ECB, with the aim of clarifying the central bank’s motives and reasoning underlying a certain policy decision. The answers to these questions are signed by the ECB President and published on the ECB’s and the European Parliament’s websites. This arrangement was set up in the early 2000s by mutual agreement between the ECB and the European Parliament and is currently formalised in Rule 131 of the RoP. Table 1 summarises the ECB’s main accountability channels vis-à-vis the European Parliament.

Table 1

The ECB’s main accountability channels vis-à-vis the European Parliament

The ECB has also developed further channels of communication over the years to make its decisions more transparent to the general public so that EU citizens are better able to understand and judge them. Communication and transparency are crucial aspects of the ECB’s accountability.[22] Through various channels, the ECB provides the general public and markets with all relevant information on its strategy, assessments and policy decisions. Among other things, the ECB holds press conferences immediately after the Governing Council’s monetary policy meetings. In addition, building on Article 284(3) TFEU and Article 15.1 of the Statute of the ESCB, eight times a year the ECB publishes its Economic Bulletin, which covers the main economic, financial and monetary developments that formed the basis for the Governing Council’s policy decision, and each week it publishes the consolidated financial statement of the Eurosystem, which provides information on monetary policy operations, foreign exchange operations and investment activity. Furthermore, the ECB recently increased the transparency of the Governing Council monetary policy meetings, which are held every six weeks, by publishing the accounts of the discussions. Notably, the ECB was the first major central bank to organise regular press conferences after each monetary policy meeting.[23] In addition, the members of the Executive Board are regularly in contact with the public through articles, interviews and speeches at public events. All these measures (summarised in Table 2) help to clarify the ECB’s policy decisions and the reasons underlying them, providing additional tools for scrutiny to other EU institutions, including the European Parliament, and to EU citizens, beyond traditional accountability channels.

Table 2

Additional information channels relevant for the ECB’s accountability

3 The challenge posed to the ECB’s accountability by the crisis

The crisis challenged the ECB’s accountability on two main fronts. The first affected all major central banks; with the crisis, the scrutiny of monetary policy became more complicated owing to the exceptional economic circumstances and the recourse to non-standard measures. The second uniquely affected the ECB, as it stemmed from the evolution of the institutional framework of Economic and Monetary Union (EMU) in response to the crisis.

The crisis and the adoption of non-standard measures challenged central banks’ accountability by making the scrutiny of monetary policy more complicated. The adoption of a variety of measures – standard and non-standard – and the implications of the crisis for the transmission of monetary policy in the euro area meant, for instance, that, in crisis times, it turned out to be nearly impossible to track the monetary policy stance using simple tools.[24] On the one hand, the realisation of the key role of monetary policy during the crisis led to increased attention being paid to its design and implications, including operational aspects of asset purchases and their distributional consequences. On the other hand, the general public had to confront the growing complexity, both in terms of the variety of instruments being used simultaneously and in terms of each individual instrument being more complex in its implementation and its effect on the economy.[25] In this context, it should also be noted that the ECB is the central bank for 19 countries, and, as an EU institution, it has to be understood in an even larger number of languages. In all these countries – as President Draghi has pointed out – citizens’ expectations are different, thus creating a continuous challenge.[26] The growing complexity posed a serious challenge in terms of accountability, not only to the ECB but also to other central banks in advanced economies, where some people have openly questioned the balance between independence and accountability.[27]

The second challenge is specific to the European institutional context and is related to the new tasks assigned to the ECB. As part of the reform of the governance of EMU during the crisis, the ECB was entrusted with a number of new functions that go beyond its traditional role as a central bank. Among other things, the ECB was given responsibility for the microprudential supervision of the euro area banking system with the creation of the Single Supervisory Mechanism (SSM) in 2014. With the entry into force of the SSM Regulation, the ECB was also given macroprudential tools to tackle the emergence of possible systemic risks in the financial system.[28] In addition, since 2010 the ECB has had an advisory role in EU financial assistance programmes, acting in liaison with the European Commission; this role was subsequently codified in the “two-pack” regulation.[29] This expansion of the ECB’s role and tasks led commentators to wonder whether the ECB could remain accountable, given the need for the “principal” to monitor a wider range of instruments and objectives simultaneously.[30] Finally, a specific feature of EMU is the interaction of the ECB’s policies with other policies in a multi-level governance context; while EU policies have assumed a greater role during the crisis (e.g. through the creation of the banking union), in some instances they still overlap with national policies, possibly contributing to confusion among the general public over the assignment of responsibilities and accountability arrangements.[31]

As a result of these challenges, the ECB’s monetary policy has been subject to increased attention and public scrutiny. Hard evidence of this growing public interest in the ECB’s actions can be seen in the media coverage. From an accountability perspective, it is notable that the sharp rise in the number of ECB-related newspaper articles after the start of the sovereign debt crisis in 2010 (Chart 1) was accompanied by a similar rise in the number of articles citing the ECB and the European Parliament together. This might suggest more extensive media reporting on ECB-European Parliament accountability channels. Such attention was not limited to the media, but extended to the wider public, which became more aware of the ECB; according to the Eurobarometer survey, the percentage of EU citizens who had heard of the ECB increased significantly during the crisis (Chart 2). Finally, market participants also paid more attention to the ECB’s accountability channels. While the regular press conference after the Governing Council meeting remained their primary focus for understanding the ECB’s monetary policy, the appearances of the ECB President before the European Parliament also captured the attention of market participants on some occasions, as they were looking for possible signs of changes in the future monetary policy stance. While the analysis of high frequency data changes in financial market asset prices tentatively shows that these hearings have generally had no significant market impact, on a few occasions (e.g. the regular hearing of November 2015) there was some relatively minor and mostly short-lived market reaction. However, the ECB has treated such appearances primarily as an accountability tool to provide MEPs with the justifications for its policy choices, rather than as an alternative channel to communicate with the markets, as is also apparent from the data.

Chart 1

Media attention on the ECB and the European Parliament

(number of newspaper articles citing the ECB or the ECB together with the European Parliament; index: 1999 = 100)

Sources: Dow Jones Factiva and ECB calculations.

Chart 2

Public awareness of the ECB

(positive responses to the question “Have you heard of the European Central Bank?”; percentages)

Sources: Eurobarometer and ECB calculations.

It was important from the ECB’s perspective to make sure that its accountability evolved to address developments brought about by the crisis in a manner consistent with its independence. After the establishment of the SSM, specific accountability arrangements were developed and put in place, to hold the supervisory arm of the ECB accountable. Such a regime, developed within the existing accountability framework, was laid down in the SSM Regulation[32] and is described in Box 1. For existing central banking tasks subject to increased scrutiny, Treaty provisions and the overall framework did not need to be amended; the extended use of their scope allowed the ECB’s accountability practices to evolve.[33]

Box 1 Accountability provisions for the new task of supervision

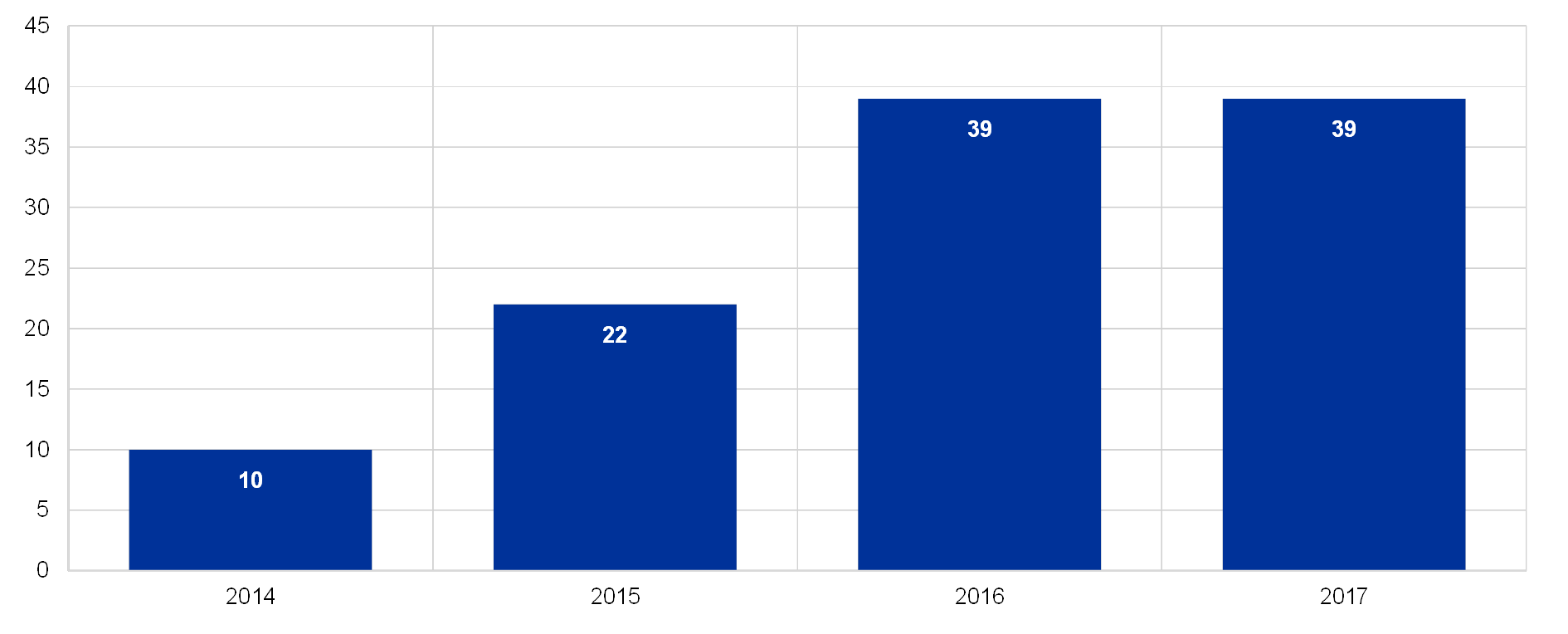

The creation of the SSM in 2014 and the consequent conferral of supervisory responsibilities on the ECB led to one of the significant changes to the accountability framework brought about by the crisis. As part of the SSM Regulation, a specific regime was laid down regarding the ECB’s accountability for this new task. The practical fulfilment of supervisory accountability requirements was further clarified in an Interinstitutional Agreement between the European Parliament and the ECB[34] and a Memorandum of Understanding between the Council and the ECB.[35] In line with these, the three “traditional” channels of the ECB accountability framework have been extended to ECB Banking Supervision. First, the Chair of the Supervisory Board attends regular hearings and exchanges of views in the European Parliament.[36] Second, MEPs can address written questions related to supervision to the Chair of the Supervisory Board. In the course of 2017, the ECB published 39 replies to MEPs’ questions on supervisory matters (Chart A). Third, since 2014 the ECB has published an annual report on its supervisory activities, which is presented by the Chair of the Supervisory Board to the European Parliament at a public hearing. The report is also submitted to the Council, the Eurogroup, the Commission and the national parliaments of participating Member States. As a result of this framework, between February 2014 and March 2018 Danièle Nouy, Chair of the Supervisory Board, appeared 20 times before the European Parliament for ordinary hearings and ad hoc exchanges of views with MEPs and to present the annual reports. In addition to the hearings and exchanges of views provided for in the Interinstitutional Agreement, the Chair and Vice-Chair of the Supervisory Board also participated in hearings with MEPs on revisions of EU banking legislation and the European Court of Auditors’ report on ECB Banking Supervision.

Chart A

Replies to questions from MEPs on supervisory matters

(number of replies to questions from MEPs on supervisory matters, 2014‑17)

Sources: ECB and ECB calculations.

In addition, the SSM Regulation and the Interinstitutional Agreement provide for some accountability channels which are specific to the ECB’s supervisory function. Among other things, as agreed in the Interinstitutional Agreement, the ECB provides the European Parliament with a comprehensive and meaningful record of the proceedings of the Supervisory Board which is accessible to MEPs in a secure reading room. The SSM Regulation also establishes the format for confidential oral discussions to ensure full confidentiality of exchanges with the European Parliament where needed. These channels allow comprehensive and thorough interaction between the ECB and the European Parliament on supervisory issues and thus a high degree of accountability.

To assess the evolution of accountability practices, it is necessary to go beyond the indexes economists use to measure the degree of central bank independence and accountability. As the criteria on which accountability indexes are built only refer to statutory provisions, they are unable to account for all relevant aspects of central banks’ democratic accountability. The indexes tend not to evolve significantly over time,[37] giving rise to the impression that changes in the frameworks do not adequately match changing accountability demands (Chart 3). However, this mismatch can largely be explained by the de jure nature of such indexes; they are estimated on the basis of legal provisions designed to ensure that the central bank remains accountable (for accountability indexes) and to shield it from political pressures (for independence indexes). As pointed out in the literature, however, it is important to look at de facto accountability, which depends not only on the legal provisions, but also on the intensity of interactions between the parliament and the central bank.[38] In the case of the ECB, its accountability practices evolved during the crisis to allow enhanced scrutiny, as discussed in the next section.

Chart 3

Accountability and independence of the ECB, the Federal Reserve System, the Bank of England and the Bank of Japan

(central bank accountability and independence indexes; x-axis: accountability; y-axis: independence)

Sources: De Grauwe and Gros (2009), Garriga (2016), Bodea and Hicks (2015), Dincer and Eichengreen (2014) and ECB calculations.

Notes: The higher the value, the higher the degree of accountability and independence respectively. The index used to calculate accountability was computed as an average of five different indexes of accountability developed in the literature and updated in 2009 by De Grauwe and Gros. The independence index was calculated as an average of the updates by Dincer and Eichengreen in 2014, Bodea and Hicks in 2015 and Garriga in 2016, who found no change in the index for the four central banks since the 1990s. These three works updated the independence indexes using the methodology developed by Cukierman, Webb and Neyapti in 1992. See Dincer N. and Eichengreen, B., "Central Bank Transparency and Independence: Updates and New Measures," International Journal of Central Banking, Vol. 10, No 1, 2014, pp. 189-259; and Cukierman, A., Webb, S.B. and Neyapti, B., “Measuring the Independence of Central Banks and Its Effect on Policy Outcomes”, The World Bank Economic Review, Vol. 6, No 3, 1992, pp. 353‑398.

4 The evolution of the ECB’s accountability practices

Building on Treaty provisions, the ECB reacted to the challenges of the crisis by enhancing its accountability practices in terms of frequency, format and content, as well as in terms of interactions with other stakeholders. The legal framework was flexible enough to accommodate the increased need for the ECB to explain and justify its policies before the European Parliament. This was not only driven by external demands, as it was in the ECB’s own interest to provide the public and the markets with a comprehensive analysis of the economic situation and monetary policy decisions to enhance the predictability and credibility of the ECB’s monetary policy.[39]

4.1 Frequency and format

The frequency of the exchanges between the ECB and the European Parliament increased substantially during the crisis, as regular hearings before the European Parliament were complemented by additional ad hoc hearings. The quarterly ECON hearings remained the cornerstone of the relationship between the ECB and the European Parliament. Nevertheless, as the parliamentary rules regulate the number and timing of MEPs’ oral questions to the ECB President, other instruments were used to intensify the frequency of ECB‑European Parliament interactions. Building on Article 284(3) TFEU, ECB representatives were invited to numerous additional exchanges during the crisis (18 exchanges between 2008 and 2017). These included an extraordinary ECON hearing of the ECB President on the crisis in August 2011, as well as an in camera exchange of views with the ECB President on the report “Toward a genuine Economic and Monetary Union” in 2012. Furthermore, there were three additional ECON hearings with ECB representatives on matters related to EU financial assistance programmes,[40] one exchange of views on the crisis in general,[41] two on economic governance, four on payment and settlement system issues, and one on statistical issues.[42] Moreover, Executive Board members participated in a series of meetings organised by the European Parliament which also involved members of national parliaments (such as in the European Parliamentary Week[43]) and in exchanges of views with national parliaments.[44]

Furthermore, the number of written questions addressed to the ECB from MEPs has increased substantially over the past two legislative terms. Chart 4 shows that the crisis was a prominent determinant of this upward trend, leading to a substantial increase in written questions between the 6th and 7th parliamentary terms, and a particularly sharp rise in the 8th term. In the 7th parliamentary term, MEPs sent more than twice as many written questions than their peers had done in the 6th term (128 written questions against 62). While only 11 written questions were sent to the ECB in 2008, in 2013 the number reached 46. The current parliamentary term (2014‑19) is, however, the most active so far, with the number of letters peaking at 152 in 2015, and already 325 letters have been sent to the ECB – more than in the 6th and 7th terms combined. Finally, it should be noted that a large number of the written questions since the beginning of the 8th parliamentary term were sent by smaller political groups, which partly compensates for the limited number of oral questions they can ask during the regular hearings.[45] This suggests that the sending of written questions has a complementary role to the regular hearings, thereby enhancing the channels for the realisation of the ECB’s accountability obligations.

Chart 4

Number of replies to MEPs’ written questions

(number per year and cumulative totals, by parliamentary term)

Sources: ECB and ECB calculations.

Note: The shaded areas represent written questions on supervisory matters.

The European Parliament resolution on the ECB Annual Report is also increasingly used to channel remarks to the ECB. While the European Parliament’s own-initiative report on the ECB’s activities has existed as a parliamentary tool since 1999, the increase in the number of amendments proposed by MEPs suggests that it has become increasingly important from their perspective. In 2017 the number of amendments tabled to the own-initiative report on the ECB’s Annual Report for 2016 was 568, compared with 269 the previous year. The difference is even starker when comparing the number of amendments prior to the sovereign debt crisis of 2010 with the number tabled during and after it. The sum of all the amendments tabled to the own-initiative reports from 2005 to 2009 is lower than the sum of the amendments tabled to the reports for 2010 and 2011 alone (375 against 468). Although these data may be the result of a higher degree of polarisation between political groups,[46] they also confirm that the ECB’s annual report has increasingly acquired relevance among MEPs as a useful accountability channel.

Chart 5

MEPs’ involvement in the own-initiative reports on ECB annual reports before, during and since the crisis

(number of amendments tabled by MEPs in the ECON committee, by legislative term)

Sources: ECB calculations based on European Parliament information.

In 2016 the ECB began to publish its feedback on the European Parliament resolution on the ECB Annual Report.[47] Each year, the European Parliament holds a plenary session in which it debates and votes on a resolution on the ECB Annual Report of the previous year. In response to an explicit request from the European Parliament,[48] the ECB has started to make public its feedback on such resolutions. This practice provides an additional channel – beyond the requirements of the Treaty – for the European Parliament to hold the ECB accountable. In fact, the feedback allows MEPs to gain additional insights on the ECB’s stance on a number of policy matters, further improving the quality of the exchange between the two institutions. For instance, in the feedback on the input provided by the European Parliament as part of its resolution on the ECB Annual Report for 2015,[49] the ECB announced that the concerns expressed by the European Parliament in relation to transparency in the development of ECB regulations on European statistics had been addressed. It stated that the Governing Council had approved new principles, taking into account the transparency practices of the European Parliament, the Council and the Commission. As a result, the European Parliament is now informed of and invited to participate in public consultations on ECB regulations concerning European statistics.[50]

4.2 Content

The intensification of the interactions between the ECB and the European Parliament has been accompanied by a change in the content of the exchanges. Looking at the evolution of topics over time, it can be observed that MEPs have focused their questions on issues that are topical at the time of the regular hearings. The regular Monetary Dialogue thus provided a primary accountability forum to explain the ECB’s position on matters related to the policy and political agenda of the day. The opportunity to discuss topical issues is certainly an important factor when determining the effectiveness of an accountability tool. In line with this, the results of a recent survey[51] showed that 50% of MEPs always found the exchanges with the ECB President useful, and none of them found them useless.

Box 2 The evolution of the topics and tone of the ECB parliamentary hearings

Text analysis techniques provide additional insights on the evolution of the content and tone of ECON hearings over time. On the basis of the ECON hearing transcripts, it is possible to identify the words used most frequently during these exchanges between 1999 and 2018 and their evolution.[52] The “word cloud” of the hearings provides a visual overview of the most frequent words in the exchanges (Chart A), showing that euro, monetary policy, inflation and growth were the most prominent terms that emerged during the debates. At the same time, the focus of attention evolved with the crisis. Understandably, the crisis itself became a prominent topic of the Monetary Dialogue, especially at the peak of the crisis in the euro area (Chart B).

Chart A

What were the words used most frequently during the hearings?

Word cloud of the ECON hearings (1999‑2018)

Sources: ECB calculations based on European Parliament information.

Notes: The word cloud displays the 200 most frequently used words (the larger the size of the word, the more frequent its occurrence), setting a minimum threshold of at least 50 occurrences in the text. The text was first cleaned of commonly used words, punctuation and numbers. “Euro” was the most frequently used word with 4,024 co-occurrences, whereas “ECB” was used 3,267 times. The word “growth” occurred 2,404 times, while “stability” and “inflation” presented similar frequencies (2,217 and 2,076, respectively).

Chart B

When did the crisis enter the ECB-European Parliament dialogue and how did it affect discussions on price stability?

(occurrence of terms related to price stability and to the crisis from 1999 to 2018, by year and parliamentary term)

Sources: ECB calculations based on European Parliament information.

Notes: The terms related to price stability matched with the text of the hearings are: price(s), inflate, inflation, inflationary, HICP, CPI, deflation, deflator, deflationary, deflate, hyperinflation, hyperinflationary. The terms related to crises are: crisis, crises, recession(s), recessionary, bust(s), stagnate, stagnation(s), stagnating, bubble(s), crash(es), slump(s), downturn(s), default(s), defaulting, turmoil(s).

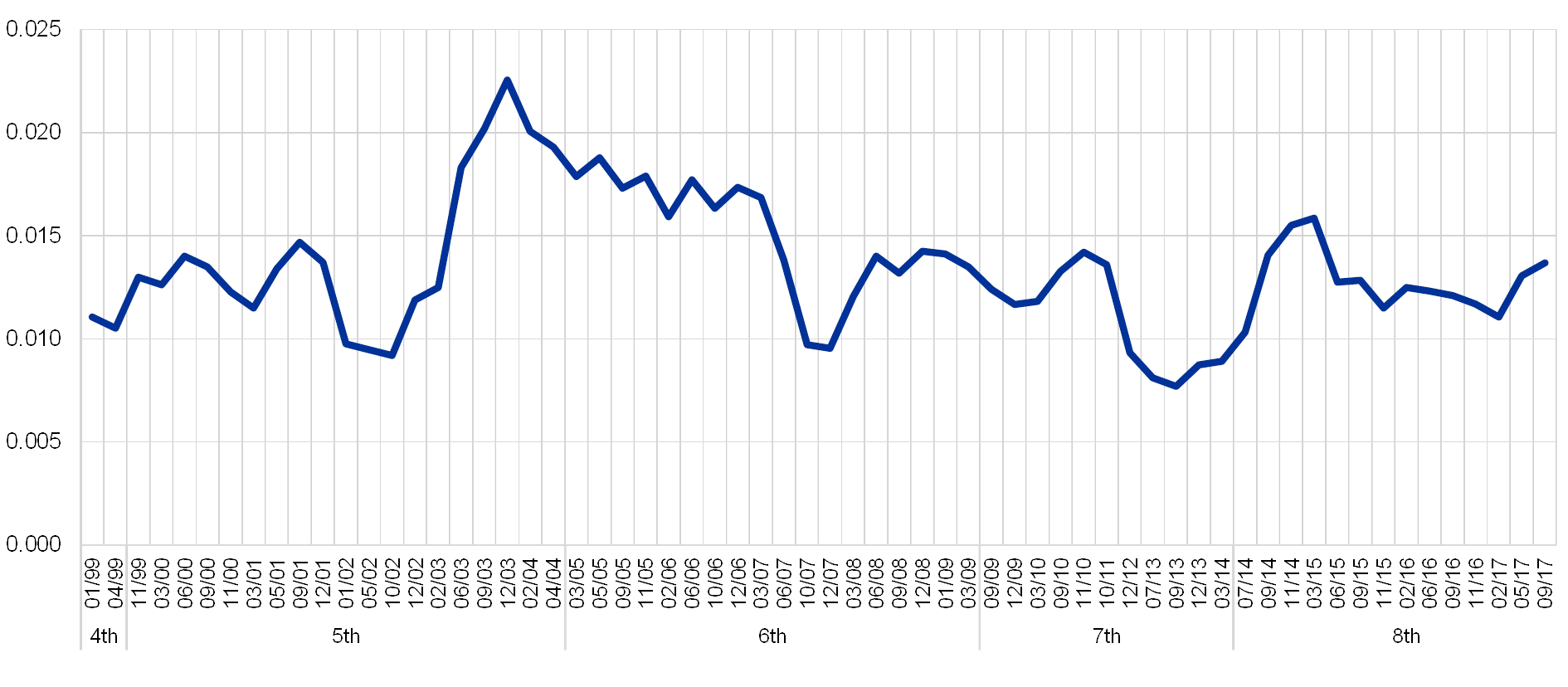

Another interesting related aspect concerns the tone of the Monetary Dialogue, which appears to have evolved over the past years. A number of commentators have argued that the rise of populism in the aftermath of the crisis put the independence of central banks at risk.[53] However, these opinions have often relied on anecdotal evidence, owing to the failure of the measures commonly used in the literature to account for such changes, as explained in the previous section. Text analysis allows this gap to be filled and provides empirical evidence. Following the literature on sentiment analysis applied to texts,[54] it is possible to calculate the degree of positive and negative sentiment populating the Monetary Dialogue, to proxy the negative tone used during hearings both by the ECB and by MEPs, and thus to measure how the tone of the parliamentary debates has changed over time (see Chart C).

Chart C

ECON hearings sentiment ratio, 1999‑2018

(sentiment ratio for transcripts of ECON hearings, by year and by parliamentary term)

Sources: European Parliament and ECB calculations.

Notes: The lists of positive and negative terms were taken from a pre-constructed text bag used in the literature developed by Bing Liu and collaborators for the tidytext R package. The text bag includes 2,006 positive terms and 4,782 negative ones. Sentiment is calculated using a common dictionary technique, which consists in matching each term of the transcripts with the ones contained in two lists of positive and negative words to obtain a sentiment ratio, calculated as follows:

Where t is a Monetary Dialogue transcript,

is the number of terms contained in transcript t, and

and

are, respectively, the number of positive and negative terms matched in each transcript. Ten Monetary Dialogue transcripts out of 75 are missing from the analysis, as they have not been fully translated into English.

In spite of the crisis, the overall tone of the debate remained positive. After reaching a peak in February 2004, sentiment fell to its worst level in December 2007, at the beginning of the recession. Nevertheless, it is worth noting that this negative level did not differ significantly from the low point reached in October 2002. Furthermore, sentiment had already started to decline, albeit more moderately, in 2005, two years before the crisis occurred. However, the tone of the dialogue swiftly recovered after 2008 and, despite being characterised by some ups and downs, remained quite stable over the crisis period, with some positive peaks. This seems to suggest that the ECON hearings between the ECB President and MEPs serve as a useful platform for constructive dialogue, even in times of crisis. This analysis has, however, some methodological limits. For example, low sentiment ratios during the crisis may stem from the negative economic outlooks discussed in the hearings and commented on by MEPs. Nonetheless, the stability of sentiment throughout the crisis suggests that the relationship between the two institutions did not crumble, and that the accountability framework supporting it proved resilient to the challenge of an economic downturn.

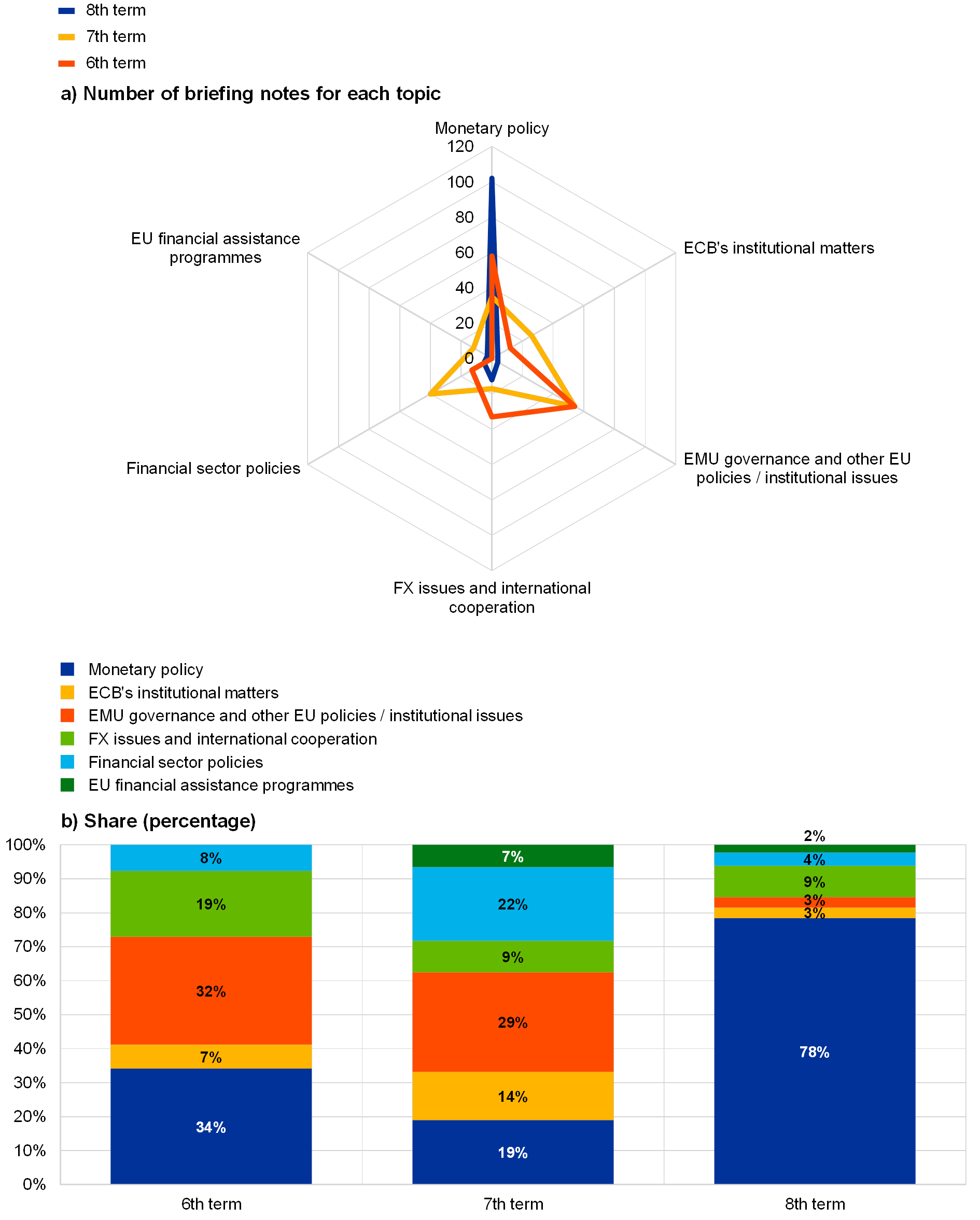

The European Parliament improved its use of expert advice in preparation for the hearings with the President. The MEPs’ lack of expertise in technical economic and financial issues was identified as a possible factor weakening the scrutiny efforts of the European Parliament.[55] Since 1999, before each Monetary Dialogue meeting, the ECON committee commissions briefing papers from a panel of experts, who provide MEPs with technical insights on current topics. It has been argued that MEPs proved more successful in influencing monetary policy when they were in line with the experts.[56] While some critics have noted in the past that the requests for advice from experts by the European Parliament did not focus enough on technical aspects related to monetary policy,[57] Chart 6 shows that over the last parliamentary term the European Parliament has reduced the number of topics and focused more on monetary policy aspects.[58] This suggests that MEPs are increasingly relying on expert input in this area, as is also evidenced by a recent survey among MEPs.[59]

Chart 6

On which subjects did MEPs seek expert advice before and after the crisis?

(topics of the monetary experts’ briefing notes, by legislative term (Q3 2004 to Q1 2018))

Sources: European Parliament and ECB calculations.

Notes: The years corresponding to each parliamentary term are: 6th term, from 2004 to 2009; 7th term, from 2009 to 2014; 8th term, from 2014 to present. Owing to rounding, percentages may not add up to 100%.

Looking at the quarterly ECON hearings, monetary policy was the main policy area raised by MEPs in the 8th term (Chart 7). This is in contrast to earlier parliamentary terms when observers remarked that MEPs’ questions were often unrelated to monetary policy.[60] However, as the ECB’s tasks expanded throughout the crisis, discussions also covered a broader range of topics. For instance, questions on EU financial assistance programmes were more prominent than monetary policy in 2010‑11, around the time when the first programmes were activated.[61] Their frequency decreased in 2012‑14, as the focus shifted to financial sector policies, mainly led by the imminent reform of the European financial architecture and the creation of the banking union. In 2015 the debate turned back to EU financial assistance programmes, mainly led by events in Greece, and touched on broader issues concerning the future of EMU, including following the publication of the Five Presidents’ Report.[62] Furthermore, with respect to the most recent years, the fact that MEPs have tended to focus on new topics and topical issues is evidenced, inter alia, by the number of questions related to Brexit (17% of questions in 2016‑17) and to fintech and cybersecurity issues (4% in 2017).[63]

Chart 7

The ECB President has been asked his view on a broad range of issues during ECON hearings

(questions asked by MEPs during quarterly ECON hearings, by topic, percentages)

Sources: European Parliament and ECB calculations.

The breakdown of topics in the written questions MEPs sent to the ECB suggests that this accountability tool plays a complementary role. Monetary policy has also been the most frequent topic in written questions during the last two parliamentary terms (Chart 8). Questions on financial sector policies shrank from 19% in the 7th term to 5% in the 8th term (partly because, since 2014, it has been possible to address written questions to the Chair of the Supervisory Board), while questions on the EU financial assistance programmes increased. It is worth noting that, unlike at regular hearings, the largest share of written questions in 2014 and 2015 concerned events in Greece. Written questions gave smaller political groups (with only limited speaking time in hearings) and national constituencies the opportunity to ask questions on the matter and gave the ECB the opportunity to present its views on several aspects of the Greek adjustment programme.[64] The higher share of written questions on institutional matters also points to the complementary role they play, suggesting that MEPs use them to ask more detailed questions on issues not usually addressed during hearings owing to, for instance, time constraints. This gave the ECB the opportunity to explain in greater detail the functioning of its decision-making process[65] and to provide more information on its activities.[66]

Chart 8

Topics of MEPs’ written questions to the ECB from 2009 to the present

(percentages)

Sources: European Parliament and ECB calculations.

Notes: Written questions addressed to the Chair of the Supervisory Board are not included. Owing to rounding, percentages may not add up to 100%.

4.3 Interaction with other stakeholders

The increased interest in holding the ECB accountable has primarily affected the ECB’s interaction with the European Parliament, but other EU institutions and actors have also played an important role in providing checks and balances. The ECB’s accountability is embedded in a network of interactions with other institutions, which are intensified at times of crisis.[67] For example, the Court of Justice of the European Union has become more involved in the judicial review of the ECB’s actions in recent years.[68] The Court’s decisions have far-reaching implications, since individuals can challenge the ECB’s conduct by seeking damages as well as by asking the Court to annul ECB decisions on grounds of illegality.[69] The European Ombudsman is another institution which plays a role, as it can be involved in matters regarding transparency and good governance. The operational efficiency of the ECB’s management is examined by the European Court of Auditors (ECA) in accordance with Article 27 of the Statute of the ESCB. Other relevant institutions include the European Anti-Fraud Office (OLAF), which has the power to conduct administrative investigations within the ECB for the purposes of fighting fraud, corruption and other illegal activities, and the European Data Protection Supervisor, which monitors and ensures compliance with data protection legislation in the ECB’s data-processing operations. Moreover, other civil society organisations have contributed to the debate on accountability. For instance, the debate spurred by the publication of the Transparency International report on the ECB’s accountability and transparency was welcomed by the ECB,[70] as it provided an opportunity for open and balanced dialogue with non-governmental organisations (NGOs).

None of these institutions and bodies act in isolation, and their actions have a bearing on the ECB’s accountability to the European Parliament. For instance, judgments of the Court have been referred to by both the ECB and MEPs during their regular exchanges. Similarly, reports by the ECA, the European Ombudsman, NGOs and academics have been discussed with MEPs, both in the context of the regular hearings and in written answers.[71]

5 Conclusions

This article has provided both quantitative and qualitative evidence of the evolution of the ECB’s accountability practices in response to the quest for scrutiny that emerged from the crisis. While the Treaty provisions on accountability have remained unchanged, a new accountability framework has been created in order to cater for the new supervisory tasks entrusted to the ECB. Moreover, within the existing framework, the ECB and the European Parliament have increased the frequency of their interactions, innovated on format and increased the focus of exchanges in response to the demand for greater scrutiny of the ECB’s actions. On the one hand, this has resulted in an enhanced use by the European Parliament of the accountability instruments at its disposal. On the other hand, the ECB also has an interest in strengthening its accountability practices vis-à-vis the European Parliament as part of an effort to explain its policies in a more complex environment.

The joint effort by the two institutions allowed a high degree of central bank accountability to be ensured throughout the crisis. The pre-existing accountability framework allowed increased scrutiny and thus proved its robustness. The ECB was able to explain and demonstrate that it was acting in accordance with its democratic mandate, which is a fundamental pillar of its legitimacy.

Despite the evolution of the ECB’s accountability practices, public demand for increased scrutiny remains high. The increase in public awareness of the ECB persists, while trust in the ECB has been recovering gradually since 2014, as reported by the Eurobarometer.[72] While enhancing the general public’s understanding of financial and economic interrelations helps them better understand the ECB’s policies,[73] accountability is still indispensable to the ECB as a channel to explain its actions to citizens and thereby contribute to public trust, which is itself an essential foundation of central bank independence.

- For an overview of the use of the Eurosystem’s monetary policy instruments and operational framework since the crisis, see Alvarez, I. et al., “The use of the Eurosystem’s monetary policy instruments and operational framework since 2012”, Occasional Paper Series, No 188, ECB, May 2017; and Task Force on the use of monetary policy instruments, “The use of the Eurosystem’s monetary policy instruments and its monetary policy implementation framework Q2 2016 – Q4 2017”, Occasional Paper Series, No 209, ECB, April 2018.

- See Draghi, M., “Verbatim of the remarks made by Mario Draghi”, speech at the Global Investment Conference, London, 26 July 2012.

- It should be noted, however, that the accountability mechanisms surrounding the architecture of Economic and Monetary Union (EMU) had already been subject to critical analysis in the academic community before the crisis. See, for example, Amtenbrink, F., “On the Legitimacy and Democratic Accountability of the European Central Bank: Legal Arrangements and Practical Experience”, in Arnull, A. and Wincott, D. (eds.), Accountability and Legitimacy in the European Union, Oxford University Press, 2002, pp. 147-163.

- See the article entitled “The accountability of the ECB”, Monthly Bulletin, ECB, November 2002.

- ibid.

- Article 284(3) TFEU reads: “The European Central Bank shall address an annual report on the activities of the ESCB and on the monetary policy of both the previous and current year to the European Parliament, the Council and the Commission, and also to the European Council. The President of the European Central Bank shall present this report to the Council and to the European Parliament, which may hold a general debate on that basis.

The President of the European Central Bank and the other members of the Executive Board may, at the request of the European Parliament or on their own initiative, be heard by the competent committees of the European Parliament.” - See Mersch, Y., “Aligning accountability with sovereignty in the European Union: the ECB’s experience”, speech at the ECB Legal Conference, Frankfurt am Main, 4 September 2017. NCBs are, nonetheless, well-placed to explain monetary policy decisions at national level through interactions and communication with national audiences, especially considering the multinational setting of the euro area. Moreover, in recent years, some NCB governors have participated in exchanges of views before the ECON committee, where they were invited to discuss the economic situation and EMU governance issues.See also Praet, P., “Communicating the complexity of unconventional monetary policy in EMU”, speech at the 2017 ECB Central Bank Communications Conference, Frankfurt am Main, 15 November 2017.

- See Mersch, Y., op. cit.

- For a comparative discussion on the design of accountability arrangements in samples numbering 38, 46 and 36 central banks in 1990, 1998 and 2006, respectively, see the report by the Central Bank Governance Group of the Bank for International Settlements on “Accountability, transparency and oversight”, in Issues in the Governance of Central Banks, BIS, 18 May 2009.

- See Cœuré, B., “Independence and accountability in a changing world”, speech at the Transparency International EU event “Two sides of the same coin? Independence and accountability of the European Central Bank”, Brussels, 28 March 2017.

- See Praet, P., “Have unconventional policies overstretched central bank independence? Challenges for accountability and transparency in the wake of the crisis”, speech at the “Symposium on Building the Financial System of the 21st Century: An Agenda for Europe and the United States”, Frankfurt am Main, 29 March 2017.

- See, for example, Fratianni, M., Von Hagen, J. and Waller, C., “Central banking as a political principal-agent problem”, Economic Inquiry, Vol. 35(2), 1997, pp. 378‑393; Dyson, K., “The age of the euro: a structural break? Europeanization, convergence and power in central banking”, in Dyson, K. and Marcussen, M. (eds.), Central Banks in the age of the euro, Oxford University Press, 2009, pp. 1‑52; and Eggertson, M.G.B. and Le Borgne, M.E., “A political agency theory of central bank independence”, Journal of Money, Credit and Banking, Vol. 42(4), 2010, pp. 647‑677.

- See Mersch, Y., op. cit.

- The need to interpret accountability not just as a “justification exercise” but as an essential activity for the fulfilment of the ECB’s tasks, for its credibility, and thus for the effectiveness of monetary policy was also highlighted by Otmar Issing in the early 2000s. See Issing, O., “The Euro Area and the Single Monetary Policy”, OeNB Working Papers, No 44, Oesterreichische Nationalbank, 2001.

- See Draghi, M., “Central bank communication”, opinion piece in Handelsblatt, 4 August 2014.

- Own-initiative reports are provided for by Rule 52 of the Rules of Procedure of the European Parliament, 8th parliamentary term – January 2017.

- The hearing is livestreamed and the text of the introductory remarks and the transcript of the Q&A sessions are published on the ECB’s and the European Parliament’s websites.

- See Rule 126 of the Rules of Procedure of the European Parliament, 8th parliamentary term – January 2017.

- The European Parliament resolution of 2 April 1998 on “democratic accountability in the third phase of EMU” already contained a call to set up a dialogue between the European Parliament and the ECB on monetary and economic affairs, the framework for which was to be confirmed by mutual agreement. In particular, in addition to the presentation of the ECB Annual Report provided for in the Treaty, it asked for quarterly meetings on recent monetary and economic developments to be convened with the President and/or other members of the Executive Board.

- See the transcript of the hearing of the ECB President in the ECON committee on 26 September 2016.

- See Eijffinger, S.C.W. and Mujagic, E., “An Assessment of the Effectiveness of the Monetary Dialogue on the ECB’s Accountability and Transparency: A Qualitative Approach”, Intereconomics, Vol. 39, No 4, 2004, pp. 190‑203.

- The two dimensions of transparency are relevant in this respect. On the one hand, transparency is considered as a tool aimed at enhancing the effectiveness of the ECB’s policy. As explained on the ECB’s website, transparency helps the public to understand the ECB's monetary policy, and better public understanding makes the policy more credible and effective. On the other hand, transparency is considered as an essential governance tool for securing public trust in the institution. See Cœuré, B., op. cit. The ECB’s transparency has recently been the subject of debate in the literature in relation to ECB accountability and independence. See, for example, Curtin, D., “‘Accountable Independence’ of the European Central Bank: Seeing the Logics of Transparency”, European Law Journal, Vol. 23(1‑2), August 2017, pp. 28‑44.

- See Liikanen, E., “Introductory Remarks at the Panel Discussion ‘Is More Always Better? Transparency, Accountability and the Clarity of Message’”, ECB Central Bank Communication Conference, Frankfurt, 14 November 2017.

- See Praet, P., “Have unconventional policies overstretched central bank independence? Challenges for accountability and transparency in the wake of the crisis”, speech at the “Symposium on Building the Financial System of the 21st Century: An Agenda for Europe and the United States”, Frankfurt am Main, 29 March 2017.

- See Cœuré, B., “Central banking in times of complexity”, remarks at a conference on the occasion of Sveriges Riksbank’s 350th anniversary, Stockholm, 25 May 2018.

- See Draghi, M., “Central bank communication”, op. cit.

- On the challenges to central bank independence posed by non-standard monetary policies, see Goodhart, C and Lastra, R., “Populism and Central Bank Independence”, Open Economies Review, Vol. 29(1), 2017, pp. 49‑68.

- In the field of financial stability, the ECB also provides analytical support to the European Systemic Risk Board.

- See Regulation (EU) No 472/2013 of the European Parliament and of the Council of 21 May 2013 on the strengthening of economic and budgetary surveillance of Member States in the euro area experiencing or threatened with serious difficulties with respect to their financial stability, OJ L 140, 27.5.2013, p. 1.

- See Pisani-Ferry, J. and von Weizsäcker, J., “Can a less boring ECB remain accountable?”, Bruegel Policy Contribution, Issue 2009/11, September 2009.

- See Mersch, Y., op. cit.

- Council Regulation (EU) No 1024/2013 of 15 October 2013 conferring specific tasks on the European Central Bank concerning policies relating to the prudential supervision of credit institutions, OJ L 287, 29.10.2013, p. 63.

- See Giovannini, A. and Jamet, J., “Matching accountability with independence: the ECB’s experience”, in Ziller, J. (ed.), The Communication of the European Central Bank: an Interdisciplinary Analysis, Giappichelli, Torino, 2018 (forthcoming).

- Interinstitutional Agreement between the European Parliament and the European Central Bank on the practical modalities of the exercise of democratic accountability and oversight over the exercise of the tasks conferred on the ECB within the framework of the Single Supervisory Mechanism (2013/694/EU), OJ L 320, 30.11.2013, p. 1.

- Memorandum of Understanding between the Council of the European Union and the European Central Bank on the cooperation on procedures related to the Single Supervisory Mechanism (SSM).

- The Chair of the Supervisory Board also attends exchanges of views with the Eurogroup. In addition, the Eurogroup can address written questions to the Chair of the Supervisory Board.

- See Garriga, A.C., “Central Bank Independence in the World: A New Dataset”, International Interactions, Vol. 42(5), 2016, pp. 849‑868, which updated the independence index for the period 1970‑2012; and Bodea, C. and Hicks, R., “Price Stability and Central Bank Independence: Discipline, Credibility and Democratic Institutions”, International Organization, Vol. 69(1), 2015, pp. 35‑61, which did the same for the period 1973‑2015. The accountability index was also computed by De Grauwe, P. and Gros, D., “Accountability and Transparency in Central Banking”, study for the European Parliament’s Committee on Economic and Monetary Affairs, 2009. Notably, De Grauwe and Gros point out that by comparing their update with the estimates proposed in the literature, “it emerges that the [accountability] indexes do not show any significant change in accountability” (p. 20). Looking at the results from the five different studies, they found that the ECB performed similarly to the Federal Reserve System and the Bank of Japan in terms of accountability, but not as well as the Bank of England. In particular, the low score of the ECB is driven by institutional factors, such as the impossibility for the European Parliament to veto the appointment of ECB Executive Board members. On the other hand, the ECB has the same score as other central banks in terms of parliamentary exchanges.

- See De Grauwe, P. and Gros, D., op. cit.

- See Mersch, Y., op. cit.

- In the context of the enquiry on the role and operations of the Troika (ECB, Commission and IMF) with regard to the euro area programme countries, the ECB also provided written replies to the questionnaire submitted by the European Parliament which are available on the ECB’s website.

- In 2009 José Manuel González-Páramo participated in a hearing organised by the European Parliament’s Special Committee on the Financial, Economic and Social Crisis (see ECB Annual Report 2009, p. 170).

- Though not to be counted as part of the ECB’s accountability obligations, there were also a number of staff-level exchanges on topical issues. See, for example, ECB Annual Report 2012, p. 148, and ECB Annual Report 2013, p. 164. The exchange of views on statistical issues mentioned in the text was in relation to AnaCredit, a statistical project aimed at setting up a dataset containing detailed information on individual bank loans in the euro area, harmonised across all member countries. The project attracted the attention of a number of MEPs who also addressed written questions to the ECB on the topic. The meeting with Executive Board member Sabine Lautenschläger provided, inter alia, an opportunity to explain in detail the procedure followed by the ECB in preparing the AnaCredit Regulation, in setting out the costs linked to it and in ensuring stakeholders’ involvement.

- Since February 2012, at the beginning of every year the European Parliament has organised an interparliamentary event on the European Semester for Economic Policy Coordination called the European Parliamentary Week which gathers together parliamentarians from all over the EU to discuss economic, budgetary and social matters. The European Parliamentary Week aims to provide a framework for debate and exchange of information between national parliaments and the European Parliament in order to ensure democratic accountability in the area of economic governance in the EU.

- While the ECB’s interaction with national parliaments is not part of its accountability activities, it is worth noting that since 2012 the ECB President has spoken before six national parliaments: in Germany (in 2012 and 2016), in Spain and France (2013), in Finland (2014), in Italy (2015) and in the Netherlands (2017). In addition, other members of the Executive Board have also participated in meetings in national parliaments.

- Under the internal rules of the European Parliament, the slots for questions and answers during hearings are allocated according to the size of the political group, thus reducing the opportunity for smaller groups and non-aligned MEPs to put oral questions to the ECB President.

- See Whitaker, R., Hix, S. and Dreyer, P., “MEPs’ attitudes in the 2014‑19 European Parliament: Key Findings from the European Parliament Research Group’s Survey”, MEP Survey Data, 22 February 2017.

- See Feedback on the input provided by the European Parliament as part of its resolution on the ECB Annual Report 2014, 7 April 2016.

- In its Resolution on the ECB Annual Report for 2014, presented on 25 February 2016, the European Parliament requested that “the annual ECB report should include feedback on the inputs provided in the annual report of Parliament”.

- See Feedback on the input provided by the European Parliament as part of its resolution on the ECB Annual Report for 2015, 10 April 2017.

- See “Transparency in developing new ECB regulations on European statistics”, available on the ECB’s website.

- See Collignon, S. and Diessner, S., “The ECB’s Monetary Dialogue with the European Parliament: Efficiency and Accountability during the Euro Crisis?”, Journal of Common Market Studies, Vol. 54, No 6, 2016, pp. 1296‑1312.

- The data used for this analysis consist of the transcripts of the hearings published by the European Parliament. A small number of transcripts (ten out of 75) were excluded from the analysis, as they are not provided fully in English.

- For a review of the debate, see Merler, S. “Central banks in the age of populism”, Bruegel blog, March 2018.

- See Nyman, R., Kapadia, S., Tuckett, D., Gregory, D., Ormerod P. and Smith, R., “News and narratives in financial systems: exploiting big data for systemic risk assessment”, Staff Working Paper, No 704, Bank of England, January 2018. See also Liu, B., Sentiment Analysis and Opinion Mining, Morgan & Claypool Publishers, 2012.

- See Wyplosz, C., “The Panel of Monetary Experts and the Policy Dialogue”, Briefing Notes to the Committee for Economic and Monetary Affairs of the European Parliament, October 2005.

- See Sibert, A., “The European Parliament’s Monetary Dialogue with the ECB and its Panel of Experts”, European Parliament, 2005.

- See Wyplosz, C., “The Monetary Dialogue”, and Sibert, A., “Monetary Dialogue 2009‑2014: Looking Backward, Looking Forward”, both in Monetary Dialogue 2009‑2014: Looking Backward, Looking Forward – Compilation of Notes, European Parliament, March 2014.

- The reduction in the topic “financial stability and supervision” is also partly explained by the establishment of dedicated hearings on European banking supervision-related matters – see Box 1.

- According to a recent survey, 74% of the sample of MEPs found the papers from the expert panel useful. The survey was published in Collignon, S. and Diessner, S., op. cit.

- See Wyplosz, C., “The Panel of Monetary Experts and the Policy Dialogue”, op. cit.

- In this respect, the response of former ECB President Jean-Claude Trichet at an ECON hearing on 30 June 2011 is quite telling: “I would have expected a lot of questions on our monetary policy, on the level of inflation, on what inflation will be in two years’ time, on whether our projections are right or wrong, and on whether we are right or wrong to have the present level of interest rates, taking into account other decisions taken elsewhere in the world. However, I see that you have such a confidence in my institution that these are not a problem or an issue at all! I have also had a lot of questions on issues for which we are not responsible. We are responsible for the euro area as a whole and for price stability.” See the transcript on the European Parliament’s website.

- See Juncker, J.-C., Tusk, D., Dijsselbloem, J., Draghi, M. and Schulz, M., “Completing Europe’s Economic and Monetary Union”, European Commission, 22 June 2015.

- Both topics are included in the “other issues” category.

- For instance, between March 2015 and October 2015, the ECB President answered 15 written questions on the Greek adjustment programme, explaining, inter alia, the precise functioning and rationale for the eligibility rules applied to Greek bonds used as collateral in Eurosystem monetary policy operations.

- For instance, in an answer to a written question from several MEPs, the ECB President provided a full description of the methodology for computing the total seigniorage income earned by the ECB and provided all the requested background information (e.g. yearly data on the retention/distribution of this income, weightings of distribution among NCBs, etc.).

- For instance, in an answer to a written question from an MEP, the ECB President provided an exhaustive list of the international fora and institutions at which members of the ECB’s Executive Board and Supervisory Board represent the institution.

- See Giovannini, A. and Jamet, J., op. cit.

- See, for example, the Court’s judgment on the ECB’s Outright Monetary Transactions (OMT) programme in Peter Gauweiler and Others v Deutscher Bundestag, C–62/14, ECLI:EU:C:2015:400, paras. 49‑51.

- See Mersch, Y., op. cit.

- See “Two sides of the same coin? Independence and accountability of the European Central Bank”, Transparency International EU, March 2017; and “ECB welcomes dialogue with NGOs on transparency”, press release, ECB, 28 March 2017. The ECB facilitated the Transparency International EU project by inviting researchers to a series of meetings with senior staff.

- See, for instance, the ECB President’s letter to Ms Kostadinka Kuneva (MEP), which discusses the ECA’s special report on “The Commission's intervention in the Greek financial crisis”. Studies by NGOs have also been discussed in answers to written questions by MEPs. See, for instance, the ECB President’s letter to various MEPs concerning the ECB’s interactions with external parties, which answers questions relating to the Corporate Europe Observatory’s report entitled “Open door for forces of finance at the ECB”.

- The latest Eurobarometer survey (November 2017) found that 39% of euro area respondents tended to trust the ECB (the highest level since autumn 2011) and 47% tended not to trust it (others did not know).

- See Cœuré, B., “Independence and accountability in a changing world”, op. cit.