- Press release

Euro money market statistics: First maintenance period 2022

5 April 2022

- Daily average borrowing turnover in the unsecured segment increased from €127 billion in the eighth maintenance period of 2021 to €138 billion in the first maintenance period of 2022

- Weighted average overnight rate on borrowing transactions in the unsecured segment remained stable at -0.56% for the wholesale sector and at -0.57% for the interbank sector

- Daily average borrowing turnover in the secured segment increased from €370 billion to €429 billion, with a weighted average overnight rate of -0.62%

Chart 1

Daily average nominal borrowing and lending turnover in the secured and unsecured wholesale markets by maintenance period (MP)

(EUR billions)

Data for daily average nominal borrowing and lending turnover in the secured and unsecured markets

Unsecured market

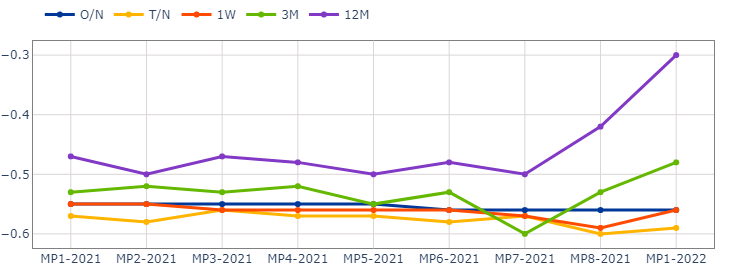

Chart 2

Weighted average rate for wholesale sector borrowing in the unsecured segment by tenor and maintenance period

(percentages)

Data for weighted average rate for unsecured wholesale sector borrowing

In the first maintenance period of 2022, which started on 9 February 2022 and ended on 15 March 2022, the borrowing turnover in the unsecured segment averaged €138 billion per day. The total borrowing turnover for the period as a whole was €3,456 billion. Borrowing from credit institutions, i.e. on the interbank market, represented a turnover of €292 billion, i.e. 8% of the total borrowing turnover. Lending to credit institutions amounted to €178 billion. Overnight borrowing transactions represented 70% of the total borrowing nominal amount. The weighted average overnight rate for borrowing transactions was -0.57% for the interbank sector and -0.56% for the wholesale sector, the same as in the previous maintenance period.

Secured market

Chart 3

Weighted average rate for wholesale sector borrowing and lending in the secured segment by tenor

Data for weighted average rate for secured wholesale sector borrowing and lending

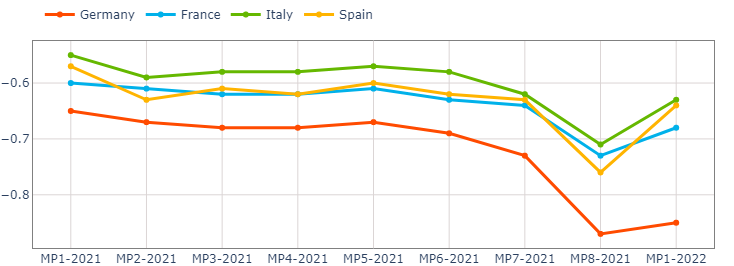

In the first maintenance period of 2022, the borrowing turnover in the secured segment averaged €429 billion per day, while the total borrowing turnover for the period as a whole was €10,727 billion. Cash lending represented a turnover of €8,763 billion and the daily average amounted to €351 billion. Most of the turnover was concentrated in tenors ranging from overnight to up to one week, with overnight transactions representing around 25% and 22% of the total nominal amount on borrowing and lending side respectively. The weighted average overnight rate for borrowing and lending transactions was, respectively, -0.62% and -0.68% for the wholesale sector, compared with -0.69% and -0.71% in the previous maintenance period. In the first maintenance period of 2022, the weighted average rate for spot/next borrowing transactions ranged from -0.63% for operations based on collateral issued in Italy to -0.85% for operations based on collateral issued in Germany.

Chart 4

Weighted average rate for spot/next borrowing in the secured segment for collateral issued by maintenance period (MP)

(percentages)

Data for weighted average rate for secured wholesale sector borrowing by collateral issuer country

Table 1

Euro money market statistics

|

| Turnover (EUR billions) | Average rate O/N (percentages) | |||||

|

| Daily average | Total |

|

| |||

|

| MP 8 2021 | MP 1 2022 | MP 8 2021 | MP 1 2022 | MP 8 2021 | MP 1 2022 | |

Unsecured | Borrowing, wholesale | 127 | 138 | 4,436 | 3,456 | -0.56 | -0.56 | |

Of which, interbank | 10 | 12 | 348 | 292 | -0.57 | -0.57 | ||

Lending, interbank | 6 | 7 | 227 | 178 | -0.42 | -0.43 | ||

Secured | Borrowing, wholesale | 370 | 429 | 12,939 | 10,727 | -0.69 | -0.62 | |

Lending, wholesale | 295 | 351 | 10,326 | 8,763 | -0.71 | -0.68 | ||

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

Notes

- The money market statistics are available in the ECB’s Statistical Data Warehouse.

- The Eurosystem collects transaction-by-transaction information from the 47 largest euro area banks in terms of banks’ total main balance sheet assets, broken down by their borrowing from and lending to other counterparties. Unsecured transactions include all trades concluded via deposits, call accounts or short-term securities with financial corporations (except central banks where the transaction is not for investment purposes), general government as well as with non-financial corporations classified as “wholesale” under the Basel III LCR framework. Secured transactions cover all fixed-term and open-basis repurchase agreements and transactions entered into under those agreements, including tri-party repo transactions, denominated in euro with a maturity of up to one year, between the reporting agent and financial corporations (except central banks where the transaction is not for investment purposes), general government as well as non-financial corporations classified as wholesale under the Basel III liquidity coverage ratio framework. As of the first maintenance period of 2019, the wholesale sector covers all counterparties in the sectors listed above. More information on the methodology applied, including the list of reporting agents, is available in the statistics section of the ECB’s website.

- The weighted average rate is calculated as the arithmetic mean of the rates weighted by the respective nominal amount over the maintenance period on all days on which TARGET2, the Trans-European Automated Real-time Gross settlement Express Transfer system, is open.

- Borrowing refers to transactions in which the reporting bank receives euro-denominated funds, irrespective of whether the transaction was initiated by the reporting bank or its counterpart.

- Lending refers to transactions in which the reporting bank provides euro-denominated funds, irrespective of whether the transaction was initiated by the reporting bank or its counterpart.

- The tenors O/N, T/N, S/N, 1W, 3M, 6M and 12M refer to, respectively, overnight, tomorrow/next, spot/next, one week, three months, six months and twelve months.

- The collateral issuer country refers to the jurisdiction that issues the collateral used for transactions secured by single collateral identified by an International Securities Identification Number.

- The missing values for tenors in some of the reserve maintenance periods may be due to confidentiality requirements.

- In addition to the developments in the latest maintenance period, this press release incorporates minor revisions to the data for previous periods.

- Data are published 15 working days after the end of each maintenance period. The release calendar and the indicative calendars for the Eurosystem’s reserve maintenance periods are available on the ECB’s website.

- The next press release on euro money market statistics will be published on 10 May 2022.

Evropská centrální banka

Generální ředitelství pro komunikaci

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Německo

- +49 69 1344 7455

- media@ecb.europa.eu

Reprodukce je povolena pouze s uvedením zdroje.

Kontakty pro média