- PRESS RELEASE

- 19 October 2018

Euro area monthly balance of payments: August 2018

- In August 2018 the current account of the euro area recorded a surplus of €24 billion, compared with a surplus of €19 billion in July 2018.[1]

- In the 12-month period to August 2018, the current account recorded a surplus of €379 billion (3.3% of euro area GDP), compared with one of €330 billion (3.0% of euro area GDP) in the 12-month period to August 2017.

- In the financial accounteuro area residents made net acquisitions of foreign portfolio investment securities of €406 billion in the 12-month period to August 2018 (decreasing from €514 billion in the 12 months to August 2017). Non-residents’ net purchases of euro area portfolio investment securities amounted to €145 billion (down from €208 billion in the 12-month period to August 2017).

Euro area current account balance

(EUR billions unless otherwise indicated; working day and seasonally adjusted data)

Source: ECB.

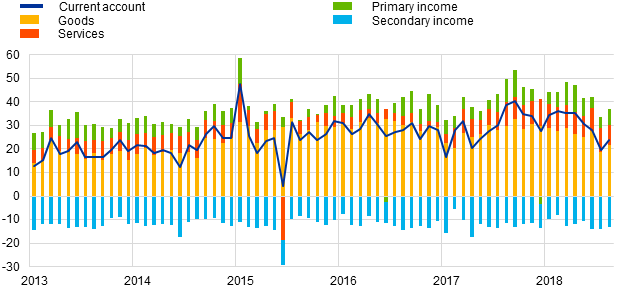

The current account of the euro area recorded a surplus of €24 billion in August 2018, increasing by around €5 billion compared with July 2018 (see Chart 1 and Table 1). Surpluses were recorded for goods (€22 billion), services (€9 billion) and primary income (€7 billion). These were partly offset by a deficit for secondary income (€13 billion).

Current account of the euro area

In the 12 months to August 2018, the current account recorded a surplus of €379 billion (3.3% of euro area GDP), compared with one of €330 billion (3.0% of euro area GDP) in the previous 12-month period. This increase was due mainly to an increase in the surplus for services (from €71 billion to €117 billion) and a lower deficit for secondary income (from €149 billion to €141 billion). These developments were partly offset by a decline in the surplus for primary income (from €81 billion to €77 billion). The surplus for goods remained stable at €327 billion.

Selected items of the euro area financial account

(EUR billions, 12-month cumulated)

Source: ECB.Note: For assets, a positive (negative) number indicates net purchases (sales) of non-euro area instruments by euro area investors. For liabilities, a positive (negative) number indicates net sales (purchases) of euro instruments by non-euro area investors.

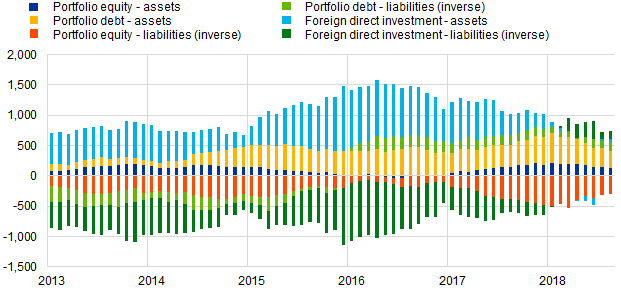

In direct investment, in the 12-month period to August 2018, euro area residents recorded net investments in non-euro area assets of €59 billion, a decrease from net investments of €337 billion in the previous 12-month period (see Chart 2 and Table 2). Non-residents recorded net disinvestments of euro area assets of €126 billion in the 12-month period to August 2018, after net investments of €224 billion in the 12 months to August 2017.

In portfolio investment, net acquisitions of foreign debt securities by euro area residents decreased to €281 billion in the 12 months to August 2018, from €363 billion in the corresponding period to August 2017. Net purchases of foreign equity by euro area residents decreased to €126 billion from €151 billion. Non-residents reduced their net purchases of euro area equity to €295 billion (from €375 billion in the 12 months to August 2017). Over the same period, their net sales of euro area debt securities decreased to €150 billion (from €167 billion).

Financial account of the euro area

In other investment, euro area residents’ net acquisitions of foreign assets amounted to €255 billion in the 12 months to August 2018 (compared with €220 billion in the 12 months to August 2017), while net incurrences of liabilities amounted to €337 billion (declining slightly from €344 billion in the corresponding period to August 2017).

Monetary presentation of the balance of payments

(EUR billions, 12-month cumulated)

Source: ECB.Notes: MFI net external assets as reported in the consolidated MFI balance sheet items (BSI). B.o.p. transactions refer only to transactions of non-MFI residents of the euro area. Financial transactions are shown as liabilities net of assets. “Other” includes financial derivatives, other investment and statistical discrepancies.

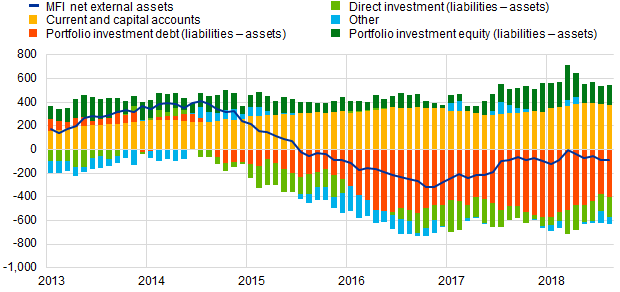

The monetary presentation of the balance of payments (see Chart 3) shows that the net external assets of euro area Monetary Financial Institutions (MFIs) decreased by €90 billion in the 12 months to August 2018. Developments in MFIs’ net external assets continued to be driven by non-MFIs’ net outflows in portfolio investment debt securities and direct investment. These were only partly offset by the euro area’s current account surplus and net inflows in portfolio investment equity.

In August 2018 the Eurosystem’s stock of reserve assets increased to €674.9 billion from €671.9 billion in the previous month (see Table 3). This modest increase (€3.0 billion) is explained by net acquisitions of assets (€3.3 billion) and, to a lesser extent, positive exchange rate changes (€1.7 billion), which were only partly offset by negative price changes (€2.0 billion).

Reserve assets of the euro area

Data revisions

This press release incorporates revisions of the data for July 2018. These revisions have not significantly altered the figures previously published. In addition, this press release includes revisions to the seasonally adjusted series from January 1999 for the components of the current account owing to the incorporation of newly estimated seasonal and calendar factors. These new estimates are broadly in line with the previously published figures.

Next press releases:

- monthly balance of payments: 19 November 2018 (reference data up to September 2018)

- quarterly balance of payments and international investment position: 8 January 2019 (reference data up to the third quarter of 2018)

For media queries, please contact Stefan Ruhkamp, tel.: +49 69 1344 5057.

Notes

The hyperlinks in the main body of the press release are dynamic. The data they lead to may therefore change with subsequent data releases as a result of revisions.

- [1]References to the current account are always to data that are seasonally and working day-adjusted, unless otherwise indicated, whereas references to the capital and financial accounts are to data that are neither seasonally nor working day-adjusted.

Den Europæiske Centralbank

Generaldirektoratet Kommunikation

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Tyskland

- +49 69 1344 7455

- media@ecb.europa.eu

Eftertryk tilladt med kildeangivelse.

Pressekontakt