- PRESS RELEASE

Euro area monthly balance of payments: October 2021

20 December 2021

- Current account recorded €18 billion surplus in October 2021, unchanged from previous month

- Current account surplus amounted to €311 billion (2.6% of euro area GDP) in 12 months to October 2021, up from €186 billion (1.6%) one year earlier

- In financial account, euro area residents’ net acquisitions of non-euro area portfolio investment securities totalled €937 billion and non-residents’ net acquisitions of euro area portfolio investment securities totalled €140 billion in 12 months to October 2021

Chart 1

Euro area current account balance

(EUR billions unless otherwise indicated; working day and seasonally adjusted data)

Source: ECB.

The current account of the euro area recorded a surplus of €18 billion in October 2021, unchanged from the previous month (Chart 1 and Table 1). Surpluses were recorded for goods (€16 billion) and services (€16 billion). These were partly offset by a deficit for secondary income (€15 billion), while the primary income was balanced.

Table 1

Current account of the euro area

(EUR billions unless otherwise indicated; transactions; working day and seasonally adjusted data)

Source: ECB.

Note: Discrepancies between totals and their components may be due to rounding.

In the 12 months to October 2021, the current account recorded a surplus of €311 billion (2.6% of euro area GDP), compared with a surplus of €186 billion (1.6% of euro area GDP) in the 12 months to October 2020. This increase was mainly driven by a switch in the services balance from a deficit of €28 billion to a surplus of €98 billion and also by larger surpluses for primary income (up from €35 billion to €53 billion) and goods (up from €327 billion to €331 billion). These developments were partly offset by a larger deficit for secondary income (up from €148 billion to €170 billion).

Chart 2

Selected items of the euro area financial account

(EUR billions; 12-month cumulated data)

Source: ECB.

Notes: For assets, a positive (negative) number indicates net purchases (sales) of non-euro area instruments by euro area investors. For liabilities, a positive (negative) number indicates net sales (purchases) of euro area instruments by non-euro area investors.

In direct investment, euro area residents made net investments of €22 billion in non-euro area assets in the 12-month period to October 2021, following net disinvestments of €75 billion in the 12 months to October 2020 (Chart 2 and Table 2). Non-residents disinvested €30 billion in net terms from euro area assets in the 12-month period to October 2021, following net acquisitions of €58 billion in the 12 months to October 2020.

In portfolio investment, euro area residents’ net purchases of non-euro area equity increased to €487 billion in the 12 months to October 2021, up from €215 billion in the 12 months to October 2020. Over the same period, net purchases of non-euro area debt securities by euro area residents increased to €450 billion, up from €278 billion in the 12 months to October 2020. Non-residents’ net purchases of euro area equity increased to €383 billion in the 12 months to October 2021, up from €153 billion in the 12 months to October 2020. Over the same period non-residents made net sales of euro area debt securities amounting to €243 billion, following net purchases of €186 billion in the 12 months to October 2020.

Table 2

Financial account of the euro area

(EUR billions unless otherwise indicated; transactions; non-working day and non-seasonally adjusted data)

Source: ECB.

Notes: Decreases in assets and liabilities are shown with a minus sign. Net financial derivatives are reported under assets. “MFIs” stands for monetary financial institutions. Discrepancies between totals and their components may be due to rounding.

In other investment, euro area residents’ net acquisitions of non-euro area assets amounted to €173 billion in the 12 months to October 2021 (down from €180 billion in the 12 months to October 2020), while their net incurrence of liabilities increased to €811 billion (up from €71 billion in the 12 months to October 2020).

Chart 3

Monetary presentation of the balance of payments

(EUR billions; 12-month cumulated data)

Source: ECB.

Notes: “MFI net external assets (enhanced)” incorporates an adjustment to the MFI net external assets (as reported in the consolidated MFI balance sheet items statistics) based on information on MFI long-term liabilities held by non-residents, available in b.o.p. statistics. B.o.p. transactions refer only to transactions of non-MFI residents of the euro area. Financial transactions are shown as liabilities net of assets. “Other” includes financial derivatives and statistical discrepancies.

The monetary presentation of the balance of payments (Chart 3) shows that the net external assets (enhanced) of euro area MFIs decreased by €169 billion in the 12-month period to October 2021. This decrease was mainly driven by euro area non-MFIs’ net outflows in portfolio investment debt and, to a lesser extent, in direct investment and portfolio investment equity. These developments were partly offset by the current and capital accounts surplus and by euro area non-MFIs’ net inflows in other investments and other flows.

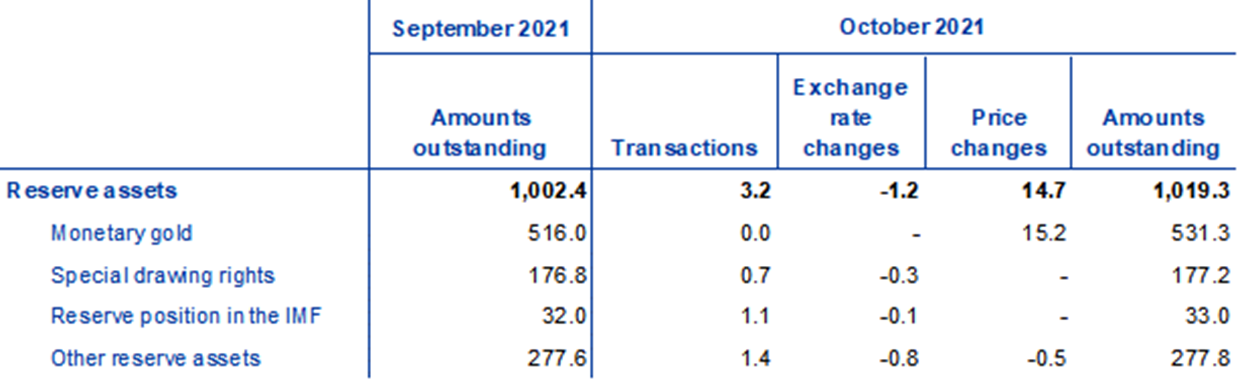

In October 2021 the Eurosystem’s stock of reserve assets increased to €1,019.3 billion, up from €1,002.4 billion in the previous month (Table 3). This increase was mainly driven by positive price changes (€14.7 billion, of which €15.2 billion was due to monetary gold) and, to a lesser extent, by net acquisitions of assets (€3.2 billion), which were only partly offset by negative exchange rate changes (€1.2 billion).

Table 3

Reserve assets of the euro area

(EUR billions; amounts outstanding at the end of the period, flows during the period; non-working day and non-seasonally adjusted data)

Source: ECB.

Notes: “Other reserve assets” comprises currency and deposits, securities, financial derivatives (net) and other claims. Discrepancies between totals and their components may be due to rounding.

Data revisions

This press release includes revisions to the seasonally adjusted current account components from January 2008 onwards owing to the incorporation of newly estimated seasonal and calendar factors. These revisions did not significantly alter the overall pattern of figures previously published

Next releases:

- Quarterly balance of payments and international investment position: 11 January 2022 (reference data up to the third quarter of 2021)

- Monthly balance of payments: 19 January 2022 (reference data up to November 2021)

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

Notes

- Current account data are always seasonally and working day-adjusted, unless otherwise indicated, whereas capital and financial account data are neither seasonally nor working day-adjusted.

- Hyperlinks in this press release lead to data that may change with subsequent releases as a result of revisions.

Banc Ceannais Eorpach

Stiúrthóireacht Cumarsáide

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, an Ghearmáin

- +49 69 1344 7455

- media@ecb.europa.eu

Ceadaítear atáirgeadh ar choinníoll go n-admhaítear an fhoinse.

An Oifig Preasa