- PRESS RELEASE

Euro area insurance corporation statistics: first quarter of 2020

3 June 2020

- Total assets of euro area insurance corporations amounted to €8,429 billion in first quarter of 2020, €278 billion lower than in fourth quarter of 2019

- Total insurance technical reserves of euro area insurance corporations dropped to €6,403 billion in first quarter of 2020, down €169 billion from fourth quarter of 2019

Total assets of euro area insurance corporations decreased to €8,429 billion in the first quarter of 2020, from €8,706 billion in the fourth quarter of 2019. Debt securities accounted for 41.3% of the sector's total assets in the first quarter of 2020. The second largest category of holdings was investment fund shares (25.7%), followed by equity (10.2%) and loans (7.4%).

Holdings of debt securities decreased to €3,478 billion at the end of the first quarter of 2020 from €3,569 billion at the end of the previous quarter (see Chart 1). Net sales of debt securities amounted to €5 billion in the first quarter of 2020; price and other changes amounted to -€86 billion. The year-on-year growth rate of debt securities held was 1.7%.

Looking at holdings by issuing sector, the annual growth rate of debt securities issued by euro area general government was 0.7% in the first quarter of 2020, with net sales in the quarter amounting to €6 billion. As regards debt securities issued by the private sector, the annual growth rate was 2.0%, and quarterly net sales amounted to €5 billion. For debt securities issued by non-euro area residents, the annual growth rate was 3.9%, with quarterly net purchases of €7 billion.

Chart 1

Insurance corporations' holdings of debt securities by issuing sector

(quarterly transactions in EUR billions; not seasonally adjusted)

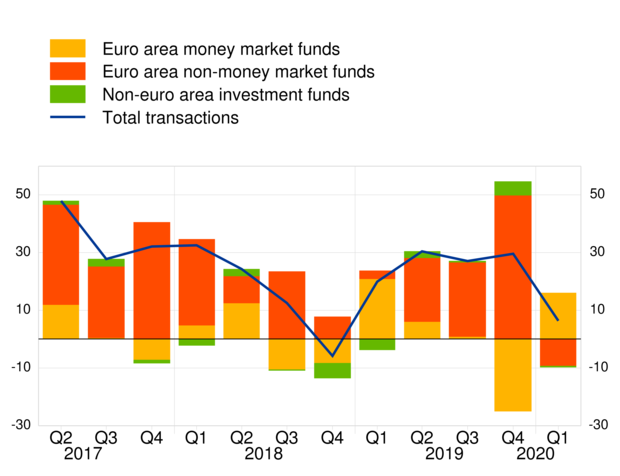

Turning to insurance corporations' holdings of investment fund shares, these decreased to €2,163 billion in the first quarter of 2020, from €2,344 billion in the previous quarter, with net purchases of €6 billion and price and other changes of -€188 billion (see Chart 2). The year-on-year growth rate in the first quarter was 4.3%.

The annual growth rate of euro area money market fund shares held by insurance corporations was -1.3% in the first quarter of 2020, with net purchases in the quarter amounting to €16 billion. As regards holdings of euro area non-money market fund shares, the annual growth rate was 4.4%, with quarterly net sales amounting to €9 billion. For investment fund shares issued by non-euro area residents, the annual growth rate was 12.2%, with quarterly net sales close to € 0 billion.

Chart 2

Insurance corporations' holdings of investment fund shares by issuing sector

(quarterly transactions in EUR billions; not seasonally adjusted)

In terms of main liabilities, total insurance technical reserves of insurance corporations amounted to €6,403 billion in the first quarter of 2020, down from €6,572 billion in the fourth quarter of 2019 (see Annex). Life insurance technical reserves accounted for 90.4% of total insurance technical reserves in the first quarter of 2020. Unit-linked products amounted to €1,159 billion, accounting for 20.0% of total life insurance technical reserves.

Annex

Annex: Table on euro area insurance corporationsFor media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

Notes:

- "Other assets" includes currency and deposits, insurance technical reserves and related claims, financial derivatives, non-financial assets and remaining assets.

- "Private sector" refers to euro area excluding general government.

- "Investment funds" includes money market funds and non-money market funds.

- Hyperlinks in the main body of the press release and in the annex table lead to data that may change with subsequent releases as a result of revisions. Figures shown in the annex table are a snapshot of the data as at the time of the current release.

Banco Central Europeo

Dirección General de Comunicación

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Alemania

- +49 69 1344 7455

- media@ecb.europa.eu

Se permite la reproducción, siempre que se cite la fuente.

Contactos de prensa