- STATISTICAL RELEASE

Euro area pension fund statistics: third quarter of 2021

22 December 2021

- Total assets of euro area pension funds amounted to €3,252 billion in third quarter of 2021, only marginally higher than in second quarter of 2021

- Total pension entitlements of euro area pension funds rose to €2,756 billion in third quarter of 2021, up €11 billion from second quarter of 2021

- From this release, euro area pension fund statistics include assets and liabilities of French institutions mainly resulting from reclassifications or transactions from insurance corporations

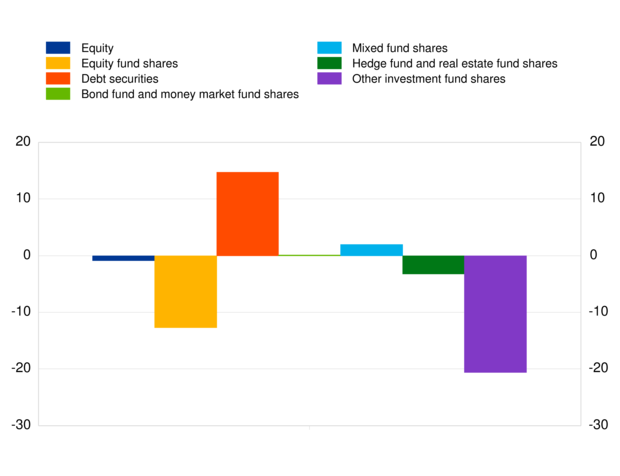

Total assets of euro area pension funds increased marginally to €3,252 billion in the third quarter of 2021, from €3,250 billion in the second quarter of 2021. Investment fund shares accounted for 47.8% of the pension funds sector's total assets in the third quarter of 2021. The second largest category of holdings was debt securities (25.5%), followed by equity (10.1%) (see respective transactions in Chart 1).

Holdings of investment fund shares decreased to €1,554 billion at the end of the third quarter of 2021 from €1,567 billion at the end of the previous quarter. Net sales of investment fund shares amounted to €34 billion in the third quarter of 2021, while price and other changes amounted to €22 billion. Looking at the main type of investment fund shares, equity fund shares totalled €489 billion, with net sales of €13 billion.

Turning to pension funds' holdings of debt securities, these increased to €831 billion at the end of the third quarter of 2021 from €816 billion at the end of the previous quarter. Net purchases of debt securities amounted to €15 billion in the third quarter of 2021, while price and other changes amounted to €0 billion. Looking at equity on the assets side, euro area pension funds' holdings increased to €328 billion at the end of the third quarter of 2021, from €326 billion at the end of the previous quarter. Net sales of equity stood at €1 billion in the third quarter of 2021, while price and other changes stood at €3 billion.

Chart 1

Transactions in main assets of euro area pension funds in the third quarter of 2021

(quarterly transactions in EUR billions; not seasonally adjusted)

In terms of the main liabilities, total pension entitlements of pension funds amounted to €2,756 billion in the third quarter of 2021, up from €2,745 billion in the second quarter of 2021. Defined benefit pension schemes amounted to €2,248 billion, accounting for 81.6% of total pension entitlements. Defined contribution pension schemes totalled €508 billion, accounting for 18.4% of total pension entitlements in the third quarter of 2021. Net purchases of defined benefit schemes amounted to €6 billion in the third quarter of 2021, while those of defined contribution schemes came to €4 billion. Price and other changes of total pension entitlements amounted to €1 billion.

For queries, please use the statistical information request form.

Notes:

- "Defined benefit schemes" includes hybrid schemes.

- "Investment funds" includes money market funds and non-money market funds.

- Hyperlinks in the main body of the statistical release and in the annex table lead to data that may change with subsequent releases as a result of revisions. Figures shown in the annex table are a snapshot of the data as at the time of the current release.

- The inception of a pension fund sector in France is related to the implementation of the Sapin II Law.

- 22 December 2021