- STATISTICAL RELEASE

Euro area quarterly balance of payments and international investment position: third quarter of 2020

12 January 2021

- Current account surplus at €231 billion (2.0% of euro area GDP) in four quarters to third quarter of 2020, down from €265 billion a year earlier

- Geographic counterparts: largest bilateral surpluses vis-à-vis United Kingdom (€138 billion) and United States (€73 billion), with largest deficits vis-à-vis offshore centres (€100 billion) and China (€79 billion)

- International investment position showed net liabilities of €10 billion (around 0.1% of euro area GDP) at end of third quarter

Current account

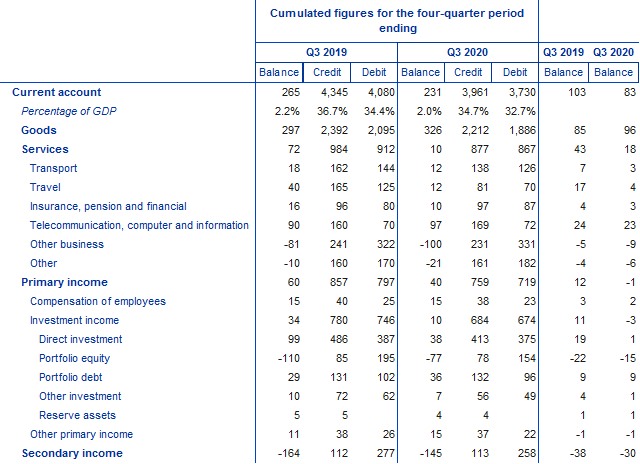

The current account surplus of the euro area declined to €231 billion (2.0% of euro area GDP) in the four quarters to the third quarter of 2020, from €265 billion a year earlier (see Table 1). This decrease reflected a reduction in the surpluses for services (from €72 billion to €10 billion) and primary income (from €60 billion to €40 billion). These developments were partly offset by an increase in the surplus for goods (from €297 billion to €326 billion) and a lower deficit for secondary income (down from €164 billion to €145 billion).

The smaller surplus for services was mainly due to a decline in the surplus for travel (from €40 billion to €12 billion) and increases in the deficit for other business services (from €81 billion to €100 billion) and for other services (from €10 billion to €21 billion). These developments were only partially offset by an increase in the surplus for telecommunication, computer and information services (from €90 billion to €97 billion).

The decrease in the primary income surplus was due to a fall in the surplus for investment income (from €34 billion to €10 billion). This reflected mainly a lower surplus for direct investment income (down from €99 billion to €38 billion), which was partly offset by a smaller deficit for portfolio equity income (down from €110 billion to €77 billion) and a larger surplus for portfolio debt income (up from €29 billion to €36 billion).

Table 1

Current account of the euro area

(EUR billions, unless otherwise indicated; transactions during the period; non-working day and non-seasonally adjusted)

Source: ECB.

Notes: “Equity” comprises equity and investment fund shares. Discrepancies between totals and their components may arise from rounding.

Data on the geographic counterparts of the euro area current account (see Chart 1) show that in the four quarters to the third quarter of 2020 the euro area recorded its largest bilateral surpluses vis-à-vis the United Kingdom (€138 billion, down from €189 billion a year earlier), the United States (€73 billion, down from €111 billion) and Switzerland (€53 billion, down from €59 billion). It also recorded a current account surplus vis-à-vis a residual group of other countries (€172 billion, up from €100 billion). The largest bilateral deficits were recorded vis-à-vis offshore centres (€100 billion, up from €77 billion) and China (€79 billion, up from €69 billion).

The most significant geographic changes in the four quarters to the third quarter of 2020 relative to the previous year were as follows. In the goods balance there were decreases in the surpluses vis-à-vis the United Kingdom (from €113 billion to €95 billion) and offshore centres (from €49 billion to €31 billion), an increase in the deficit vis-à-vis China (from €82 billion to €92 billion), and a shift from a deficit of €14 billion to a surplus of €68 billion vis-à-vis the residual group of other countries, partly reflecting a decline in the deficit vis-à-vis Russia (from €39 billion to €10 billion). In services, the deficit vis-à-vis the United States increased (from €15 billion to €58 billion) and the surplus vis-à-vis the United Kingdom decreased (from €45 billion to €31 billion). Moreover, in primary income surpluses decreased vis-à-vis the United Kingdom (from €27 billion to €11 billion) and vis-à-vis the residual group of other countries (from €120 billion to €106 billion) were recorded, while the secondary income deficit vis-à-vis the EU Member States and EU institutions outside the euro area declined from €103 billion to €80 billion.

Chart 1

Geographical breakdown of the euro area current account balance

(four-quarter moving sums in EUR billions; non-seasonally adjusted)

Source: ECB.

Note: “EU non-EA” comprises EU Member States and EU institutions outside the euro area. “Other countries” includes all countries and country groups not shown in the chart, as well as unallocated transactions.

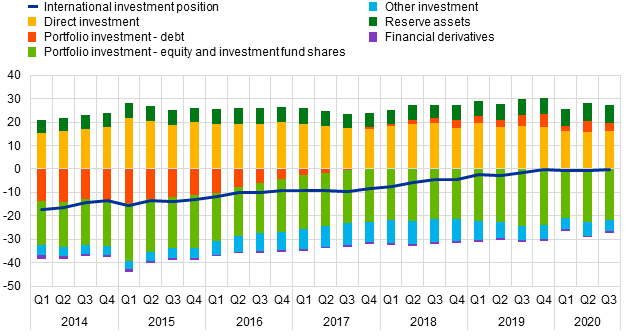

International investment position

At the end of the third quarter of 2020 the international investment position of the euro area recorded net liabilities of €10 billion vis-à-vis the rest of the world (0.1% of euro area GDP), compared with net liabilities of €100 billion in the previous quarter (see Chart 2 and Table 2).

Chart 2Net international investment position of the euro area

(net amounts outstanding at the end of the period as a percentage of four-quarter moving sums of GDP)

Source: ECB.

This improvement of €90 billion reflected large but partly offsetting changes in the various investment components. Smaller net liabilities were recorded for portfolio equity (€2,482 billion, down from €2,616 billion) and other investment (€562 billion, down from €662 billion), while net assets increased in direct investment (€1,830 billion, up from €1,813 billion) and decreased for portfolio debt (€392 billion, down from €531 billion).

Table 2

International investment position of the euro area

(EUR billions, unless otherwise indicated; amounts outstanding at the end of the period, flows during the period; non-working day and non-seasonally adjusted)

Source: ECB.

Notes: “Equity” comprises equity and investment fund shares. Net financial derivatives are reported under assets. Discrepancies between totals and their components may arise from rounding.

The change in the euro area’s net international investment position in the third quarter of 2020 was driven by positive net flows due to price changes, transactions and other volume changes, which were partially compensated by negative net exchange rate changes (see Chart 3).

The increase in net assets for direct investment was mainly due to transactions and positive net price changes, partially compensated by negative net exchange rate changes (see Table 2). Lower net liabilities for portfolio equity resulted mainly from positive net price changes and transactions, while lower net liabilities for other investment were mainly driven by transactions. The decrease in net assets for portfolio debt was due to negative net flows in transactions, price changes, exchange rate changes and other volume changes (see Table 2).

At the end of the third quarter of 2020 the gross external debt of the euro area amounted to €15.1 trillion (around 133% of euro area GDP), down by €145 billion compared with the previous quarter.

Chart 3

Changes in the net international investment position of the euro area

(EUR billions; flows during the period)

Source: ECB.

Note: “Other volume changes” mainly reflect reclassifications and data enhancements.

Data revisions

This statistical release incorporates revisions to data for the reference periods between the first quarter of 2017 and the second quarter of 2020. The revisions reflect revised national contributions to the euro area aggregates as a result of the incorporation of newly available information and do not significantly alter the figures previously published.

Next releases

- Monthly balance of payments: 19 January 2021 (reference data up to November 2020)

- Quarterly balance of payments and international investment position: 9 April 2021 (reference data up to the fourth quarter of 2020)

For queries, please use the Statistical information request form.

Notes

- All data are neither seasonally nor working day-adjusted. Ratios to GDP (including in the charts) refer to four-quarter sums of non-seasonally and non-working day-adjusted GDP figures.

- Hyperlinks in this press release lead to data that may change with subsequent releases as a result of revisions.