FAQ on incorporating climate change considerations into corporate bond purchases

Updated on 13 February 2024

On 4 July 2022 the ECB announced the incorporation of climate change considerations into the Eurosystem’s purchases of corporate sector securities, encompassing both the corporate sector purchase programme (CSPP) and pandemic emergency purchase programme (PEPP) corporate bond holdings. With these measures, the Eurosystem aims to gradually decarbonise its corporate bond holdings on a path aligned with the goals of the Paris Agreement. To that end, as of October 2022, the Eurosystem started to tilt its purchases towards issuers with a better climate performance. Additionally, on 2 February 2023 the Governing Council decided that the Eurosystem’s corporate bond purchases would be tilted more strongly towards issuers with a better climate performance. The overall volume of corporate bond purchases is solely determined by monetary policy considerations and the role played by such purchases in achieving the ECB’s inflation target. Finally, the Governing Council decided to discontinue the reinvestments under the asset purchase programme (APP), including the CSPP, as of July 2023. On 14 December 2023 the Governing Council announced that it intends to continue to reinvest, in full, the principal payments from maturing securities, including corporate debt instruments, purchased under the PEPP during the first half of 2024 and to reduce the PEPP portfolio by €7.5 billion per month on average over the second half of the year. The resulting purchases will be tilted towards issuers with a better climate performance.

These responses to frequently asked questions (FAQs) provide further details on the technical aspects of the measures implemented by the Eurosystem to integrate climate change considerations into its corporate securities purchases. For more information about how the Eurosystem conducts its transactions in corporate sector securities, please refer to the FAQ on purchases of corporate sector debt instruments. For a non-technical explanation of how climate change considerations are incorporated into corporate bond purchases, see our explainer on how we aim to decarbonise our corporate bond holdings.

Q1 What are the key elements of the incorporation of climate change considerations into Eurosystem corporate bond purchases?

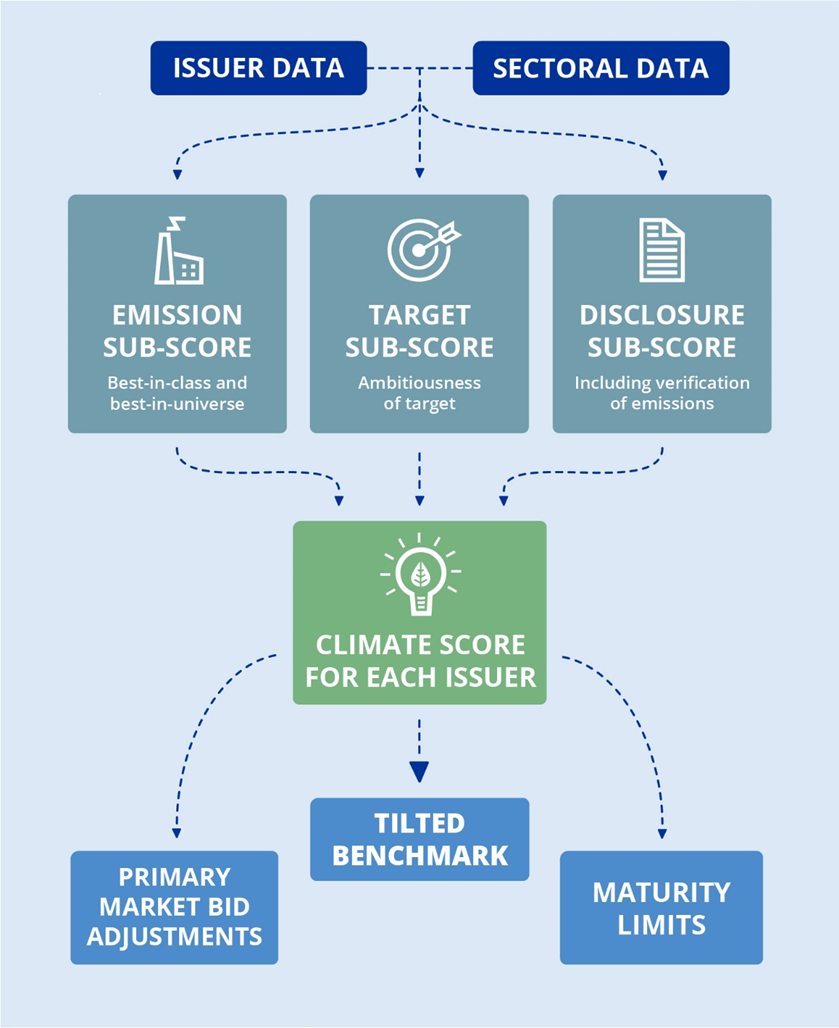

To operationalise the tilting of corporate bond purchases towards companies with a better climate performance, a specific climate score is calculated for each issuer. Purchases are then tilted towards bonds from issuers with higher (i.e. better) climate scores. The tilting of the purchases is designed to improve the weighted average climate score of the holdings over time so that it is consistent with a decarbonisation path in line with the goals of the Paris Agreement. The climate score methodology is reviewed at least once every 12 months and may be amended if warranted.

In addition, securities of issuers with a better climate performance and green bonds will continue to be purchased in the primary market. The Eurosystem is not conducting primary market purchases of any other eligible securities.

Finally, the Eurosystem employs other differentiated measures, such as maturity limits for lower-scoring issuers, to further mitigate its climate-related financial risk.

A broad overview of the methodology used for the climate score is set out in the infographic below.

Q2 How is an issuer’s climate performance assessed?

The Eurosystem has developed a climate scoring methodology to assess the climate performance of eligible issuers based on three sub-scores: (i) backward-looking climate metrics, which assess the level of issuers’ past greenhouse gas (GHG) emissions in terms of emission intensity and the rate of decarbonisation; (ii) forward-looking climate metrics, such as whether the issuer has and adheres to credible and ambitious decarbonisation targets; and (iii) the quality of climate disclosures, such as their completeness and verification by third parties.

These metrics are based on publicly available data as well as other relevant information and methodologies, such as science-based targets. Combining these metrics reflects emerging market practice. Furthermore, the design of the climate scoring methodology is guided by the requirements for the EU Climate Transition Benchmarks and EU Paris-aligned Benchmarks.[1]

The Eurosystem will review its climate scoring methodology at least once every 12 months to reflect the increasing availability and quality of climate data and models, any relevant regulatory developments, and advances in risk assessment capabilities.

Q3 How is each individual sub-score calculated?

The backward-looking emissions sub-score reflects past GHG emissions in terms of emission intensity and the rate of decarbonisation. It encompasses Scope 1 and 2 data[2] for the issuer concerned and Scope 3 data at the sector level. The sub-score combines a best-in-class with a best-in-universe approach. The best-in-class approach compares companies against their peers within specific industry sectors, while the best-in-universe approach compares companies across the entire corporate universe in terms of emission intensity and the rate of decarbonisation. If issuers do not have self-reported emissions data, they are assigned a lower backward-looking emissions sub-score. This approach incentivises issuers to decrease their carbon emissions using the best data available at the issuer level and, at the same time, to adopt a more holistic view of the carbon impact of the sector in which they operate.

The forward-looking target sub-score reflects the issuer’s expected changes in future GHG emissions. Issuers that are on an ambitious decarbonisation path towards Paris Agreement targets are given a higher score, particularly if the issuers adhere to their own GHG emissions intensity reduction targets, the targets are science-based and have been validated by a third party. If issuers have no self-reported emissions data, such that emissions reduction targets cannot be verified, they are assigned the lowest sub-score. Similarly, if issuers do not have concrete short-term decarbonisation targets or have low adherence to their own targets, they are assigned lower values for this forward-looking sub-score. This approach incentivises all eligible issuers to plan and set up their forward-looking decarbonisation targets.

The climate disclosure sub-score reflects the quality of the emissions data provided by issuers. The sub-score considers the current challenges in terms of data availability and accuracy, and rewards issuers with high-quality disclosures, thus creating incentives to improve data quality. For example, the Eurosystem looks at whether issuers disclose their GHG emissions and whether these are verified by a reliable third party. The Eurosystem does not rely on estimated or modelled data on issuers’ emissions. If issuers have no self-reported emissions data, they are given the lowest sub-score, reflecting the fact that it is not possible to assess the transition risk to which these issuers are subject. The aim of this approach is to provide the Eurosystem with better insight into issuers’ climate-related financial risks and to incentivise all issuers to calculate and disclose their carbon footprint.

The three sub-scores are combined into a single climate score for each issuer.

Q4 Why do you use Scope 3 data at the sector level and not at the issuer level for the backward-looking emissions sub-score?

Scope 3 data provide the most comprehensive picture of the total emissions of companies, but such data are also more complicated to calculate at this stage. The quality of issuer-specific Scope 3 data is currently not deemed sufficient for the data-dependent decision-making process that is used for tilting. However, sectoral Scope 3 data were assessed as being sufficiently reliable and were therefore included in the methodology. Using these data ensures that the tilting methodology more accurately reflects the issuer’s overall carbon footprint. The inclusion of sectoral data also makes it possible to incorporate Scope 3 data progressively, thereby minimising any cliff effects that might occur if issuer-specific Scope 3 data were introduced at a later stage.

Q5 How are issuers’ individual climate scores used to tilt purchases?

The Eurosystem tilts corporate bond purchases towards issuers with higher climate scores. While the asset allocation for the corporate bond purchases was previously based mainly on issuers’ market capitalisation – meaning that the Eurosystem bought more bonds from issuers that issued more bonds – it now also takes into account information that is relevant for assessing the climate-related risks of companies.

First, the benchmark guiding Eurosystem purchases is tilted by increasing the benchmark weighting given to higher scoring issuers and decreasing the weighting of issuers with lower scores. The higher the climate score, the larger the weight increase. Second, the tilted benchmark is incorporated into issuer group limits to ensure that purchases are guided by the tilted benchmark. This means that the issuer limits are raised for higher scoring issuers, resulting in greater purchases from issuers with a better climate performance.

In general, the purchase volumes for a specific issuer do not only depend on its climate performance (which in turn determines its benchmark allocation), but also on any potential risk management considerations and on the current Eurosystem holdings of that issuer.

Q6 Does the Eurosystem publish the climate scores of individual issuers?

No. The climate scores of individual issuers are not published. Publishing such information might undermine monetary policy objectives and the effectiveness of the Eurosystem’s corporate bond purchases.

Q7 Does the Eurosystem apply any maturity limits to the securities it purchases from issuers with lower climate scores?

The Eurosystem imposes maturity limits on corporate sector securities issued by companies with lower climate scores. This helps to mitigate the longer-term exposure of the Eurosystem to transition risks.

Q8 Does the Eurosystem give favourable treatment to green bonds?

Tilting is intended to mitigate climate-related financial risks on the Eurosystem’s balance sheet. It is the risk profile of the bond issuer that poses financial risks for the Eurosystem. Consequently, the Eurosystem looks at the key drivers of climate-related financial risks when tilting its corporate bond purchases based on issuer profile.

The Eurosystem acknowledges, however, the importance of green bonds in funding climate transition. It therefore gives preferential treatment to green bonds in its primary market bidding behaviour, subject to certain conditions. However, aggregate purchases of each issuer continue to follow the tilted benchmark.

In order to mitigate risks associated with greenwashing, the Eurosystem adopted a stringent identification process for the green bonds that are given preferential treatment. The criteria include, as a starting point: (1) alignment of the issuer’s green bond framework[3] with a leading market standard, such as the International Capital Market Association Green Bond Principles or Climate Bonds Initiative; (2) a second-party opinion indicating that adherence to that standard has been reviewed and is confirmed; and (3) a declaration in the bond prospectus to the effect that regular verification by an independent third party on the use of proceeds is expected (for example, annual verification by an external auditor) until the funds concerned have been fully deployed. Going forward, the European Union’s Green Bond Standard (EUGBS) is expected to become a leading standard for green bonds, enabling companies and public bodies to raise large-scale financing more easily for climate and environmentally friendly investments, while protecting investors from greenwashing. The Eurosystem intends to assess the potential role of the EUGBS as part of its regular reviews of the climate scoring methodology.

Q9 Have the eligibility criteria for corporate bond purchases changed? Have the purchasing modalities changed?

The eligibility criteria for corporate bond purchases remain unchanged. Moreover, corporate bond purchases continue to be conducted by the six purchasing national central banks[4] on behalf of the Eurosystem. Please refer to the FAQ on purchases of corporate sector debt instruments for more information.

Q10 Will the Eurosystem sell holdings because their issuer has a low climate score? Does the Eurosystem exclude specific issuers or industry sectors from its purchases?

It is not currently foreseen that a low climate score will trigger sales. Rather, further purchases of low-scoring issuers are constrained, or even halted, until their climate score improves. Specific issuers and industry sectors are not excluded from the tilted benchmark. Their climate performance instead affects their benchmark share, which in turn affects the volume of future purchases from those issuers and industry sectors. This approach is expected to incentivise a wide range of issuers and sectors to improve their climate risk profile and performance.

More generally, the corporate bond portfolio remains a monetary policy portfolio, and the overall purchase volumes continue to be determined solely by monetary policy considerations and the role in delivering on the ECB’s price stability objective.

Q11 How does the Eurosystem publish climate-related information on its corporate bond holdings?

As communicated in the ECB press release of 23 March 2023, the Eurosystem started publishing climate-related information on its corporate bond holdings, with future reports to be published annually.

Q12 Does the Eurosystem publish the changes to the Eurosystem holdings of bonds from individual issuers resulting from the application of these measures?

The Eurosystem publishes the ISIN codes of its holdings, but does not publish a detailed breakdown of the value of its corporate bond holdings by issuer, given that this could undermine the monetary policy objectives of the purchases. However, the Eurosystem remains committed to being as transparent as possible. It therefore continues to publish breakdowns by country, rating and industry sector every six months.

In accordance with Regulation (EU) 2019/2089 of the European Parliament and of the Council of 27 November 2019 amending Regulation (EU) 2016/1011 as regards EU Climate Transition Benchmarks, EU Paris-aligned Benchmarks and sustainability-related disclosures for benchmarks (OJ L 317, 9.12.2019, p. 17).

Scope 1 emissions encompass an entity’s direct emissions, and thus its exposure to rising costs from higher carbon taxes. Scope 2 covers indirect emissions from electricity, heat and steam consumption, and therefore reflects an entity’s exposure to rising input prices. Scope 3 is defined in the GHG Protocol as all the indirect emissions of an entity and its products, excluding those falling under Scope 2, i.e. it includes emissions across the entire value chain.

The framework in which the issuer sets out how the proceeds raised through a green bond issuance will be used in undertaking eligible green projects.

Nationale Bank van België/Banque Nationale de Belgique, Deutsche Bundesbank, Banco de España, Banque de France, Banca d’Italia and Suomen Pankki ‒ Finlands Bank.

↑