- PRESS RELEASE

- 31 October 2018

Euro area bank interest rate statistics: September 2018

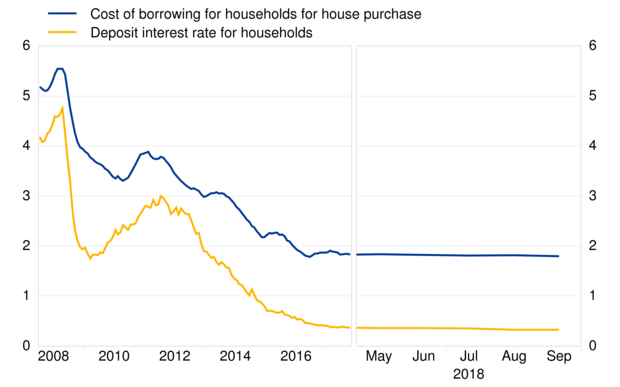

- The composite cost-of-borrowing indicator for new loans to corporations[1] and for new loans to households for house purchase[2] remained broadly unchanged in September 2018, at 1.65% and at 1.79%, respectively.

- In the same month, the euro area composite interest rate for new deposits from corporations remained broadly unchanged at 0.10%, and the one from households showed no change at 0.33%.

Bank interest rates for corporations

Bank[3] interest rates on new loans to, and deposits from, euro area corporations

(percentages per annum)

While the composite cost-of-borrowing indicator, which combines interest rates on all loans to corporations, remained broadly unchanged, September 2018 saw mixed developments in the cost of new borrowing by corporations both for small loans of up to €250,000 and for loans of over €1 million. For example, the interest rate on new loans of over €1 million with a floating rate and an initial rate fixation period of up to three months remained broadly unchanged at 1.13%. The rate for new loans of the same size with an initial rate fixation period of over ten years increased by 10 basis points to 1.85%. This increase was due to the developments in two euro area countries and was driven mainly by the weight effect. In the case of new loans of up to €250,000 with a floating rate and an initial rate fixation period of up to three months, the average rate charged remained broadly unchanged at 2.22%.

As regards new deposit agreements, the interest rate on deposits from corporations with an agreed maturity of up to one year stayed constant at 0.08% in September 2018.

The interest rate on new loans to sole proprietors and unincorporated partnerships with a floating rate and an initial rate fixation period of up to one year decreased by 9 basis points to 2.34%.

Data for bank interest rates for corporations

i.r.f. = initial rate fixation

Bank interest rates for households

Bank interest rates on new loans to, and deposits from, euro area households

(percentages per annum)

The composite cost-of-borrowing indicator, which combines interest rates on all loans to households for house purchase, remained broadly unchanged in September 2018. The interest rate on loans for house purchase with a floating rate and an initial rate fixation period of up to one year also remained broadly unchanged at 1.60%, and the interest rate on housing loans with an initial rate fixation period of over ten years showed no change at 1.85%. In the same period, the interest rate on new loans to households for consumption with a floating rate and an initial rate fixation period of up to one year rose by 8 basis points to 5.52%. The month-to month change was driven by the interest rate effect which outweighed the corresponding weight effect.

Rates agreed on new deposits from households remained broadly unchanged. The interest rate on deposits with an agreed maturity of up to one year remained broadly unchanged at 0.30%, and the interest rate on deposits redeemable at three months' notice was unchanged at 0.45% in September 2018.

Data for bank interest rates for households

i.r.f. = initial rate fixation * For this instrument category, the concept of new business is extended to the whole outstanding amounts and therefore it is not comparable with the business volumes of the other categories; deposits placed by households and corporations are allocated to the household sector. Volume data are derived from the ECB's monetary financial institutions balance sheet statistics.

Further information

Tables containing further breakdowns of bank interest rate statistics, including the composite cost-of-borrowing indicators for all euro area countries, are available from the ECB's Statistical Data Warehouse. A subset is visually presented in "Our statistics" at www.euro-area-statistics.org. The full set of bank interest rate statistics for both the euro area and individual countries can be downloaded from SDW. More information, including the release calendar, is available under "Bank interest rates" in the statistics section of the ECB's website.

For media queries, please contact Alexandrine Bouilhet, tel.: +49 69 1344 8949.

Notes:

- The composite cost-of-borrowing indicators are described in the article entitled "Assessing the retail bank interest rate pass-through in the euro area at times of financial fragmentation" in the August 2013 issue of the ECB's Monthly Bulletin (see Box 1).

- Interest rates on new business are weighted by the size of the individual agreements. This is done both by the reporting agents and when the national and euro area averages are computed. Thus changes in average euro area interest rates for new business reflect, in addition to changes in interest rates, changes in the weights of individual countries' new business for the instrument categories concerned. The "interest rate effect" and the "weight effect" presented in this press release are derived from the Bennet index, which allows month-on-month developments in euro area aggregate rates resulting from changes in individual country rates (the "interest rate effect") to be disentangled from those caused by changes in the weights of individual countries' contributions (the "weight effect"). Owing to rounding, the combined "interest rate effect" and the "weight effect" may not add up to the month-on-month developments in euro area aggregate rates.

- In addition to monthly euro area bank interest rate statistics for September 2018, this press release incorporates minor revisions to data for previous periods. The hyperlinks in the press release are dynamic; thus, the data might slightly change with the next monthly release due to revisions. Unless otherwise indicated, these euro area statistics cover the EU Member States that had adopted the euro at the time to which the data relate.

- As of reference period December 2014, the sector classification applied to bank interest rates statistics is based on the European System of Accounts 2010 (ESA 2010). In accordance with the ESA 2010 classification and as opposed to ESA 95, the non-financial corporations sector (S.11) now excludes holding companies not engaged in management and similar captive financial institutions.

- [1]In this press release "corporations" refers to non-financial corporations (sector S.11 in the European System of Accounts 2010, or ESA 2010).

- [2]In this press release "households" refers to households and non-profit institutions serving households (ESA 2010 sectors S.14 and S.15).

- [3]In this press release "Banks" refers to monetary financial institutions except central banks and money market funds (ESA 2010 sectors S.122).

Europese Centrale Bank

Directoraat-generaal Communicatie

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Duitsland

- +49 69 1344 7455

- media@ecb.europa.eu

Reproductie is alleen toegestaan met bronvermelding.

Contactpersonen voor de media