Euro area quarterly balance of payments and international investment position (third quarter of 2014)

The current account of the euro area showed a surplus of €234.4 billion (2.3% of euro area GDP) in the four quarters up to the third quarter of 2014.

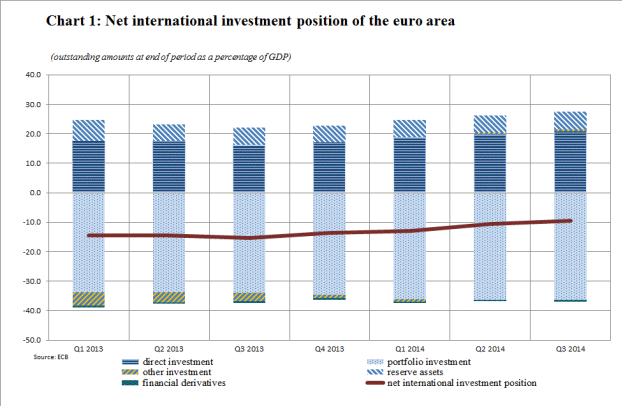

At the end of the third quarter of 2014, the international investment position of the euro area recorded net liabilities of €0.9 trillion (approximately 9% of euro area GDP).

Current account

In the third quarter of 2014, the current account of the euro area showed a surplus of €72.2 billion, compared with €52.2 billion in the third quarter of 2013 (see Table 1). The increase in the current account surplus was due to increases in the surpluses for goods (from €49.3 billion to €62.2 billion) and primary income (from €13.5 billion to €15.7 billion), and to a decrease in the deficit for secondary income (from €33.3 to €25.5 billion) [1]. These developments were partly offset by a decrease in the surplus for services (from €22.8 billion to €19.8 billion).

The developments in services were explained by a deterioration of the balances for all major components, with the exception of telecommunication, computer and information services, where the surplus rose from €8.7 billion to €10.2 billion.

The increase in the primary income surplus was driven by improvements in compensation of employees and in the investment income balances for direct investment and portfolio investment, which were partly offset by developments in the other primary income components

International investment position

At the end of the third quarter of 2014, the international investment position of the euro area recorded net liabilities of €0.9 trillion vis-à-vis the rest of the world (approximately 9% of euro area GDP; see Chart 1). This represented a decrease in net liabilities of €105 billion in comparison with the second quarter of 2014 (see Table 2).

This decrease was the result of a higher net asset position for direct investment (from €1,943 billion to €2,039 billion), other investment (from €51 billion to €66 billion) and reserve assets (from €583 billion to €597 billion), and to a lower net liability position for portfolio investment (from €3,572 billion to €3,559 billion). This was partly offset by an increase in the net liability position for financial derivatives (from €44 billion to €77 billion).

The changes in the net position for direct investment and reserve assets mainly reflected revaluations – changes in exchange rates and asset prices – and other volume changes, whereas the developments in portfolio investment and other investment (mainly currency and deposits) were explained by transactions and offsetting other changes (see Chart 2).

At the end of the third quarter of 2014, the gross external debt of the euro area amounted to €12 trillion (approximately 119% of euro area GDP), which represented an increase of €320 billion in comparison with the second quarter of 2014. By contrast, the net external debt decreased by €127 billion on account of a more marked increase in euro area residents’ holdings of (debt) assets issued by non-residents.

Data revisions

This press release incorporates revisions to the data for the reference periods from the first quarter of 2013 to the second quarter of 2014. These revisions have not significantly altered the figures previously published.

Additional information

Time series data: ECB’s Statistical Data Warehouse (SDW).

Methodological information: ECB’s website.

Monthly balance of payments: 19 January 2015 (reference data up to November 2014).

Quarterly balance of payments and international investment position: 9 April 2015 (reference data up to the fourth quarter of 2014)

Annexes

Table 1: Current account of the euro area

Table 2: International investment position of the euro area

For media queries, please contact Stefan Ruhkamp, tel.: +49 69 1344 5057.

-

[1]In broad terms, the new BPM6 concept of “primary income” corresponds to the old BPM5 concept of “income”, and the new concept of “secondary income” corresponds to the old concept of “current transfers”.

Evropska centralna banka

Generalni direktorat Stiki z javnostjo

- Sonnemannstrasse 20

- 60314 Frankfurt na Majni, Nemčija

- +49 69 1344 7455

- media@ecb.europa.eu

Razmnoževanje je dovoljeno pod pogojem, da je naveden vir.

Kontakti za medije