Euro money market statistics: eighth maintenance period 2017

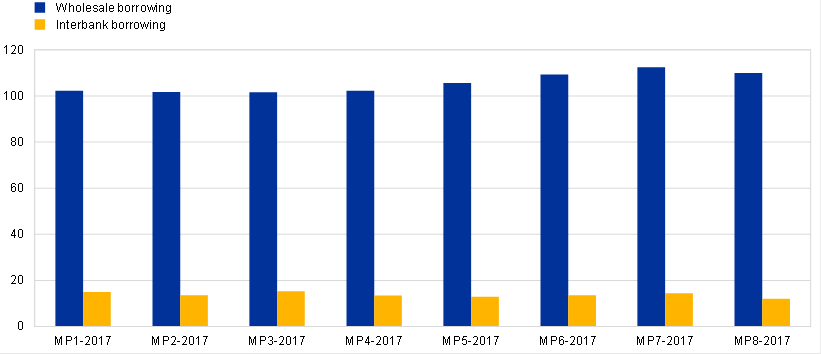

- The daily average borrowing turnover in the unsecured segment decreased from €112 billion in the seventh maintenance period to €110 billion in the eighth maintenance period of 2017

- The weighted average overnight rate on borrowing transactions remained unchanged at −0.40% for the wholesale sector and decreased from −0.39% to −0.42% for the interbank sector

Daily average nominal borrowing amount in the unsecured segment for the wholesale and interbank sectors, by maintenance period

(EUR billions)

Weighted average rate for wholesale sector borrowing in the unsecured segment by tenor and maintenance period

(Percentage)

In the latest maintenance period, which started on 20 December 2017 and ended on 30 January 2018, the borrowing turnover in the unsecured segment averaged €110 billion per day, compared to €112 billion in the previous period. The total borrowing turnover for the period as a whole was €2,969 billion. Borrowing from other credit institutions, i.e. on the interbank market, represented a turnover of €325 billion, i.e. 11% of the total borrowing turnover, and lending to other credit institutions amounted to €286 billion. Borrowing overnight transactions represented 48% of the total borrowing nominal amount. The weighted average overnight rate for borrowing transactions was −0.42% for the interbank sector and −0.40% for the wholesale sector, compared with −0.39% and −0.40% respectively in the previous maintenance period.

For media queries, please contact Stefan Ruhkamp, tel.: +49 69 1344 5057.

Notes

- The money market statistics are available in the ECB’s Statistical Data Warehouse.

- The Eurosystem collects transaction-by-transaction information from the 52 largest euro area banks in terms of banks’ total main balance sheet assets, broken down by their borrowing from and lending to other counterparties. Transactions include all trades concluded via deposits, call accounts or short-term securities with financial counterparties including banks, the government sector and non-financial corporations. More information on the methodology applied, including the list of reporting agents, is available in the statistics section of the ECB’s website.

- The weighted average rate is calculated as the rates weighted by the respective nominal amount over the maintenance period.

- The tenors O/N, T/N, S/N, 1W, 3M, 6M and 12M refer to, respectively, overnight, tomorrow/next, spot/next, one week, three months, six months and twelve months.

- In addition to the developments in the latest maintenance period, this press release incorporates minor revisions to the data for previous periods.

- The data are published every six to seven weeks, after each of the Eurosystem’s reserve maintenance periods. The indicative calendars for the Eurosystem’s reserve maintenance periods are available on the ECB’s website.

- The next press release on euro money market statistics will be published on 5 April 2018.

Európai Központi Bank

Kommunikációs Főigazgatóság

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Németország

- +49 69 1344 7455

- media@ecb.europa.eu

A sokszorosítás a forrás megnevezésével engedélyezett.

Médiakapcsolatok